|

Consumer confidence dips

|

|

February 29, 2000: 12:43 p.m. ET

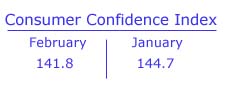

February confidence index falls to 141.8, trailing expectations

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. consumer confidence took a breather in February after surging to a record the month before, as stock market volatility, higher short-term interest rates and rising gas prices made people think twice about their economic prospects and spending plans.

The Conference Board reported Tuesday that its key consumer gauge rang in at 141.8 in February, down from 144.7 in January and below Wall Street forecasts of 143.5. The numbers are often significant for financial markets because consumer spending accounts for about two-thirds of U.S. economic output. The index is based on a survey of 5,000 U.S. households.

While weaker than a month before, the business group's index remained at its third-highest level ever, indicating consumers aren't overly pessimistic about prospects for themselves or for the economy, now in a record 107th month of uninterrupted expansion.

"Declining consumers' expectations for the next six months was the major reason for the overall dip in confidence," said Lynn Franco, director of the Conference Board's consumer research center. At the same time, "consumer attitudes will bear watching over the next few months to gauge the impact of rising rates," she said.

That pesky wealth effect

Of concern to Federal Reserve Chairman Alan Greenspan and other policy makers is the so-called wealth effect, the fairly recent phenomenon in which stock market and other paper gains have made Americans feel more confident about their economic outlook. That, in turn, has spurred consumers to open their wallets a little wider when it comes to purchasing goods and services.

To temper that enthusiasm, the Fed has raised short-term rates four times since last June, lifting its benchmark Fed funds rate to 5.75 percent. Higher official rates force banks to raise the rates they charge consumers and businesses to borrow, deterring lending. The central bank is widely expected to lift its key rate a fifth time at its March 21 policy meeting. To temper that enthusiasm, the Fed has raised short-term rates four times since last June, lifting its benchmark Fed funds rate to 5.75 percent. Higher official rates force banks to raise the rates they charge consumers and businesses to borrow, deterring lending. The central bank is widely expected to lift its key rate a fifth time at its March 21 policy meeting.

At the same time, jobs are plentiful, incomes are rising, prices -- with the exception of oil and gas -- are stable, and rates -- while higher -- are not yet at a level that should significantly deter confidence going forward, said Steven Wood, an economist with Banc of America Securities in San Francisco.

"These data suggest that as long as job creation and income growth remain strong, consumer spending is likely to be solid as well," he said. "Moreover, these assessments of the labor market still reflect strong job creation and low unemployment."

That crazy stock market

Bill Sharp, senior economist with Chase Securities, told CNNfn's In the Money that he also expects U.S. consumers to keep picking up the tab in the months ahead -- something that will probably show up in strong consumer spending numbers. (385KB WAV) (385KB AIFF)

Of course, one of the main deterrents to confidence in February was the extremely volatile stock market. The Dow Jones industrial average is off almost 13 percent since the start of the year, while the technology rich Nasdaq composite index is up by almost the same amount, leaving investors confused about the prospects for further "wealth effect" gains.

The Conference Board's gauge of how consumers assess their present conditions fell to 181.1 from a record high of 183.1 in January. Its gauge of expectations for the next six months also declined, slipping to 115.5 from 119.7 in January -- its highest level in 16 years.

Fewer people said they expect their salaries to rise over the next six months. Roughly 25.3 percent of those surveyed in February expect their incomes to rise in six months, compared with almost 27 percent that expected a raise when surveyed a month before.

Separately, the National Association of Purchasing Management-Chicago said its barometer of business expectations rose to a seasonally adjusted 56.7 in February from 55.6 in January. The report typically provides clues about the strength of national manufacturing, which the NAPM will unveil on Wednesday. An index below 50 signals a slowing manufacturing economy, while a reading above 50 suggests expansion.

|

|

|

|

|

|

Conference Board

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|