|

Stock picks by the pros

|

|

July 5, 2000: 3:28 p.m. ET

Qwest, Global Crossing, Pharmacia, Veritas, NetIQ, Broadwing selected

|

NEW YORK (CNNfn) - Sector analysts and market strategists favored the telecom, tech, pharmaceutical and consumer products sectors Wednesday as good places to park money. Quest, Oracle, Sprint, General Mills, Pepsi, HMG Worldwide and PSINet were some names that made the list.

While the sell-off in the markets continued into midday, recent guests on CNNfn commented on the stocks they are buying, and why.

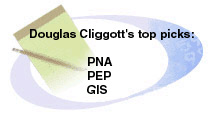

"The way the economy tends to slow down is in things that either we as individuals or businesses can push off into the future," said Douglas Cliggott, U.S. equity strategist, J.P. Morgan. "Auto sales are slowing. That is [due to] individuals this time. We can wait to buy a new car. These announcements from the technology sector appear to imply that a lot of companies are saying we can wait a little while with our business spending." "The way the economy tends to slow down is in things that either we as individuals or businesses can push off into the future," said Douglas Cliggott, U.S. equity strategist, J.P. Morgan. "Auto sales are slowing. That is [due to] individuals this time. We can wait to buy a new car. These announcements from the technology sector appear to imply that a lot of companies are saying we can wait a little while with our business spending."

"What we like in the market now are companies or industries where EPS growth tends not to depend on the economic cycle," he said. So whether growth slows a little or a lot, pharmaceutical earnings growth tends to be in the 15-to-16 percent range. And we think Pharmacia (PHA: Research, Estimates) is just a great pharmaceutical stock."

"We think Pepsi (PEP: Research, Estimates) and General Mills (GIS: Research, Estimates) fit the same bill. We're not going to slow our purchases of soft drinks. We're not going to slow our purchases of breakfast cereal even if the economic growth surprises on the downside."

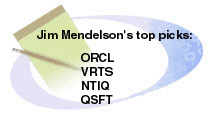

"I actually am quite optimistic that the June quarter will generally be a strong quarter for the software sector as a whole, obviously excluding those companies that are heavily laced in the framework space and the OS390 mainframe space," said Jim Mendelson, software analyst, Wit SoundView. "I actually am quite optimistic that the June quarter will generally be a strong quarter for the software sector as a whole, obviously excluding those companies that are heavily laced in the framework space and the OS390 mainframe space," said Jim Mendelson, software analyst, Wit SoundView.

"I would focus heavy on those companies that are playing directly to supporting the e-business infrastructure opportunity, and apart from Oracle (ORCL: Research, Estimates), where I'm very, very bullish, probably my No. 1 pick among the large-cap names would be Veritas (VRTS: Research, Estimates) which is the clear leader in the software storage management space."

"In the mid-cap arena, NetIQ (NTIQ: Research, Estimates) and Quest Software (QSFT: Research, Estimates) are both systems management software companies, that are very much focused around specific market opportunities that are very hot and exciting right now."

"NTIQ is directed towards the Windows 2000 rollout, and is benefiting significantly from that, especially as it grows as a platform for e-business. And Quest is very much a derivative play on the strength that we're seeing in the Oracle marketplace right now, and all three of these companies are very high-momentum stocks, and that's really where the money's been made in the technology sector this year."

"Oracle is very fortunate in being increasingly recognized as the core building block for supporting the Internet e-business movement that we're seeing here, so I would continue to be very supportive of Oracle at these levels."

"What you're seeing in the telecom sector is the old-line telecom companies who relied historically on voice services, looking at companies who have new assets, new fiber, which is more customized for Internet traffic and IP traffic. So it's the old-line companies looking at higher margin, higher value services, and looking to actually merge or take them on to their own business," said James Linnehan, telecom analyst, Thomas Weisel Partners. "What you're seeing in the telecom sector is the old-line telecom companies who relied historically on voice services, looking at companies who have new assets, new fiber, which is more customized for Internet traffic and IP traffic. So it's the old-line companies looking at higher margin, higher value services, and looking to actually merge or take them on to their own business," said James Linnehan, telecom analyst, Thomas Weisel Partners.

