|

Treasurys drop post-data

|

|

April 27, 2000: 3:24 p.m. ET

Robust GDP, ECI fuel rate fears; euro continues slide against dollar

By Staff Writer Jill Bebar

|

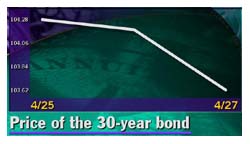

NEW YORK (CNNfn) - Treasury securities ended sharply lower Thursday after robust economic data re-ignited fears of aggressive rate hikes ahead, pushing the 30-yield bond yield to 6 percent, its highest level since late March.

Although the market was expecting the gross domestic product and employment cost index reports to be strong, trading was volatile throughout the session.

"We have strong growth and inflation is picking up from its low levels," said John Stiles, senior bond strategist at IDEAglobal.com, an analytical research firm. "It's making investors wonder whether they will see more tightening than expected."

Shortly after 3 p.m. ET, the 30-year Treasury bond fell 24/32 of a point in price to 103-14/32. The yield, which moves inversely to price, rose to 6 percent, its highest level since March 28 and up from 5.95 percent Wednesday.

The 10-year note dropped 26/32 to 101-26/32, its yield rising to 6.24 percent from 6.13 percent.

Earlier in the session, 30-year bonds advanced as investors fled equities for  the relative safety of government securities. But as stocks stabilized, investors turned their focus back to economic news. the relative safety of government securities. But as stocks stabilized, investors turned their focus back to economic news.

Preliminary gross domestic product (GDP) rose 5.4 percent in the first quarter, according to the Commerce Department. Although GDP, the broadest measure of goods and services produced, was below Wall Street forecasts of 6 percent, the price deflator, a measure of inflation, surged 2.7 percent.

In a separate report, the Labor Department said its first-quarter employment cost index (ECI) jumped 1.4 percent. The ECI, a gauge of employment costs, was the largest gain in more than 10 years and was far greater than the 0.9 percent increase expected. This report is thought to be closely watched by Federal Reserve Chairman Alan Greenspan.

The reports fueled doubts as to whether the Fed's tightening cycle -- five quarter-point hikes since June -- has had any impact on the economy. Analysts say more-aggressive action may be necessary.

Joseph LaVorgna, senior economist at Deutsche Bank Securities, told CNNfn's market coverage the Fed will need to boost rates in order to contain inflation. (320K WAV) (320K AIFF)

The next Fed monetary policy meeting is scheduled May 16.

In other economic news, jobless claims rose 26,000 to 283,000 in the week ended April 22. Analysts said the number, coupled with the ECI data, reveal a continued tight labor market.

Meanwhile, the government completed its fourth buyback operation, repurchasing $3 billion of older debt. It received $10.831 billion of offers and paid $3.724 billion for the securities with an average yield of 6.296 percent.

Thursday's purchase is the largest to date of the Treasury's ongoing program to reduce older, longer-term debt as a result of the budget surplus. The previous three operations have totaled about $4 billion.

The department is expected to provide more details of the buyback program at its May 3 refunding announcement.

Remarks by Greenspan, who spoke about rural America in Kansas City, Mo., had no market impact.

Euro continues slide

The euro fell to a new lifetime low against the dollar Thursday at 90.59 cents, surpassing its previous record low of 91.62 cents set Tuesday. The decline came despite the European Central Bank's (ECB) decision to raise interest rates by 25 basis points.

The euro has fallen nearly 22 percent since its inception at $1.16 in January 1999.

Analysts said the ECB action was fully discounted by the market because it did nothing to change the fundamental outlook for the euro. In addition, the GDP and ECI reports reinforced the market's view that the U.S. economy outperforms the European economies.

Shortly after 3 p.m. ET, the euro traded at 91.07 cents, down from 92.37 cents Wednesday, a 1.4 percent gain in the dollar's value.

Meanwhile, the dollar was virtually flat against the yen, at 106.36 yen compared with 106.33 yen Wednesday.

|

|

|

|

|

|

|