|

Stock picks by the pros

|

|

June 13, 2000: 5:53 p.m. ET

Unocal, American General, Novoste, Lear, Home Depot make the list

|

NEW YORK (CNNfn) - Market analysts and portfolio managers spanned the breadth of the market, coming up with a mixed bag of stocks for investors to park their money. Top picks came from oil, energy, finance, communications, and the consumer products sectors.

While the markets dipped in the late afternoon trading, recent guests on CNNfn commented on the stocks they are buying, and why.

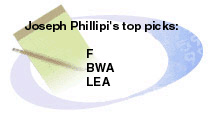

"I think there's some real risk that we'll see some buying down on the part of consumers, particularly those that have been looking at big trucks and SUVs," said Joseph Phillippi, auto analyst, Paine Webber. "We may very well see some movement down to the smaller SUVs and the smaller trucks, and particularly on the SUV side, probably a lot more concentration in the car base for utilities, because there's a whole group coming out at this point." "I think there's some real risk that we'll see some buying down on the part of consumers, particularly those that have been looking at big trucks and SUVs," said Joseph Phillippi, auto analyst, Paine Webber. "We may very well see some movement down to the smaller SUVs and the smaller trucks, and particularly on the SUV side, probably a lot more concentration in the car base for utilities, because there's a whole group coming out at this point."

"Ford (F: Research, Estimates) looks extraordinarily strong to us. They have got just a terrific portfolio of products -- obviously they're very strong on the truck side. And of course, they've got this whole luxury portfolio of brands, with Jaguar, Volvo, and quite soon, with Land Rover, once they close that transaction. They look really strong to us. We've got a $70 price target on the stock, and it's our strongest auto pick at this point in time."

His second pick is BorgWarner (BWA: Research, Estimates). "It's a very interesting story because they are a major, major player, both in the truck side in terms of its 4-by-4 sport utilities. But most importantly, they've got a terrific portfolio of fuel efficiency type product, including turbo chargers for high fuel efficiency out of a very small displacement engine. You have got a lot of horsepower. They've got a lot of products that will be utilized in both automatic transmissions -- again, to increase fuel efficiency. And what are now known as automated manual transmissions for the European market."

His final pick is Lear (LEA: Research, Estimates). "Terrific company. A little bit high on the leverage side, but really doing an absolutely outstanding job in terms of developing complete interiors for the auto makers on a global basis."

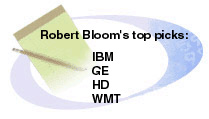

"The reaction to a disappointing announcement is really quite hostile," said Robert Bloom, president, Friends, Ivory & Sime. "If you look at each statistic as it comes in, you can get mesmerized by the details. But if you aggregate them and look at all the numbers that are coming in it looks to us as if still about two out of three [announcements] are coming in above expectations." "The reaction to a disappointing announcement is really quite hostile," said Robert Bloom, president, Friends, Ivory & Sime. "If you look at each statistic as it comes in, you can get mesmerized by the details. But if you aggregate them and look at all the numbers that are coming in it looks to us as if still about two out of three [announcements] are coming in above expectations."

His picks include IBM (IBM: Research, Estimates) and General Electric (GE: Research, Estimates). "We like GE mostly because it's very visible, very conservatively managed and there's been a little bit of uncertainty about succession, as Jack Welsch goes out in April of 2001. But they've pretty much announced that it's going to be someone from either power, aircraft, or medical. And they don't want it to be a negative surprise, quite the contrary. So we think with a little bit of weakness here, GE looks interesting."

He also said that he likes Home Depot (HD: Research, Estimates) and Wal-Mart (WMT: Research, Estimates). "Both are down relatively sharply for no apparent reason. Now it may be that we're going to see some signs of slowing -- I think HD has now admitted that. But probably from 9 percent to 7. How bad is that, when we still think the EPS for the year will be up close to 25 percent? So with that stock down from 70 to 47, 30 percent plus, we think it is attractive. We think they will make the earnings."

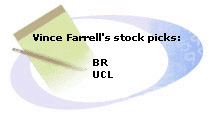

"Mr. Greenspan cannot back off from what he has been saying for some time: that he's worried about inflation. There's no reason to. The markets are kind of going his way. The economy seems to be slowing down. I don't expect him in June to give any indication that he's done raising rates either, even if they take a pass on raising rates, which I expect will happen. He's just got to wait and see. And he's not going to give any early indications otherwise," said Vince Farrell, chairman and chief investment officer, Spears Benzak Salomon & Farrell. "Mr. Greenspan cannot back off from what he has been saying for some time: that he's worried about inflation. There's no reason to. The markets are kind of going his way. The economy seems to be slowing down. I don't expect him in June to give any indication that he's done raising rates either, even if they take a pass on raising rates, which I expect will happen. He's just got to wait and see. And he's not going to give any early indications otherwise," said Vince Farrell, chairman and chief investment officer, Spears Benzak Salomon & Farrell.