"The best way I think for investors to play it -- well, in the short term, if you want to play the arbitrage, look at Sprint (PCS: Research, Estimates) stock. But, for the long-term investors, look at the newer companies who have done a great job of laying out fiber across the U.S., across the oceans, and throughout Europe. Some of the stocks may be a bit expensive right now, but they will be very premium priced, once they get their business up and running, and can bring on a lot more customers."

"I like Qwest Communications (Q: Research, Estimates) right now. They just closed their transaction with U S West (USW: Research, Estimates). The company is growing 15 percent in the top line in the combined form, faster than any other competitors. Global Crossing (GBLX: Research, Estimates) we like, mainly because of the same reasons. They control a great part of the undersea traffic that goes between the U.S. and Europe and the U.S. and Asia."

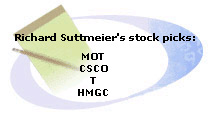

"I think the Nasdaq, if it has a weekly close above 4000 at any point in time in here, can trade up to 4400. So the intermediate cycle in the Nasdaq is still positive. So 4400 would be where the resistance is and support if it breaks under its 200-day moving average, which is now around 3700," said Richard Suttmeier, chief financial strategist, Joseph Stevens. "I think the Nasdaq, if it has a weekly close above 4000 at any point in time in here, can trade up to 4400. So the intermediate cycle in the Nasdaq is still positive. So 4400 would be where the resistance is and support if it breaks under its 200-day moving average, which is now around 3700," said Richard Suttmeier, chief financial strategist, Joseph Stevens.

"I think there's still a lot of investors -- particularly the shorter-term investors -- who are looking to sell strength. They're trying to shore up their accounts by selling strength in this market. They've just had a lot of problems and they were obviously some hurting portfolios, if you will, based upon the declines that we saw for March and for May."

"Now Motorola (MOT: Research, Estimates) is our leader in the wireless -- getting on the wireless with hand-held sets and other devices. Cisco Systems (CSCO: Research, Estimates) is our first pick in networking. Then there is AT&T (T: Research, Estimates), in content and wireless long-distance. So we're creating a theme that the wireless arena is going to be a growth sector regardless of the other parts of the market. HMG Worldwide (HMGC: Research, Estimates), they're a marketing firm, in-store and online marketing, and they have core clients that have been with them for about 30 years. And they're in 15 countries with ISPs. So it's a growth story for HMG Worldwide. The stock bottomed around $3 a share, and closed last week just above $4."

"We like SBC (SBC: Research, Estimates). SBC has a good collection of assets across local, long-distance, Internet and wireless. In wireless they're in an alliance with BellSouth (BLS: Research, Estimates). They have a good national footprint, or are approaching a national footprint," said Anthony Ferrugia, telecom analyst, A.G. Edwards. "We like SBC (SBC: Research, Estimates). SBC has a good collection of assets across local, long-distance, Internet and wireless. In wireless they're in an alliance with BellSouth (BLS: Research, Estimates). They have a good national footprint, or are approaching a national footprint," said Anthony Ferrugia, telecom analyst, A.G. Edwards.

"Broadwing (BRW: Research, Estimates) is a little smaller cap. It's not a small-cap stock, but by my industry standards, it is. And it's probably about $5 billion in market cap. It's the old Cincinnati Bell -- picked up the IXC network. Great set of management out of MCI (WCOM: Research, Estimates). PSINet (PSIX: Research, Estimates), I don't follow that directly, but it's one of the best Internet backbone assets in the world. Internationally, it's the second largest. They carry the third- or fourth-largest number of Internet protocol revenues over that network. It's very cheap at $24."

--Compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|