|

JDS pulls Nasdaq down

|

|

July 10, 2000: 4:52 p.m. ET

Fiber optic deal hurts composite index; Dow steadied by strong Alcoa earnings

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - JDS Uniphase took a beating Monday, helping to send the Nasdaq composite index lower, after the fiber optic component maker announced a takeover offer for one of its rivals, SDL.

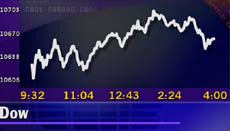

But the Dow Jones industrial average held on to a modest gain after aluminum maker Alcoa started the earnings season by reporting positive quarterly results.

Analysts said they expect further positive corporate quarterly earnings to help lift both the Dow and the Nasdaq, as more reports are posted and concerns about revenue growth for the next six months are alleviated.

"Folks are waiting for earnings to start rolling in," said Peter Coolidge, senior trader at Brean Murray & Co. "There's not much to motivate the market, and the Nasdaq action has been dominated by JDS Uniphase's proposed takeover of SDL and the ramifications for those two companies as well as competitors."

The Nasdaq slumped 42.91 to close at 3,980.29. The Dow gained 10.60 to end the day at 10,646.58. The broader S&P 500 slipped 3.28 to 1,475.62. The Nasdaq slumped 42.91 to close at 3,980.29. The Dow gained 10.60 to end the day at 10,646.58. The broader S&P 500 slipped 3.28 to 1,475.62.

Market breadth was mixed but volumes were only moderate. Advancing issues on the New York Stock Exchange beat declining ones 1,605 to 1,246, as trading volume reached 819 million shares. Nasdaq losers topped winners 2,104 to 1,945, as more than 1.3 billion shares changed hands.

"I think we're clearly in summer vacation mode, so we're going to have low volumes -- which has a strange effect on equity valuations and tends to exaggerate moves," said Art Hogan, chief market analyst at Jefferies & Co. "I think we're clearly in summer vacation mode, so we're going to have low volumes -- which has a strange effect on equity valuations and tends to exaggerate moves," said Art Hogan, chief market analyst at Jefferies & Co.

In currency markets, the dollar fell against the yen and euro. Treasury securities edged lower.

JDS Uniphase, Alcoa dominate the action

With Alcoa kicking off the corporate quarterly earnings season, investors remained cautious and were biding their time for further affirmation that results would meet expectations and yield no negative surprises, according to analysts.

"The market is having a little trouble making up its mind," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "We'll probably waffle around a little but the tone of the market should improve as the earnings continue to come in."

Investors rewarded Dow component Alcoa (AA: Research, Estimates), which rose 1-7/8 to 29-1/2 after posting second-quarter net income of 47 cents a share, beating estimates by 2 cents a share and rising from the 32 cents a share in the year-earlier period.

In the other direction, there was little indecision about JDS Uniphase (JDSU: Research, Estimates). It tumbled 15-1/4 to 100-15/16 after unveiling a $41 billion all-stock purchase of rival fiber-optic components maker SDL (SDLI: Research, Estimates) -- offering SDL shareholders a 50 percent premium over the stock's recent price. SDL gained 25-3/8 to 320-11/16.

Credit Suisse First Boston said the acquisition will complement JDS's source laser business, and it highlights a strategic importance in key optical component technologies, as higher levels of integration are required to deliver next generation systems. The firm maintains a "buy" rating for the stock.

SG Cowen also applauded the potential deal, saying the combined company will dominate the optical components business and maintaining a "strong buy" on the stock.

Other fiber-optic makers received buying attention. New Focus (NUFO: Research, Estimates) jumped 17-5/32 to 98-21/32, Avanex (AVNX: Research, Estimates) gained 19-3/4 to 126-1/2, and Ciena (CIEN: Research, Estimates) rose 1-7/8 to 173-3/4.

"I think the market here is a little undecided," said Peter Cardillo, director of research at Westfalia Investments. "Technology stocks seem to be taking it on the chin again."

Tech leaders were sold. Microsoft (MSFT: Research, Estimates) fell 2-9/16 to 79-7/16, Intel (INTC: Research, Estimates) dropped 1-3/8 to 137-15/16, Oracle (ORCL: Research, Estimates) slid 1-3/4 to 74-1/8, and Yahoo! (YHOO: Research, Estimates), which reports its second-quarter results Tuesday, lost 6-1/2 to 110. Tech leaders were sold. Microsoft (MSFT: Research, Estimates) fell 2-9/16 to 79-7/16, Intel (INTC: Research, Estimates) dropped 1-3/8 to 137-15/16, Oracle (ORCL: Research, Estimates) slid 1-3/4 to 74-1/8, and Yahoo! (YHOO: Research, Estimates), which reports its second-quarter results Tuesday, lost 6-1/2 to 110.

Cardillo said some of the day's market waffling was due to investor concern about corporate statements that accompany earnings releases. "There's skepticism about earnings -- companies may report good earnings but they might have some negative comments to make about future revenue growth," he said.

In an example of that waffling, Honeywell (HON: Research, Estimates) rose 1/8 to 34-3/4 after saying it should edge past estimates for the second quarter while lowering earnings forecasts for this year and next. In an example of that waffling, Honeywell (HON: Research, Estimates) rose 1/8 to 34-3/4 after saying it should edge past estimates for the second quarter while lowering earnings forecasts for this year and next.

"I think we're looking at nothing but good news on the earnings front," said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum. "It will be more critical to see what guidance these companies give us toward the next six months to one year. Today's action is a little too premature to say how the markets will react to earnings."

Linda Jay, NYSE floor trader for RPM Specialists, told CNNfn's Market Call that Tuesday's earnings from Yahoo! coupled with remarks by Fed Chairman Alan Greenspan could have a big impact on the markets. (330K WAV) (330K AIFF)

The Fed chief is scheduled to speak on the new economy at the National Governors Association conference in State College, Pa., Tuesday morning, and on global economy decision-making Wednesday evening in New York.

"(Greenspan's) a proponent of what productivity gains have brought to this new economy," said Jefferies' Hogan. "Of all the things he says, the least hawkish is when he talks about productivity and the new economy. In terms of Wall Street's reaction, I wouldn't say we could garner anything but a positive feeling."

|

|

|

|

|

|

|