1. Banking on results: It's time for big banks to report their quarterly earnings.

Citigroup (C), JPMorgan Chase (JPM), Wells Fargo (WFC), PNC (PNC), and First Republic Bank (FRC) are all releasing earnings before the open Friday.

S&P Global Market Intelligence recently predicted that profit for companies in the S&P 500 in the second quarter would be up by 19.5% from a year earlier.

2. Talcum trouble: Shares in Johnson & Johnson (JNJ) are set to fall at the open after a Missouri court ruled the company had to pay $4.7 billion in compensation and damages in a case about talcum powder and cancer.

The jury made the award after 22 women and their families alleged that daily use of J&J products caused their ovarian cancer, according to a lawyer who represented the women.

"Johnson & Johnson remains confident that its products do not contain asbestos and do not cause ovarian cancer and intends to pursue all available appellate remedies," the company said in a statement.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. British pound getting crushed: President Donald Trump's visit to the United Kingdom is not doing any favors for the British currency. The pound is slumping by about 0.7% against the US dollar and declining against a range of other currencies.

This comes after Trump told British tabloid newspaper The Sun that the UK government's post-Brexit plans would "probably kill" any chance of a trade deal with the United States.

The Brexit plan published by the UK government on Thursday is designed to keep the country closely aligned in key areas with the European Union. That will severely limit its scope to negotiate new trade agreements.

Trump is taking part in a range of activities in the United Kingdom, including a meeting with Prime Minister Theresa May and tea with Queen Elizabeth II.

4. Government appeals AT&T-TimeWarner takeover: Shares in AT&T (T) are expected to dip about 2% on Friday after the US Justice Department said it would appeal a judge's approval of the company's purchase of Time Warner.

Judge Richard Leon, who presided over the lawsuit, ruled last month that the government had failed to show that the deal violates antitrust law.

AT&T closed the acquisition of Time Warner, including CNN, immediately after the ruling.

The Justice Department had tried to stop the deal, arguing that a distributor, AT&T, owning the likes of HBO, CNN and Warner Bros. would harm consumers by pushing up prices and damaging innovation and competition.

"The Government has failed to meet its burden of proof to show that the merger is likely to result in a substantial lessening of competition," Judge Leon wrote in his ruling.

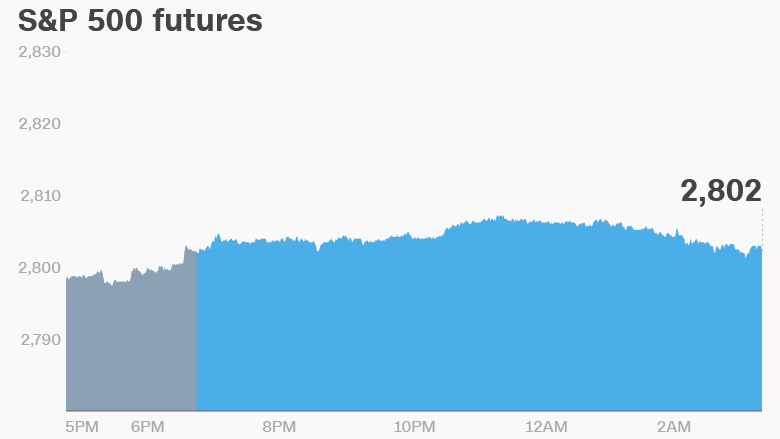

5. Global market overview: US stock futures were pointing up, indicating the Nasdaq could hit fresh record highs on Friday. The tech-heavy index finished Thursday at an all-time high.

Most European markets were also pointing up in early trading.

Asian markets ended the day with gains. The Nikkei in Tokyo shot up by 1.9%, with help from Fast Retailing (FRCOF), owner of clothing brands including Uniqlo and Comptoir Des Cotonniers. Shares in the fashion firm rose by 7% on Friday after the company released quarterly results.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Friday — US Bureau of Labor Statistics releases import and export price data for June; University of Michigan releases its updated consumer sentiment index for June.