Two classic brands are cruising for a comebackThe two Harvard Business School classmates who resurrected Chris-Craft have a new plan to bring Indian Motorcycle back from the brink. Can this icon be saved? Fortune's Eugenia Levenson reports(Fortune Magazine) -- In a tiny hotel screening room in Miami, 20 friends and colleagues crowded around Stephen Julius and Steve Heese. It was February 2005, and they were there to watch a prerelease version of a film called "The World's Fastest Indian." The movie featured Oscar-winner Anthony Hopkins as the New Zealander who set a land-speed record on an Indian Scout motorcycle in the 1960s, but the group had gathered to see the film's real star: the bike itself. When credits rolled, the room sprang to a standing ovation. For Heese and Julius, Indian's new owners, the good news was that the fabled brand still resonated. The bad news? Indian, which the pair had bought out of bankruptcy a year earlier, wasn't exactly ready for its close-up.

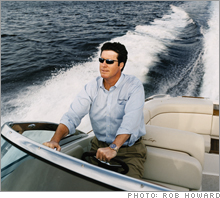

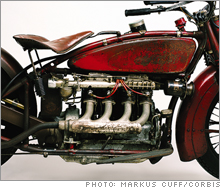

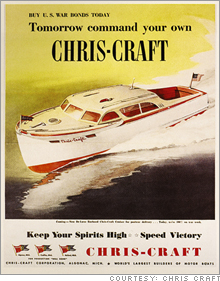

Founded in 1901, Indian beat Harley-Davidson to market by two years and invented the brawny "cruiser" class of bikes that defined American motorcycle style. Yet poor management after World War II pushed the company into bankruptcy in 1953, and production of all Indian motorcycles halted for nearly half a century. Efforts to resuscitate Indian in the late 1990s, first by a Canadian investor group and then by a Boston-based private-equity firm, ended in Chapter 11. As Indian's previous owners learned, reviving a so-called heritage brand is a rare and complicated undertaking. Classic brands can lose relevance if current models fail to live up to a storied past, but they also contain enormous potential for tapping into deep-seated loyalties. "The real trick is to find a brand that is still meaningful, that people associate with something positive, and then to create a product that matches that brand," says William Sahlman, a professor at Harvard Business School. Incidentally, the greatest example of an icon's revival may be Indian's old rival Harley (Charts), says Sahlman. Its reputation tarnished by years of overpriced, inferior products, Harley nearly went bankrupt before improving manufacturing and emphasizing retro styling in the 1980s. Today it's the market leader in the U.S. The right men for the job Julius and Heese thought Indian was due for a comeback too. "There are some brands you have to club to death for them to truly die," says Julius. And the pair, who met as classmates at HBS in the late '80s, had more than case studies to draw on: They had spent the past four years turning around legendary boatmaker Chris-Craft, which had suffered a similar fall from grace. For the first half of the century, Chris-Craft's boats ruled American waters when it came to speed, style and luxury, and its loyal customers included brand-name tycoons Harvey Firestone, Walter Chrysler, Eli Lilly and Philip Wrigley. But after the family-owned business was sold and resold, the brand languished. Through 2000 it had posted 11 consecutive years of financial losses, had long ago lost the rights to its own trademark, and had squandered its legacy by churning out mass-market boats. Then, one morning in late 2000, Heese spotted a story in a newspaper: Outboard Marine Corp. had filed for bankruptcy, and one of the assets on the auction block was the Chris-Craft boatyard. An avid sailor who "grew up fooling around on boats," Heese, 46, had just sold his stake in a global construction-products firm and moved back to Florida looking for his next gig. "I can run any manufacturing company and get paid well," says Heese, "but it's nice to work with a product you identify with and that you're passionate about." Since he knew that the Chris-Craft factory was in nearby Sarasota, he drove there the same morning and found shell-shocked employees eager to give him a tour of the plant. That afternoon he got a call from Julius, 47, who was running a private-equity firm in London called Stellican. Earlier that year Julius had finished (with Heese's consulting help) the turnaround and sale of Riva, an Italian luxury-motor-yacht manufacturer. He had heard the news about Chris-Craft too. "Let's work on this together," Julius said. Unfortunately they weren't the only ones interested in the boat business. At the auction they were outbid by raider-turned-CEO Irwin Jacobs, who won all of Outboard's boating assets. Still, Julius persisted. On the way out of the sale, he told Jacobs that if Chris-Craft ever went back on the block, he was ready to buy it. Days later Jacobs agreed to sell. ("We never intended on keeping Chris-Craft," says Jacobs. "It was a brand that was beaten up too badly by its past owners.") Worse, its past owners hadn't even been able to buy back the brand name - Herb Siegel, who had kept the rights for his media company, Chris-Craft Industries, famously refused to part with it. But Julius had learned that Siegel was preparing to sell his company to Rupert Murdoch's News Corp. (Charts) Julius approached Murdoch and, in March 2001, bought the trademark as he was closing the deal with Jacobs. He paid $5 million for the assets and another $5 million for rights to the name. While Julius and Heese waited for the FCC to approve the News Corp. deal, they finished manufacturing boats still in the plant and sold off the inventory. They also began working on new "design DNA" that recalled Chris-Craft's legendary elegance and high-end position. In November 2001, assembly lines at the Sarasota plant started running again. Chris-Craft turned profitable three years later on $30 million in revenues, and Ebitda has grown 262 percent since 2002. New models such as the classically styled Corsair series have helped Chris-Craft grow sales even as the pleasure-boat industry slumped post - Hurricane Katrina. Heese expects revenues to top $55 million this year. A new revival In mid-2004, with Chris-Craft headed toward calmer waters, Heese noticed another auction in the paper, this one for Indian. "The motorcycle market is bigger than the boating market," says Heese. "And there's no question that motorcyclists are a passionate group. These are people who tattoo brand names on their body! There's not another product category on earth that drives people to do that." Within days Julius's private-equity firm swooped in with a bid, picking up intellectual property including trademarks, engineering and designs, as well as the tooling to manufacture Indian's distinctive parts. (Stellican won't say what it paid.) For the next two years the partners (Julius is chairman, Heese president) immersed themselves in every aspect of Indian's production and marketing. "One of the beauties of these brands is that everybody will take your phone call," says Heese. "You wind up on a first-name basis with the biggest players in the industry." They got to know Indian's former customers too. After sending out 2,500 surveys to former owners, they heard from nearly 1,000 about everything from engineering to design - and continue to receive close to 100 e-mails daily from people who want to play a part in the resurrection. They also moved Indian's headquarters from California to North Carolina, where they were offered tax incentives and could draw from a NASCAR skilled-labor pool. (In January they're opening a second Chris-Craft factory nearby, on the site of a former DaimlerChrysler subsidiary plant.) Indian's first model - the Chief - won't get to market till late 2007, so the turnaround is just beginning. But one thing's for sure: For Julius and Heese, it's already been a great ride. _____________________ From the November 27, 2006 issue

|

|