|

Europe mixed, Dax down

|

|

July 11, 2000: 2:20 p.m. ET

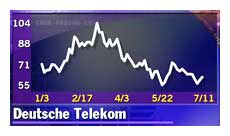

Deutsche Telekom weighs down Frankfurt market, telecoms slump

|

LONDON (CNNfn) - European market closed mixed on Tuesday, with Germany's key index sliding as heavyweight Deutsche Telekom fell on reports the company might be nearing the U.S. buyout target it has been looking for.

The Xetra Dax in Frankfurt fell 66.84 points, or 0.95 percent, to 7,003.98, with Deutsche Telekom (FDTE) dropping 2.8 percent to rank among the leading losers. Media reports said the company was set to make a $30 billion offer for Bellevue, Wash.-based mobile-phone operator VoiceStream Wireless (VSTR: Research, Estimates). Deutsche Telekom declined to comment.

The CAC 40 index in Paris was little changed at 6,409.19 points, as insurance stocks weakened. Axa (PCS), the world's largest insurer, fell 5.3 percent, and rival AGF (PAGF) shed 1.1 percent. Zurich's SMI index slipped 0.1 percent. The CAC 40 index in Paris was little changed at 6,409.19 points, as insurance stocks weakened. Axa (PCS), the world's largest insurer, fell 5.3 percent, and rival AGF (PAGF) shed 1.1 percent. Zurich's SMI index slipped 0.1 percent.

London's FTSE 100 index, in and out of negative territory, ended the session up 18.4 points, or 0.3 percent, at 6,484.6, led by HSBC Holdings and business services firm Capita Group.

The FTSE Eurotop 300 index, a basket of Europe's biggest companies, rose 0.2 percent.

In the currency market, the euro weakened to 94.97 U.S. cents from 95.48 cents in late trading in New York on Monday.

Telecom stocks lose power

With Deutsche Telekom leading stock markets lower, industry peers declined in turn. France Telecom (PFTE) - also reported to be a possible bidder for VoiceStream - shed 3.4 percent in Paris, and Vodafone Airtouch (VOD), the world's biggest mobile-phone operator, fell 2.9  percent in London. percent in London.

Weakness among banking stocks also depressed Frankfurt's Dax. HypoVereinsbank (FHVM) fell 1.7 percent, and Commerzbank (FCBK), which has said it is in talks about a merger or pact with Dresdner Bank (FDRB), shed 1 percent.

Retailer Metro (FMTR) fell 4.5 percent, while department store operator Karstadt Quelle (FKAR) dropped 2.6 percent.

Germany's largest chemicals company Henkel (FHKL) dropped 3.3 percent, and steel producer Thyssen Krupp (FTKA) shed 3.4 percent.

Leading a short list of gainers in Frankfurt was automaker BMW (FBMW), up 4.4 percent.

In London, consumer electronic retailer Dixons Group (DXNS) posted the biggest gain on the FTSE 100, jumping 6.2 percent, and business services firm Capita Group (CPI) rose 5.6 percent.

Banking and financial stocks were firmer, as HSBC Holdings rose almost 5 percent, Barclays (BARC) climbed 1.2 percent, Royal Bank of Scotland (RBOS) leapt 1.4 percent, and investment bank Schroders (SDR) added 2.5 percent. Banking and financial stocks were firmer, as HSBC Holdings rose almost 5 percent, Barclays (BARC) climbed 1.2 percent, Royal Bank of Scotland (RBOS) leapt 1.4 percent, and investment bank Schroders (SDR) added 2.5 percent.

BP Amoco (BPA) jumped 1.8 percent after the oil company said it aims to increase underlying earnings during the next three years by at least 10 percent a year. Rival Shell Transport and Trading Co. climbed 1.1 percent, and Total Fina [PAR: ] advanced 1.5 percent in Paris.

Drugs company SmithKline Beecham (SB-) climbed 1.3 percent, and merger partner Glaxo Wellcome (GLXO) rose 1.4 percent. German rival Schering (FSCH) added 1.7 percent in Frankfurt.

Energis, Britain's biggest carrier of Internet traffic (EGS), fell more than 3 percent, and Freeserve (FRE), the No. 1 U.K. Internet service provider, declined 2.5 percent.

Granada Media debuts in London

Outside the FTSE index, newly listed shares of Granada Media (GME) rose 6.7 percent to 550 pence after going on sale to institutional investors at 515 pence. Parent Granada Group (GAA) raised £1.3 billion ($1.97 billion) for its broadcasting and program-making unit in the sale. Granada Group's stock was little changed.

In Paris, shares in the European Aeronautic, Defense and Space Co., Europe's largest aerospace company, rose 4 percent to  18.15, recovering from a decline on their market debut Monday, but still below the IPO price of 18.15, recovering from a decline on their market debut Monday, but still below the IPO price of  19. EADS was formed by the three-way merger of Aérospatiale-Matra, the Dasa aerospace unit of Germany's DaimlerChrysler (FDCX), and Spain's Construcciones Aeronauticas SA, or Casa. 19. EADS was formed by the three-way merger of Aérospatiale-Matra, the Dasa aerospace unit of Germany's DaimlerChrysler (FDCX), and Spain's Construcciones Aeronauticas SA, or Casa.

"New-economy" issues in the telecom, media, and technology sectors were mixed in Paris. Dutch-based networking company Equant (PEQU) shed 2.2 percent, utility and media company Vivendi (PEX) dropped 3 percent, and chip maker STMicroelectronics (PSTM) climbed 3.1 percent. Bouygues (PEN), a conglomerate with businesses in construction and telecommunications firm, rose 2 percent.

Information technology consultant Cap Gemini (PCAP) lost 1.1 percent and Europe's biggest pay-TV company, Canal Plus (PAN), fell 2.3 percent.

|

|

|

|

|

|

|