|

Economic reports mixed

|

|

August 1, 2000: 1:14 p.m. ET

Manufacturing growth in check as construction falls; spending, pay grow

|

NEW YORK (CNNfn) - Higher raw material prices are keeping manufacturing growth in check while spending on new construction fell unexpectedly to its lowest level in six months, reports showed Tuesday.

Meanwhile, consumer spending, which fuels two-thirds of the economy, rose modestly last month, a bit faster than personal income, according to a separate government report.

Economists said the latest reports contain new arguments against another interest rate increase by the Federal Reserve when it meets later this month. The Fed has raised rates six times in the last 13 months in a bid to slow the economy and ward off inflation. But some economists said they believe a rate hike still is a possibility. Economists said the latest reports contain new arguments against another interest rate increase by the Federal Reserve when it meets later this month. The Fed has raised rates six times in the last 13 months in a bid to slow the economy and ward off inflation. But some economists said they believe a rate hike still is a possibility.

"I would think the probability of a move (on interest rates) would be somewhere around the 40 percent range," said Oscar Gonzalez, economist with John Hancock Financial Services.

U.S. stock markets were mixed after the reports. Investors looking for signs about what the Fed will do when the central bank's policy makers meet on Aug. 22 are awaiting Friday's jobs report, as well as the wholesale and retail prices reports due later this month, said Gonzalez. Ian Shepherdson, chief U.S. economist for High Frequency Economics, said the retail sales report due next Friday would also be closely watched.

"My guess is that is that at the moment these numbers seem to be supporting the slow down story," said Shepherdson. "But the market is pretty much ignoring it and moving on."

Manufacturing shows narrow growth

The closely watched National Association of Purchasing Management's index came in at 51.8 percent in July, the same as in June. While it was the first time since February that the measure of manufacturing activity did not decline, it came in below the 52.5 percent forecast by economists surveyed by Briefing.com. A reading above 50 indicates expansion in manufacturing, while readings below that point to contraction.

The prices paid index rose to 61.9 percent, an increase of 0.7 percentage point from June's 61.2 figure.

"Comments from purchasing managers this month generally expressed concerns about prices in general and energy prices in particular," the group's report said.

Shepherdson said the prices paid are primarily a function of commodity prices, and are less important than labor costs, which he said continue to be helped by productivity gains. He also said that the NAPM report is less important than it once was because of manufacturing's declining influence in the economy. Shepherdson said the prices paid are primarily a function of commodity prices, and are less important than labor costs, which he said continue to be helped by productivity gains. He also said that the NAPM report is less important than it once was because of manufacturing's declining influence in the economy.

"I think it's going to keep trending downwards. But the bigger story is whether the slow down in manufacturing affects the rest of the economy," he said. "So far, consumers haven't been worried about anything."

Construction spending drops unexpectedly

Construction spending posted an unexpected 1.7 percent decline in June to an $800 billion annual rate, the lowest level of spending in the sector since December, according to a Census Bureau report. Economists surveyed by Briefing.com forecast construction spending to post a 0.3 percent gain in June, after a 0.2 percent decline in May.

Spending on new residential housing units was at a seasonally adjusted annual rate of $260.9 billion in June, a 2 percent drop from the revised May estimate of $266.2 billion. Non-residential construction edged 1 percent lower to a $214.8 billion annual rate in June, while public construction projects fell 4.4 percent to a $174.3 billion annual rate.

Shepherdson said he believes statistics such as mortgage applications suggest the slowdown in home building is poised for a rebound, despite Federal Reserve Chairman Alan Greenspan recent testimony to Congress that he expects that slow down to continue.

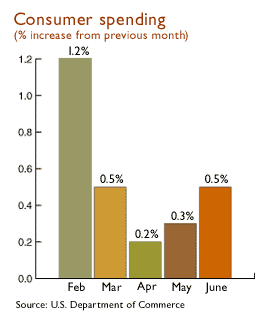

Personal spending outpaces earnings gain

The Commerce Department report shows spending by consumers grew $32.5 billion, or 0.5 percent, in June, slightly above the Briefing.com forecast of a 0.4 percent rise. Consumer spending increased a revised 0.3 percent in May.

Consumer spending accounts for about two-thirds of the nation's economy, and the number is watched for signs of both consumer confidence and overall economic strength.

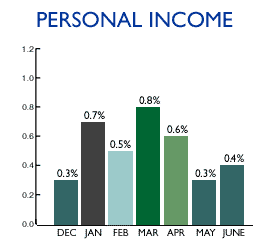

The report also showed personal income grew 0.4 percent in June, up from a revised 0.3 percent increase in May. The forecast of economists surveyed by Briefing.com was for a 0.5 percent increase. The report also showed personal income grew 0.4 percent in June, up from a revised 0.3 percent increase in May. The forecast of economists surveyed by Briefing.com was for a 0.5 percent increase.

The spending numbers were reflected in the gross domestic product number for the second quarter, reported Friday, so Tuesday's report was anti-climatic, said David Orr, chief economist for First Union. He said the most interesting number he saw in the personal spending report was a modest 0.3 percent price deflator, a measure of inflationary pressures, and an unchanged core price deflator, which excludes energy and food prices.

Orr said the Fed watches that measure of prices paid by when it tries to determine whether interests rates are needed to keep inflation in check.

"Given that the Fed has indicated this is a key number, that's very hopeful," Orr said.

Tuesday's Commerce Department report suggests that consumers apparently dug into savings for some of their purchases in June, as the report shows that personal saving as a percentage of disposable personal income fell to 0.1 percent from a 0.3 percent rate in May. But Orr said his measures of savings, such as money market accounts and certificates of deposit, show no drop in savings.

|

|

|

|

|

|

|