|

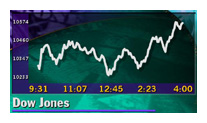

Blue chips boost Wall Street

|

|

April 17, 2000: 5:32 p.m. ET

Investors snap up technology bargains, lifting both Nasdaq and the Dow

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stock markets soared Monday in a choppy trading session as investors jumped into the bargain bin to snap up technology stocks, cheapened by last week's hefty sell-off.

Technology high flyers led the Nasdaq composite index higher, and investor confidence in quality blue chip companies, led by strength in the financial sector, lifted the Dow Jones industrial average.

Analysts were cautiously optimistic that the rally could herald stronger moves toward the upside, but warned there could be more selling on the horizon. "I think it's (the market) going to keep taking its temperature," Art Cashin, head of floor trading for Prudential Securities, told CNN's In the Money.

The Nasdaq jumped 217.87 points to 3,539.16. That's up more than 6 percent, but still more than 29 percent below its March 10 highs, sitting deeply in what Wall Street defines as bear territory.

The Dow Jones industrial average soared 276.74 points to 10,582.51. The broader S&P 500 index gained 44.22 to 1,401.53.

Analysts said market breadth was a sign the selling was not finished. Decliners outpaced advancers on the New York Stock Exchange 1,734 to 1,283, as more than 1.2 billion shares changed hands. Losers beat winners on the Nasdaq 2,616 to 1,750, on volume of more than 2.5 billion shares.

The dollar was slightly stronger against the euro but weakened versus yen. Treasury securities edged lower.

Bargain hunters raising the bull

Both indexes were struggling for stable ground, led by the highflying technology leaders, but analysts warned that the firming was confined to a limited number of technology stocks while other segments were faltering under selling pressure.

"There's been a lot of margin selling in the stocks that dropped," said Joseph Barthel, chief investment strategist at Fahnestock & Co.

Ralph Acampora, chief technical analyst with Prudential Securities, agreed, telling CNN's In the Money, "it's the same names and it's not broad at all. I hope they've learned that Wall Street is not an easy day-trading event."

Click here to see and hear Ralph Acampora

|

| VIDEO |

Ralph Acampora of Prudential Securities talks with CNNfn's In the Money, advising investors to remain cautious about tech and Net stocks following last week's sell-off in the markets.

Ralph Acampora of Prudential Securities talks with CNNfn's In the Money, advising investors to remain cautious about tech and Net stocks following last week's sell-off in the markets.

|

| Real |

28K |

80K |

| Windows Media |

28K |

80K |

|

Among the mid- and small-caps that suffered, Celera Genomics (CRA: Research, Estimates) fell 3-7/16 to 70-9/16, Ariba Inc. (ARBA: Research, Estimates) shed 7-13/16 to 54-7/16, and Infospace Inc. (INSP: Research, Estimates) dropped 3-5/16 to 45-7/16.

"I think investors are saying these things look cheap," said Art Hogan, chief market analyst at Jefferies & Co. "We're clearly overdone and I would expect this momentu  m to carry through to the morning." m to carry through to the morning."

Among key technology issues helping keep stocks supported, Cisco Systems (CSCO: Research, Estimates) rose 9-1/2 to 66-1/2, Intel Corp. (INTC: Research, Estimates) jumped 12-3/4 to 123-1/4, and Oracle (ORCL: Research, Estimates) gained 12-5/16 to 74-13/16.

Bill Meehan, senior market analyst at Cantor Fitzgerald, told CNNfn's Market Coverage that it will take more than the recent sell-off to convince investors of the need to re-evaluate the markets. (345K WAV) (345K AIFF)

Individual investors were taking a tepid view of the day's action. "This week will be really chaotic. I don't think it will continue in the long term, but it will get worse before it gets better," said DeeDee McGann-Gollwitzer, a real estate agent from Southern California. "I have a lot of information on the companies that I invest in. Other people buy on a tip; a lot of investors don't get enough information." Individual investors were taking a tepid view of the day's action. "This week will be really chaotic. I don't think it will continue in the long term, but it will get worse before it gets better," said DeeDee McGann-Gollwitzer, a real estate agent from Southern California. "I have a lot of information on the companies that I invest in. Other people buy on a tip; a lot of investors don't get enough information."

Goldman's Cohen keeps outlook unchanged

Investors could gain some respite from analysts' comments that the market remains fundamentally sound. Influential market strategist Abby Joseph Cohen, chairwoman of Goldman Sachs' investment policy committee, told clients Monday that the recent stock volatility has been driven more by market factors rather than a change in fundamentals.

"We continue to believe that a sharp upward move in inflation is unlikely," she wrote in a research note.

Cohen wasn't the only analyst issuing reports Monday. Seeing opportunity following the recent sell-off, Thomas Galvin, chief equity analyst at Donaldson Lufkin & Jenrette, upped the stock percentage in his firm's model portfolio to 90 percent stocks and 10 percent cash, eliminating the 15 percent in bonds.

"We continue to view most stocks (excluding dot.coms) as cheap, with an S&P 500 median (price-to-earnings ratio) of roughly 15 times 2000 estimates," Galvin wrote.

Earnings bode well for firming market

With first-quarter earnings meeting or beating expectations, analysts anticipate a resurgence of investor confidence.

Citigroup (C: Research, Estimates) rose 1-13/16 to 59-13/16, after reporting first-quarter earnings of $1.04 a share, beating analysts' expectations of 78 cents a share and the year-earlier 69 cents a share.

Merrill Lynch (MER: Research, Estimates) remained steady at 90, after topping first-quarter earnings forecasts to reach $2.38 a share, up from the previous year's $1.44 a share and the anticipated $1.83 a share.

Ford Motor Co. (F: Research, Estimates) jumped 4-3/4 to 57, after posting strong first-quarter earnings of $1.70 a share, versus the forecast of $1.58 per share and the prior year's $1.29 a share.

Dow component Eastman Kodak Co. (EK: Research, Estimates) gained 5/16 to 61-13/16, after surpassing analysts' first-quarter earnings estimates in posting a profit of 95 cents a share, up from the forecast 93 cents a share and the 80 cents a share earned a year earlier.

(Click here for the latest news about the day's corporate earnings)

|

|

|

|

|

|

|