"Here are a couple of stocks that still look attractive. Burlington Resources (BR: Research, Estimates) has not really kept with the group. I think it's a very good company in the low 40s. Unocal (UCL: Research, Estimates) might be a very interesting play because not only are the assets worth more than the current stock price but they have a patent for reformulated gasoline. It's in the courts. They've won in the appeals. It's a question of what they're really going to get out of this patent," Farrell said.

"Financials tend to rally before the Fed is finished. Now the financials have acted well. But I would expect them to lead a market rally," he said.

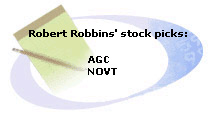

"I'm still super-bullish. I think the market's in a summer rally, about half along, towards all time highs. I expect minor all-time highs. No change in that view," said Robert Robbins, chief investment strategist, Robinson-Humphreys. "I'm still super-bullish. I think the market's in a summer rally, about half along, towards all time highs. I expect minor all-time highs. No change in that view," said Robert Robbins, chief investment strategist, Robinson-Humphreys.

"I think investors have got to be more selective than usual for a few reasons. There's really a broader leadership in the market. There are a lot of finance stocks that are acting great. And that wasn't the case over the last two years to three months ago," Robbins said. "This is pretty recent. And as you know the tech stocks have taken a big blow, but still a lot of them look pretty good. So I would spread things out. Finance is my favorite area. I have about one-fourth of total stock holdings there. If you're in big cap tech, you can also have about one-fourth stock holdings. I think if you're in secondary or small cap, probably about one-fifth. Consumer cycles have gotten very choppy. Maybe about 12-to-15 percent of total stock holdings. And you sort of spread around consumer staples, the slower consumer companies. And health care has got some attractive areas, but it's pretty choppy too."

"Some of the stocks that I would concentrate on would be in finance. American General (AGC: Research, Estimates), that's an insurance company, and it's a value-oriented play. But it's also a takeover candidate," said Robbins. "In the health care area, I think Novoste (NOVT: Research, Estimates) is something of turnaround. It's a very risky company, sort of a one-product, no-earnings company. But that one product has got tremendous promise in the area of cardiology and radiation, specifically the more attractive area of beta radiation. This would be a nice fit for one of the larger medical device companies. And then finally, in the foreign emerging markets, the Morgan Stanley Emerging Market Fund."

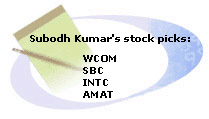

"I think that the objective of the interest rate hikes is to keep the economy in the 3-1/2, maybe 3-3/4 range. So the Fed has been saying all along, give us 12 months from when we start to raise rates and we'll get the trajectory down. And I think that's what they've done," said Subodh Kumar, chief investment strategist, CIBC World Markets. "I think that the objective of the interest rate hikes is to keep the economy in the 3-1/2, maybe 3-3/4 range. So the Fed has been saying all along, give us 12 months from when we start to raise rates and we'll get the trajectory down. And I think that's what they've done," said Subodh Kumar, chief investment strategist, CIBC World Markets.

"In the last few months, there's been a lot of volatility. I look for less volatility in the markets. And I look for the leadership to evolve to the following areas -- where the rates stay in check - the banks, the utility stocks - those do very well, and financial services and utilities. And the second area that I would look for to do better would be companies with real earnings but relatively low multiples, and examples of those are the communications companies and semiconductor stocks," Kumar said.

"WorldCom (WCOM: Research, Estimates), the growth rate is quite high

for the company to lift earnings growth. The multiple is relatively low for a

growth company. Expansion and communication services worldwide is going on. And I think it's got a good mix of assets," said Kumar. "With SBC Communications (SBC: Research, Estimates), the same kind of thought process -- that it's benefiting from the communications revolution."

Kumar's other two picks are Intel (INTC: Research, Estimates) and Applied Materials (AMAT: Research, Estimates).

"What we look at is basic fundamentals, looking at cash flow, looking at a franchise, so when a company has a solid business in a local marketplace, with a good customer base, we like that. It's very simple to understand. Consistent generation of cash flow is something that no matter what the interest rate environment does, no matter how volatile the market is, the company continues to build what we'd call, asset value in the form of cash," said Marc Gabelli, managing director, Gabelli Funds. "What we look at is basic fundamentals, looking at cash flow, looking at a franchise, so when a company has a solid business in a local marketplace, with a good customer base, we like that. It's very simple to understand. Consistent generation of cash flow is something that no matter what the interest rate environment does, no matter how volatile the market is, the company continues to build what we'd call, asset value in the form of cash," said Marc Gabelli, managing director, Gabelli Funds.

"We look at all sectors, everything from the food and consumer products sector -- and in that area we like Ralston-Purina (RAL: Research, Estimates) — to the telecommunications area, Bell Atlantic (BEL: Research, Estimates). We also like Time Warner (TWX: Research, Estimates)," Gabelli said. Time Warner is the parent company of CNNfn.

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|