NEW YORK (CNNfn) - U.S. stocks rallied broadly Tuesday, sending every major market gauge higher and the Nasdaq composite index to its 12th record close of the year as investors snapped up technology shares expected to lead the economy's growth.

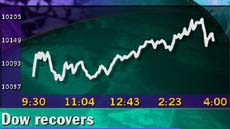

And the beaten-up Dow Jones industrial average, which fell 3.5 percent last week, continued its recovery as money moved into so-called "old economy" stocks cheapened by the sell-off.

The tech-heavy Nasdaq composite surged 118.72 points, or 2.59 percent, to 4,696.57. The gains surpassed the 4,617.65 milestone set last Thursday and gave the Nasdaq stock market its busiest day on record. More than 2.08 billion shares changed hands, ahead of the 2.01 billion set Feb. 17.

Buying in chipmakers, wireless providers and software firms powered the rise.

"People want to own these (technology) stocks," said Richard Cripps, chief market strategist at Legg Mason. "And that's what limits any significant drop on these stocks and it's what puts pressure on the remainder of the market."

The Dow Jones industrial average rose 89.66 points, or almost 1 percent, to 10,128.31. Wal-Mart, General Electric and Citigroup lifted the Dow.

The broader S&P 500 rose 18.36 points, or 1.36 percent, to 1,366.42.

"Today was a great day with all sectors moving up," Sylvester Marquardt, director of research at John Hancock Funds, told CNN's Street Sweep.

Market breadth widened Tuesday as more stocks rose than fell. Advancing issues on the New York Stock Exchange beat decliners 1,813 to 1,185. Trading volume exceeded 1.1 billion shares. Nasdaq winners topped losers 2,548 to 1,673. The Russell 2000, the Dow Jones utilities average, the Dow Jones transportation average and the AMEX composite index all rose. Market breadth widened Tuesday as more stocks rose than fell. Advancing issues on the New York Stock Exchange beat decliners 1,813 to 1,185. Trading volume exceeded 1.1 billion shares. Nasdaq winners topped losers 2,548 to 1,673. The Russell 2000, the Dow Jones utilities average, the Dow Jones transportation average and the AMEX composite index all rose.

In currency markets, the dollar climbed against the yen and euro. Treasury securities edged lower.

Oracle, 3Com soar

The Nasdaq -- up 13.3 percent this year -- continued its run Tuesday, led by tech leaders such as Oracle (ORCL: Research, Estimates), which rose 5-5/8 to 74-1/4 and JDS Uniphase (JDSU: Research, Estimates), which gained 10-5/8 to 263-5/8.

"It's the sexy sectors -- tech, biotech -- that are behind the explosive growth," said Art Hogan, chief market analyst at Jefferies & Co. "Everybody wants to be a part of that."

3Com Corp. (COMS: Research, Estimates) surged 12-1/2 to 91-13/16 after it boosted the offering price of its Palm Inc. spin-off late Monday to $30-to-$32 per share from $14-to-$16 per share. 3Com stock has risen sharply since December, when it announced that it would take public the Palm unit, which makes the popular "Palm Pilot" handheld computing devices.

Chipmakers gained after Deutsche Banc Alex Brown and Salomon

Smith Barney made positive comments about the sector. Micron Technology (MU: Research, Estimates) rocketed 19-15/16 to 98 and Advanced Micro Devices (AMD: Research, Estimates) rose 1-3/8 to 39-1/8.

Sam Stovall, sector strategist at Standard & Poor's, told CNNfn's Before Hours he expects the tech sector's strong performance to continue. (271K WAF) (271K AIFF).

The Dow -- off 11.9 percent this year -- staged a partial recovery led by some of its beaten up components. Wal-Mart (WMT: Research, Estimates) jumped 2-11/16 to 48-7/8, General Electric (GE: Research, Estimates) rose 2-15/16 to 132-3/8 and Citigroup(C: Research, Estimates) climbed 2-13/16 to 51-13/16.

But with the Federal Reserve expected to keep raising interest rates, analysts see the Dow's economically sensitive components remaining pressured ahead.

"I think it's going to be very difficult for this bounce back to continue," Gregg Hymowitz, money manager at EnTrust Capital, told CNN's Street Sweep, referring to the Dow.

Stocks showed little reaction to the day's most closely watched economic indicator. Consumer confidence dipped to 141.8 in February after hitting a record in January, the Conference Board said Tuesday.

Instead, investors are focusing on key manufacturing data Wednesday and February's employment figures Friday.

A batch of strong numbers could give Federal Reserve inflation fighters one more reason to raise interest rates next month. The Fed, the nation's central bank, tightened credit four times since June. Stock investors fret that more rate hikes could hurt corporate profits by raising borrowing costs. But technology companies, which are not as reliant on the bond market for borrowing money, are seen as less affected by higher rates.

The day's deals, earnings

Clear Channel Communications Inc. (CCU: Research, Estimates) fell 8-9/16 to 66-5/8 after the nation's No. 2 radio broadcaster said it agreed to buy leading concert promoter SFX Entertainment Inc. (SFX: Research, Estimates) for $4.4 billion. SFX rose 1/2 to 38-1/2.

Target (TGT: Research, Estimates) climbed 1/8 to 59 after the nation's fourth-largest retailer beat estimates for the fiscal fourth quarter with earnings before special charges of $522 million, or $1.12 a diluted share.

America Online Inc. (AOL: Research, Estimates) slipped 1-5/8 to 59 after the Internet service provider and Time Warner Inc (TWX: Research, Estimates) promised Tuesday to open Time Warner's cable systems to other Internet service providers after their proposed merger is complete. Time Warner, the parent of CNNfn, fell 1-7/16 to 85-1/4.

|