LONDON (CNNfn) - Asia's leading markets closed mixed Tuesday, with leading technology and telecommunications companies declining in Tokyo, while Hong Kong made progress thanks to gains for property shares and a leading bank.

Tokyo's benchmark Nikkei 225 index closed down 68.32 points, or 0.4 percent, at 17,504.36, as tech issues weakened after a 1.1 percent decline Monday on the U.S. Nasdaq composite index, a leading barometer for the world's top technology stocks.

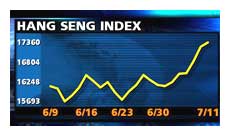

The Hang Seng index in Hong Kong closed up 120.99 points, or 0.7 percent, at 17,359.66, lifted by a 3.6 percent gain for HSBC Holdings. Shares of the London-based global bank rose ahead of the completion of its buyout of Credit Commercial de France, which is set to close Wednesday.

Elsewhere in the Pacific Rim, Australia's S&P/ASX 200 was down fractionally at 3,323.3, with media company News Corp. dropping 1.3 percent. Singapore's Straits Times index climbed 0.4 percent to 2,107.08.

In Taipei, the Taiwan Weighted index was up 0.1 percent. But Korea's Kospi index dropped 1.7 percent in Seoul as investor confidence was rattled by a strike by bank workers protesting government reforms of the financial industry.

In the currency market, the dollar fell against the Japanese yen to ¥106.88 from ¥107.16 in late New York trade Monday.

Setbacks for Tokyo techs

Leading technology stocks in Tokyo remained weak, with blue-chip consumer-electronics maker Sony down 2.5 percent and Fujitsu off 1.2 percent, following a 1 percent decline on the Nasdaq composite index Monday.

Internet investor Softbank fell 6.9 percent, reversing the previous day's gain, on declines in the market value of several of the U.S.-based Internet firms in which Softbank holds stakes.

Sogo plunged 14.1 percent after Japanese Prime Minister Yoshiro Mori said he had instructed ruling party officials to review a near-$1 billion dollar bailout plan for the ailing department store operator.

Auto parts maker Ikeda Bussan soared 30 percent to ¥218, rising by its daily limit, as it extended Monday's rise on news that U.S.-based Johnson Controls (JCI: Research, Estimates) had launched a takeover offer at ¥120 a share.

In Hong Kong, property investor Henderson Land rose 4.3 percent after technology spinoff Henderson Cyber said its HK$937.5 million ($120 million) initial public offering was oversubscribed. Elsewhere in the sector, New World Development added 2.7 percent, Sino Land rose 7 percent and Hang Lung Development leapt 6.1 percent.

HSBC's good fortunes lifted others in the banking sector. Hang Seng Bank rose 1.9 percent and Bank of East Asia leapt 3.1 percent.

In the telecom arena, China Mobile, previously known as China Telecom, was down 1.7 percent.

Boost for red chips

Morgan Stanley on Tuesday raised its Hong Kong equity weighting to "overweight" from neutral. That helped lift mainland China-based companies - also known as "red chips" -- such as computer maker Legend Holdings, which rose 5.5 percent.

In Singapore, property heavyweight City Developments rallied 10 percent as the company began road shows for investors following its recent restructuring. Straits Times index heavyweight Singapore Telecommunications added 0.8 percent.

Elsewhere in the region, Jakarta's JSX index added 0.8 percent, Manila's PHS composite rose 0.4 percent, the KLSE composite in Kuala Lumpur rose 1 percent, and in Bangkok, the SET index fell 0.3 percent.

-- from staff and wire reports

|