|

AT&T: hogging the phone?

|

|

April 23, 1999: 4:08 p.m. ET

U.S. giant, broken up in 1984, could re-emerge as dominant world telecom

|

NEW YORK (CNNfn) - The most dominant telecommunications company for most of the 20th century could be the most dominant company of the 21st century as well -- and not just in America.

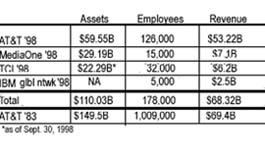

With its proposed acquisition of MediaOne Group (UMG), and its purchases of Tele-Communications Inc. cable services and IBM's (IBM) global network operations, AT&T (T) is becoming as formidable a force as it was before its 1984 breakup.

Ma Bell has maintained its long-distance dominance, positioned itself to regain the local service it lost in the split, become the leading cable operator, and entered such fields as Internet access and wireless communications that were unthought of 15 years ago.

"It started with AT&T, and it may end with AT&T," said Philip Wohl, a telecommunications analyst with Standard & Poor's Group. "They're going to be the premier company in telecommunications services."

Source: Company reports

While the proposed acquisition of MediaOne Group by AT&T isn't directly related to the proposed merger of Deutsche Telekom and Telecom Italia, both symbolize an industry consolidation that analysts and company officials say will result in far greater services and choices for consumers throughout the world.

But while further consolidation may eventually lead to global "supercompanies," such massive entities are still several years off.

International alliances exist

One reason is that there already are cross-national telecom alliances offering a broad range of services. AT&T, for instance, is linked to British Telecom in an alliance to offer various telecom services. Deutsche Telekom is part of the Global One venture with France Telecom and the U.S. company Sprint (FON).

"I don't know if that's really necessary," said Wohl of the idea of a global power at this time. "Both AT&T and British Telecom can operate independently -- they both have very good global operations."

In the U.S., these alliances may leave out the same Baby Bells and local phone companies that seemed so well positioned for individual growth a decade ago.

"If they don't get together (with other companies), they're going to be in trouble," said Wohl.

Some of them already are taking partners. Bell Atlantic (BEL) and long-distance carrier GTE (GTE) are getting together, and the joint company plans a broadband communication partnership with America Online (AOL), the nation's largest Internet access service.

Another possibility for the Baby Bells is linkage with a European partner. Wohl believes BellSouth (BLS), which just formed a partnership with Qwest Communications (QWST), is the best candidate for such a deal.

European deals more difficult

Technically, the Deutsche-Italia deal should be a clarion call for more cross-border European mergers. But James Ross, an ABN Amro telecom analyst in London, says the reality is that national boundaries in Europe still tend to be much less porous than those between U.S. states.

"There are lots of formal obstacles in terms of the European Union policies, but the real barriers are cultural," said Ross. "People who have been basically fighting each other for the past 2,000 years are now expected to merge."

Yet Ross said that even European telecoms are fated to follow other industries on the "bigger-is-better" bandwagon .

"In the end, the core driver is the fact that telecommunications is a capital intensive industry," Ross said. "Left to their devices the telecoms will carry on consolidating forever."

Of the continental European companies, Deutsche Telekom seems most likely to be the one to emerge from the consolidation wave, said S&P's Wohl. "It may take six months or so to get things together," he said. "But they're going to be the most dominant European provider."

If the German-Italia merger is approved -- and it faces daunting regulatory and political obstacles -- eight of the world's top 10 telecom groups will boast a market capitalization in excess of $100 billion. Of those, five involve tie-ups between American companies, or, in the case of U.K.-based Vodafone's planned merger with U.S. AirTouch -- an American-British alliance.

One of the behemoths, Japan's NTT, commands a market capitalization of more than $172 billion.

Both the companies and analysts say the chief beneficiaries of all this consolidation will be consumers, who will gain access to multiple services at lower cost.

"We are going to provide even better and more sophisticated products to customers," Deutsche Telekom spokesman Hans Ehnert said. "We are offering fixed line, mobile Internet, multimedia and cable infrastructure."

Wohl, looking at the U.S. market, agreed, adding that regulators will pose little obstacle to the deal.

"It will be a bonanza for consumers," he said. "And that's what the FCC (Federal Communications Commission) wanted to see." He expects consumers to begin seeing a whole array of low-priced communications services -- including local phone service through a cable line -- coming into their homes by late 2000.

Narrowing down the field

As for the global industry, Wohl said he expects it to boil down to about five to seven major international companies. These include AT&T, MCI WorldCom (WCOM), SBC-Ameritech (SBC), British Telecom, Deutsche Telekom, Bell Atlantic and possibly Bell South.

And from there, Wohl said, further consolidation could occur.

Right now, MCI WorldCom remains the dominant industry participant in his eyes. "When you have an industry like the Internet growing like that, and you have the lion's share in providing access to it, you're in good shape," Wohl said.

But AT&T is coming on strong. It has gone from being merely the nation's largest long-distance telephone service to being the dominant company in cable, thanks in part to its acquisition of Tele-Communications Inc. and its proposed purchase of MediaOne Group.

In the process, it has become about as big as it was on Dec. 31, 1983.

"In a couple of years, this company is going to skyrocket," said Wohl. A telecommunications world dominated by AT&T "could be down the road," he added.

-- by Mark Meinero, with Doug Herbert

|

|

|

|

|

|

AT&T

Deutsche Telecom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|