1. Apple's big reveal: Apple (AAPL) is expected to unveil new iPhones and an updated Apple Watch at its annual press conference in Cupertino, California.

The iPhone is traditionally Apple's biggest cash cow, but investors will want to learn more about the company's other revenue sources — its media business and services like iTunes and iCloud.

Apple will likely give the dates for upcoming software updates, such as iOS 12 and Mac OS Mojave, and possibly share news about AirPods, its AirPower charging pad, and the iPad Pro line.

The event, which will be livestreamed, kicks off at 1 p.m. ET.

2. Europe on tech: The European Parliament is expected to vote on new copyright rules that could mean major changes for tech platforms.

Supporters say reforms are needed to restore the balance of power between content producers and Big Tech. But critics warn of dire consequences: They say the proposal could signal the end of internet memes, or lead to the closure of Google News.

Big tech companies including Google (GOOGL) have been lobbying against the rules.

Separately, the European Commission has called for fines to be imposed on tech companies that fail to remove terror content within an hour of it being flagged.

3. Carney warns: Bank of England Governor Mark Carney has warned that another financial crisis could happen.

"Could something like this happen again?" he told the BBC on the 10th anniversary of the collapse of Lehman Brothers. "Could there be a trigger for a crisis? If we're complacent, of course it could."

One big risk cited by the influential central banker was China.

"Their financial sector has developed very rapidly, and it has made many of the same assumptions that were made in the run up to the last financial crisis," he said of the country.

Also on Wednesday, the Brookings Institution will host a panel discussion on the financial crisis with former Fed chairman Ben Bernanke and ex-Treasury secretaries Tim Geithner and Hank Paulson.

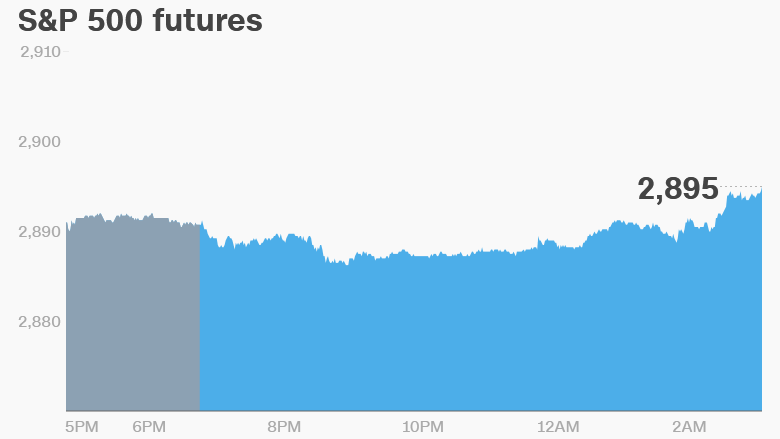

4. Global market overview: US stock futures were edging higher.

European markets opened up, while stocks in Asia ended lower. Hong Kong's Hang Seng shed 0.3% after slipping into bear market territory on Tuesday.

The Dow Jones industrial average and the S&P 500 closed 0.4% higher on Tuesday, while the Nasdaq added 0.6%.

Oil futures were trading 1% higher at around $70 per barrel. A weekly report on US crude inventories will be released at 10:30 a.m. ET.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Companies and economics: Shares in Hermes (HESAF) gained 2.6% after the maker of Birkin bags posted record profitability in the first half of the year. The company attributed the performance to "positive momentum in continental China."

The US Bureau of Labor Statistics will release its producer price index for August at 8:30 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Wednesday — Brookings Institution hosts a panel on the financial crisis, Apple announces its new products

Thursday — Kroger reports earnings, US consumer inflation report, European and English central banks report interest rate decisions

Friday — US retail sales and consumer sentiment reports