1. Facebook reeling: Shares in Facebook (FB) are set to plunge about 20% after the company said it expects revenue growth to slow as it "puts privacy first" and rethinks its product experiences.

The sharp reaction follows an earnings report that showed slower than expected user growth and ad revenue. Sales hit $13.2 billion for the quarter, up 42% from the same period a year prior but below Wall Street estimates.

The earnings report offered the clearest look yet into how the Cambridge Analytica debacle impacted the business.

During a conference call with analysts, Facebook CFO David Wehner warned that sales growth may decline as the company offers users "more choice around privacy."

2. Trade relief: Shares in European automakers surged after President Donald Trump and European Commission President Jean-Claude Juncker said they would work toward eliminating tariffs and barriers on trade.

Trump had threatened a 25% tariff on cars made in Europe after his administration slapped tariffs on EU steel and aluminum imports. Juncker said both sides agreed to "hold off on other tariffs" while talks proceed.

Shares in Volkswagen (VLKAY) and BMW (BMWYY) gained 4% and 3%, respectively.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Trade escalation: A $44 billion tech deal is the latest casualty of escalating US-China trade tensions.

Qualcomm had been waiting nearly two years for its purchase of Dutch chip maker NXP to clear global regulatory hurdles. The deal, first announced in October 2016, had been approved by regulators in eight other jurisdictions, including the European Union and South Korea. China was the lone holdout.

The final deadline for the agreement was midday Thursday in China -- and Beijing's Ministry of Commerce simply let the clock run out.

Qualcomm (QCOM) had warned investors that this would likely happen. CEO Steve Mollenkopf said Wednesday that if China failed to approve Qualcomm's deal with NXP, the company would walk away.

4. Earnings: American Airlines (AAL), Bristol-Myers (BMY), Comcast (CMCSA), ConocoPhillips (COP), Dunkin Brands (DNKN), Hershey Foods (HSY), LendingTree (TREE), MasterCard (MA), McDonald's (MCD), Nielsen (NLSN), Penske Auto (PAG), PG&E (PCG), Southwest Air (LUV), Spotify (SPOT), Under Armour (UA), World Wrestling (WWE) and Xerox (XRX) will report earnings before the opening bell.

Amazon (AMZN), Chipotle (CMG), Electronic Arts (EA), Expedia (EXPE), Intel (INTC) and Starbucks (SBUX) will follow after the close.

Investors will also have to sort through earnings released after the close on Wednesday. Shares in Mattel (MAT) were down 9% in extended trade. PayPal (PYPL) stock was off 5% following its earnings release.

In Europe, shares in Anheuser-Busch InBev (BUD) dropped 6% and Nokia stock declined 9% after they reported disappointing earnings.

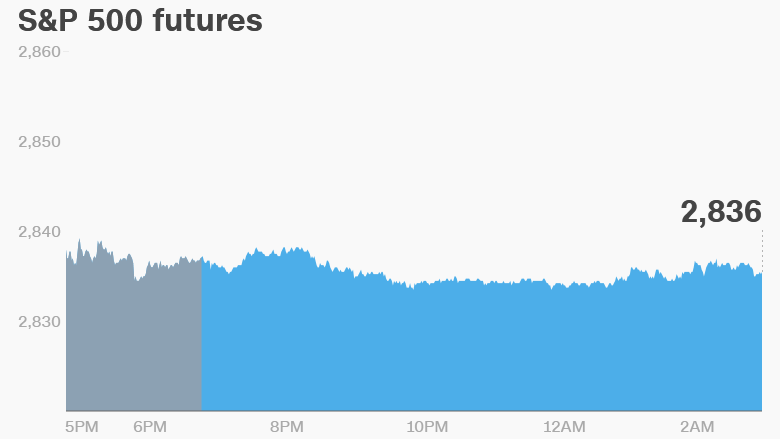

5. Global market overview: US stock futures were mixed.

European markets rose as investors reacted to trade news out of Washington.

Asian markets ended the day with mixed results. Major markets in China declined.

Oil prices were volatile following reports that Saudi Arabia had suspended crude shipments through a Red Sea shipping lane after an attack on two oil tankers.

6. New kid on the block: A three-year-old Chinese startup will make its Nasdaq debut on Thursday.

Pinduoduo is set to raise around $1.5 billion in its initial public offering. The IPO values the Beijing startup at around $20 billion or higher.

It's an online shopping platform where people can get goods for cheaper when they recruit friends to buy the same item. There are also flash sales, as well as free gifts and coupons for getting friends to follow companies on social media. Think of the company as a mash up of Groupon (GRPN), Gilt and eBay (EBAY).

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Thursday — Earnings from Amazon (AMZN), American Airlines (AAL), Chipotle (CMG), McDonald's (MCD) and Starbucks (SBUX)

Friday — Exxon Mobil (XOM), Merck (MRK) and Twitter (TWTR) report earnings; 21st Century Fox (FOX) holds shareholder meeting; US reports Q2 GDP data