|

Stock picks by the pros

|

|

June 28, 2000: 3:20 p.m. ET

Texas Instruments, AIG, Home Depot, eBay, Global Marine, Wells Fargo rate

|

NEW YORK (CNNfn) - Market analysts were upbeat on tech, financial, retail and industrial stocks Wednesday, favoring such names as Motorola, DoubleClick, Johnson & Johnson, Merrill Lynch, and Helmerich & Payne.

While the markets rose on news of stabilized interest rates following the Federal Reserve's latest announcement, recent guests on CNNfn commented on the stocks they are buying, and why.

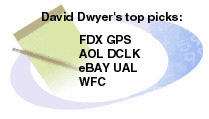

"We listed 10 stocks yesterday we call our 'future economy portfolio'; FedEx (FDX: Research, Estimates) was included in there because we look at it more as a logistical play-off of the Internet, really on the B2B side," said David Dwyer, analyst, Salomon Smith Barney. "We called it future economy portfolio because we are really looking for the future economy to be a merger between the old and the new economy." "We listed 10 stocks yesterday we call our 'future economy portfolio'; FedEx (FDX: Research, Estimates) was included in there because we look at it more as a logistical play-off of the Internet, really on the B2B side," said David Dwyer, analyst, Salomon Smith Barney. "We called it future economy portfolio because we are really looking for the future economy to be a merger between the old and the new economy."

Dwyer said that there are "three things that we look for in our picks, one: companies that have the ability to generate traffic to the Web site; two: companies that generate a proprietary product; and three: companies that really get into logistics business of supply chain management or procurement."

"The Gap (GPS: Research, Estimates) is a very interesting one. A lot of apparel manufacturers have a problem selling to independent retailers, a real channel conflict. The Gap has an exclusive brand that they sell through a proprietary distribution channel. They can really focus the Internet on that - on that exclusive chain."

Other picks on his list include America Online (AOL: Research, Estimates), DoubleClick (DCLK: Research, Estimates), eBay (EBAY: Research, Estimates), United Airlines' parent company UAL Corp. (UAL: Research, Estimates), and Wells Fargo (WFC: Research, Estimates).

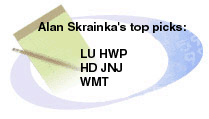

"Our very specific advice for many months and continues to be: Limit technology to 20 percent of your equities, don't get carried away with any one stock, and avoid those companies that do not have an established track record of growth," said Alan Skrainka, chief market strategist, Edward Jones. "It's OK to own companies like Lucent (LU: Research, Estimates) or Hewlett-Packard (HWP: Research, Estimates) but if you are buying a company that is trying to sell you something on the Internet, that's going to be a very tough cut-throat competitive environment." "Our very specific advice for many months and continues to be: Limit technology to 20 percent of your equities, don't get carried away with any one stock, and avoid those companies that do not have an established track record of growth," said Alan Skrainka, chief market strategist, Edward Jones. "It's OK to own companies like Lucent (LU: Research, Estimates) or Hewlett-Packard (HWP: Research, Estimates) but if you are buying a company that is trying to sell you something on the Internet, that's going to be a very tough cut-throat competitive environment."

"In the drug stocks we love companies like Johnson & Johnson (JNJ: Research, Estimates)," Skrainka said. They're a very dependable growth stock. They still have a lot of growth left."

"Retailers are out of favor so we love Wal-Mart (WMT: Research, Estimates) and Home Depot (HD: Research, Estimates)," he said. They're well off of their highs. Consumer spending is going to slow down, but that news is already reflected in the price of these super growths."

"The fact of the matter is this economy needs to pull back a little bit, build a base, and once it builds that base, I think we're going to take off and see all-time new highs in the market. And you're going to see prosperity like we've never seen since World War II because of that," said David Elias, chief investment officer at Elias Asset Management. "The fact of the matter is this economy needs to pull back a little bit, build a base, and once it builds that base, I think we're going to take off and see all-time new highs in the market. And you're going to see prosperity like we've never seen since World War II because of that," said David Elias, chief investment officer at Elias Asset Management.

"We continue to like the technology stocks like Texas Instruments (TXN: Research, Estimates), Motorola (MOT: Research, Estimates), and Intel (INTC: Research, Estimates)," he added. "We would be aggressive buyers in here, because again three to five years from today, all of those stocks have the potential of doubling. Their earnings are growing at double digits. That is not going to slow down."

"We have to always remember we're living in a one-world economy today," Elias said. "It's not just the United States. Asia is starting to pick up again. Europe is starting to do what we did back in the 1980s where they've restructured their positioning themselves. I think (in) the next 10 years, you're going to see Europe really booming. That is going to bode well for the American technology companies."

"The same thing (is true) in the financial service area," he said. "Citigroup (C: Research, Estimates), AIG (AIG: Research, Estimates), Fannie Mae (FNM: Research, Estimates), all of those companies are going to do very, very well in the environment that we're in. And what's interesting even though interest rates are up significantly over the last 18 months, Citigroup is selling near it's all-time high, AIG is selling near its all-time high. Merrill Lynch (MER: Research, Estimates) is also selling near its all-time high."

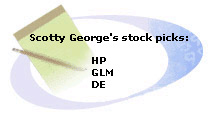

"It's the micro management, the machinations up and down of interest rates, that has really gotten us to the point where we are now, rather than the market playing out at its own natural cycle," said Scotty George, chairman of Corinthian Partners Asset Management, before the Federal Reserve made public its decision to hold the line on interest rates. "So the Fed today, I believe, will take a look back at the landscape, assess what they've done, and probably use August to evaluate whether or not to come back in and raise rates." "It's the micro management, the machinations up and down of interest rates, that has really gotten us to the point where we are now, rather than the market playing out at its own natural cycle," said Scotty George, chairman of Corinthian Partners Asset Management, before the Federal Reserve made public its decision to hold the line on interest rates. "So the Fed today, I believe, will take a look back at the landscape, assess what they've done, and probably use August to evaluate whether or not to come back in and raise rates."

"This is an 18-year bull market that is expiring. The bull isn't but the phasing is," George added. "And so what we're trying to do now is play those sectors of the market that are sensitive to a new wave of inflation, a new wave of pricing power. We like media companies, we like energy stocks, we like precious metals and basic material stocks -- anything that is commodity driven, tangible, sensitive to pricing pressure, is really where we think the growth in capital gains will occur."

"Helmerich & Payne (HP: Research, Estimates) is a drilling company, and we're staying very close to our knitting when we talk about the drillers and the oil producers," he said. "The stock, as you see, has had a fairly nice run recently. But we also believe that going forward, pricing power in the production side of energy is really where it is. Global Marine (GLM: Research, Estimates) is probably a sister company in terms of our portfolio allocation into the drilling companies, and we would feel very favorably towards that as well."

"We like Deere & Co. (DE: Research, Estimates)," George said. "We like the big global industrial companies that might benefit from a rise in industrial production worldwide as opposed to focusing on U.S. economy. These are also sectors that we feel represent this back-end industrial side of the market, and typify what we feel are better capital gains opportunities than trying to micromanage the technology sector, or the retail side of the market."

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|