|

Jobs take August break

|

|

September 3, 1999: 3:42 p.m. ET

Employment growth is slower than expected; jobless rate dips to 4.2%

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - The U.S. economy didn't generate as many new jobs as expected last month and wages remained almost unchanged, a signal to financial markets that the Federal Reserve may hold off raising short-term interest rates a third time when policy makers meet next month.

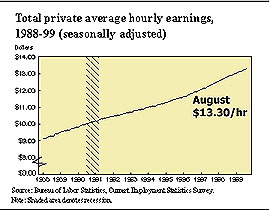

Some 124,000 new jobs were added to the economy in August, the Labor Department said Friday, significantly fewer than the 220,000 economists had anticipated. Wages rose just 2 cents an hour to $13.30, well below the 5 cents forecast, while the jobless rate slipped to a generation low of 4.2 percent.

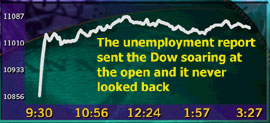

Both stocks and bonds soared on optimism that the robust U.S. labor market may be starting to slow, reducing inflationary pressures and allowing the Fed to hold off raising interest rates again. Shortly after 3 p.m. Eastern time, the Dow Jones industrial average was up more than 200 points. Treasury bonds, meantime, posted their biggest one-day rally in almost a year, with the benchmark 30-year Treasury bond surging 1-1/2 points in price and its yield falling 11 points to 6.01 percent.

Click on the chart to see the latest Dow stats

"It's obviously a very market friendly report," said Dick Berner, chief economist at Morgan Stanley Dean Witter in New York. "It reduces the chance of the Fed moving in October, but it does not take the Fed completely out of the game."

Not off the hook

For months, Fed policy makers, particularly Chairman Alan Greenspan, have focused intently on the red-hot U.S. labor market, watching for signs of accelerating inflation. Their concern has been that, because so many people are working, a shortage of available labor would cause wages of existing workers to surge.

Higher wages typically lead to higher spending, which in turn drives up prices for goods and services. To rein in price increases, the Fed has lifted its so-called fed-funds in quarter-point steps twice in the past two months -- on June 30 and on Aug. 24. The Fed next meets Oct. 5, three days before the September employment report is released.

Friday's report, in particular, prompted a surge of optimism among investors that the U.S. economy is throttling back on its own accord without the helping hand of the Fed. But other economic reports of late have suggested robust growth - particularly among manufacturers -- and there's more to come before the next Fed meeting, economists said.

"This report muddies the policy waters," said Ian Shepherdson, senior U.S. economist at High Frequency Economics in Valhalla, N.Y. "Strong numbers would have confirmed the third rate hike. Now we will have to wait for retail sales and price

numbers too.

"The Fed is not off the hook," he added.

Looking for a rebound

Indeed, most economists are predicting a sharp rebound in economic activity in the third quarter of the year as consumers keep spending their hard-earned cash and demand picks up overseas. Many are forecasting growth in the neighborhood of 3 percent to 4 percent for the third quarter, up significantly from the 1.8 percent output registered in the second quarter. That could prompt the Fed to raise rates a third time in November or even December, they said.

"The economy is really quite hot right now and dismissing any kind of rate action for the rest of the year on one report isn't a good idea," warned Marc Wanshel, a senior economist with J.P. Morgan.

And wages, while tame in August, could very well post stronger gains in September and beyond as unions negotiate higher pay for workers.

Machinists at Boeing Co. (BA) this week voted to accept a company offer that will boost their salaries and benefits by 4 percent over two years and another 3 percent in the third year. Earlier this month, about 16,000 flight attendants, ground workers and machinists at Trans World Airlines Inc. (TWA) approved a new 18-month contract with the nation's eighth-largest airline, boosting wages in that industry.

"The economy is still going very, very strong," said Bruce Steinberg, chief economist at Merrill Lynch. "I think in October the Fed will take a pass, what they do after that remains to be seen."

On the other hand, companies are laying off employees. U.S. companies' intentions to reduce their work forces rose by almost 8 percent in July compared with a year earlier, according to a monthly report released by Chicago-based employment firm Challenger, Gray & Christmas.

Manufacturing still robust

August's increase in new jobs was the smallest since a 28,000 gain in May, and the unemployment rate tied a 29-year low set earlier this year. The job growth figures are based on statistics compiled from businesses, while the jobless rate is based on a survey of U.S. households.

Service-related employment rose by 219,000 in August, while manufacturing employment decreased by 63,000 last month -- the biggest decline since July 1998 during the General Motors Corp. (GM) strike -- after rising 51,000 in July. Construction employment fell by 29,000.

The surprising decline in manufacturing employment was mostly a result of seasonal factors -- fewer employees taking time off in July and fewer scheduled plant shutdowns, the Labor Department said. Even so, a rebound in manufacturing activity and manufacturing jobs in the months ahead will not necessarily preclude another rate rise, analysts said.

That's because demand from overseas for U.S.-made goods could very well prompt strong gains in manufacturing activity without necessarily boosting economic output, Morgan Stanley's Berner said.

"Ideally what the Fed and most of us would like to see right now is domestic demand slowing and overseas growth rising," he said. At the same time, "we'll likely need higher rates to slow things down on this end further."

Fed officials and economists want to see consumers curb their spending and keep their cash in their wallets

Any way you slice it, few economists and experts see any threat of real inflation anytime soon.

"When you look at the fact that real wage gains are very much in line with productivity, I do not believe that we have inflationary pressures on the economy," said Labor Secretary Alexis Herman. "As long as we can continue to see that picture in the future, then I think we should not be extraordinarily concerned about inflationary pressures."

"The market has just dodged a bullet," Merrill's Steinberg said. "What this report does is remove the likelihood of a Fed tightening on Oct. 5, but we really can't rule out a tightening in November. We have to stay tuned for more economic data."

|

|

|

|

|

|

Labor Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|