NEW YORK (CNNfn) - Treasury bonds ended sharply higher Wednesday, recovering from losses in the previous session after weaker-than-expected economic news calmed investors' fears of rising interest rates.

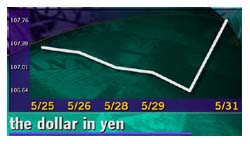

In the currency markets, the dollar climbed against the yen following news of the failure of a Japanese insurance company. The collapse fueled speculation that more insurance companies may be in trouble.

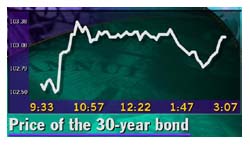

Shortly after 3 p.m. ET, the 30-year Treasury bond rose 1-2/32 points to 103-6/32. The yield, which moves in the opposite direction to price, fell to 6.01 percent from 6.09 percent Tuesday. Shortly after 3 p.m. ET, the 30-year Treasury bond rose 1-2/32 points to 103-6/32. The yield, which moves in the opposite direction to price, fell to 6.01 percent from 6.09 percent Tuesday.

The 10-year note, which now is considered by many as the market benchmark, gained 18/32 to 101-14/32, its yield retreating to 6.29 percent from 6.37 percent.

Uncertainty about whether the Federal Reserve will need to continue to boost  rates in the months ahead has weighed on the market. But the latest economic news suggested that the economy may be slowing, and the central bank may be close to the end of its tightening cycle. rates in the months ahead has weighed on the market. But the latest economic news suggested that the economy may be slowing, and the central bank may be close to the end of its tightening cycle.

New home sales fell 5.8 percent to an annual rate of 909,000 in April from a revised 965,000 in the prior month, according to the Commerce Department. The decline was the largest drop since last September and well below expectations of a 940,000 annual rate.

In addition, the Chicago Purchasing Management Index (PMI), which measures manufacturing in the region, fell to 53.9 in May, an eight-month low, from 56.5 in April. An index level of 50 or more indicates manufacturing is expanding.

"The data reinforced the view that the Fed may not have to tighten much more and relieves anxiety about inflation," said Jim Glassman, senior U.S. economist at Chase Securities.

In an effort to slow the economy and contain inflation, the Fed has raised interest rates six times since last June. Prior to these reports, many analysts were expecting two more rate boosts of a quarter percentage point each, which would bring the federal funds rate, the rate banks charge each other for borrowing money, to 7 percent.

But investors still face a major hurdle -- Friday's key May employment report. Analysts polled by Briefing.com forecast that payrolls to have risen to 375,000 compared to 340,000 in the prior month, and the unemployment rate to hold steady at 3.9 percent.

(Click here for a look at Briefing.com's economic calendar.)

Analysts noted longer-dated maturities, such as 30-year bonds, also benefited from month-end index buying. During the course of the month, the benchmark indexes are adjusted to reflect the removal and addition of various fixed income securities. As a result, managers whose funds mirror these indexes bought securities, particularly longer-term issues, at month end to reflect those changes.

Dollar strengthens vs. yen

The dollar climbed against the Japanese yen Wednesday, hitting a five-day high following news of the collapse of a Japanese insurance company, Daihyaku Mutual Life Insurance.

With mounting concerns about the Japan's economic recovery, analysts said there were rumors that more insurance companies may be in trouble. "The market feels if one is in trouble, there could be more we don't know about," said Tom Benfer, global currency analyst at Bank of Montreal.

Meanwhile, the dollar slipped against the euro. Expectations of an interest rate hike from a European Central Bank meeting next week helped Europe's common currency. Although the euro has rallied recently, many analysts expect its recovery to be limited due to the gap between European and U.S. economic growth.

Shortly after 3 p.m. ET, the dollar traded at 107.74 yen, up from 106.63 yen Tuesday, a 1 percent gain in the dollar's value. The euro was at 93.64 cents, up from 92.94 cents Wednesday. Shortly after 3 p.m. ET, the dollar traded at 107.74 yen, up from 106.63 yen Tuesday, a 1 percent gain in the dollar's value. The euro was at 93.64 cents, up from 92.94 cents Wednesday.

|