|

Making your nest egg last

|

|

August 25, 2000: 7:13 a.m. ET

Stretching your retirement dollars takes a lot of careful planning

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - It took hard work, discipline and 30 some-odd years to whip your nest egg into shape; the pot of gold that would pay the bills long after you bid farewell to the boss.

You did without when duty called. You did yourself proud.

And now, as retirement day dawns, you're fully prepared to sit back, relax and enjoy the fruits of your labor.

A little advice? Don't get too comfortable.

Experts say too many retirees get caught off guard by the staggering number of investment decisions that must be made as their fast-track careers fade to black. Worse yet, they note, even the slightest mistake can deal a devastating blow to the underlying value of your accounts.

"So many Baby Boomers are closing in on retirement and the big important question for them used to be, 'How should I invest my money?'" said Ned Notzon, president of Spectrum Fund, a diversified fund of funds managed by Baltimore-based brokerage house T. Rowe Price. "Now, it's, 'How much can I afford to spend without running too great a risk of running out?' It's a much harder question because deciding how to spend it shapes everything. There's very little guidance on the subject."

Deciding how best to dip into your dollars, once the paychecks stop, is a daunting task indeed.

In the best-case scenario, it involves elaborate projections, strict budgets and complex regulations from the Internal Revenue Service. In the worst, it can lead to  some unwelcome lifestyle adjustments to make your money last. some unwelcome lifestyle adjustments to make your money last.

"Making that transition from paycheck to no paycheck scares a lot of people," said Kacy Gott, a certified financial planner with Kochis Fitz in San Francisco.

(Click here for a quick look at some of the most common 'unexpected life events' that can cause an otherwise carefully crafted retirement plan to self-destruct.)

Decision time

One of the first things many planners suggest, for new retirees, is that they roll over any 401(k)s they may have into an IRA. Such a move allows those dollars to retain their tax-advantaged status, while providing greater control, since IRAs have more flexible investment options.

Be careful, though. The rollover process must be handled in a trustee-to-trustee transfer so you never actually withdraw the money yourself. If you are less than 59-1/2, doing so would be viewed by Uncle Sam as an early withdrawal, and as such, the money would be taxed as regular income and be assessed an additional 10 percent penalty.

Click here for CNNfn.com's special report, The Road to Riches.

"IRAs give you more control and they give you more investment options than a 401(k)," Gott said.

Same goes for pension plans and defined contribution plans that allow for IRA rollovers. If it's available, take it.

"Don't automatically choose the annuity payout many of them offer if you're given a choice," Gott said. "Again, the IRA just gives you more flexibility."

Christine Fahlund, however, a CFP with T. Rowe Price, notes there are occasions when it's best to avoid a rollover, specifically when a large portion of your 401(k) includes highly appreciated company stock.

That's because, if you take that stock out and move it to a regular, taxable brokerage account, you would only owe taxes on the average cost basis (your human resources will do that math for you) of those shares, rather than the current price at which they're trading. In other words, you might only owe taxes on shares with a cost basis of $20, when they're really worth five times that amount.

Taking distributions

Distributions from your IRA - which for most constitute the largest part of their portfolio - are another matter entirely. And it's where many retirees make their biggest mistakes.

First: the rules.

The Internal Revenue Service, anxious to collect on your tax-deferred traditional IRA, requires retirees to either withdraw the entire amount of their account or begin taking minimum distributions by April 1, in the year after you turn 70-1/2. Obviously, taking minimum distributions is generally considered best since it allows more of your money to maintain its tax-deferred status longer.

Bear in mind that dipping into your IRA, or any qualified retirement plan, before you reach 59-1/2 is considered an early withdrawal. In addition to being taxed as regular income, that money will be hit with an additional 10 percent penalty.

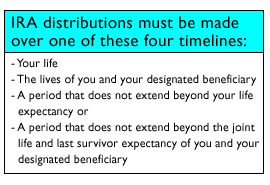

There are several types of IRA distribution methods to choose from, but once you begin taking them, the method you choose is set in stone. Choosing a method of distribution, therefore, is one of the first significant decisions that you'll be forced to make.

"I don't think a lot of people appreciate the implications of the different methods and how they can effect whether you'll meet your financial goals for those assets," Fahlund said.

The first option is called "Term Certain," which essentially just determines your monthly payments by dividing the amount of money in your account, as of Dec. 31, by the numbers of years you expect to live. If you've got an account worth $400,000 and you're now 71, with a life expectancy of 81, for example, you'd divide $400,000 by 10. That figure would then be divvied up over the 12-month period.

Life expectancies are determined using life expectancy tables like Tables I and II in Appendix E of IRS Publication 590. (Scroll down to page 24.)

The other common distribution method is called Recalculation, which allows you to stretch out the benefit of your tax-deferred IRA longer by taking smaller monthly payments over a longer period of time. Many planners recommend such a method, since life expectancies are continuing to climb.

Be aware, though, that there's a downside to recalculating, too. From an estate planning perspective, if you die prematurely, the beneficiaries (or non-spousal heirs) of your account will be forced to take that money out the following year in one lump sum - and get hit with a stiff upfront tax burden.

"If you had not recalculated, your heirs would get to take that money out over many years," said Kenn Beam Tacchino, an associate professor of taxation at Widener University in Chester, Pa. and author of numerous personal finance books including, "Financial Decision Making at Retirement." "But if you are not worried about estate planning and many people are not, or you have a separate account for that, then you do the recalculating."

There are several other "hybrid methods" described in the link below. Experts suggest exploring all the options available and they stress the need to make your decision final before minimum distributions begin.

(Click here for a breakdown of the various types of distribution methods.)

Bear in mind, too, that distribution rules can differ significantly for pension fund holders, depending on your company and the plan administrator. The biggest difference, however, stems from the fact that pension fund holders are not allowed to bypass their spouse as the immediate beneficiary of their account, Fahlund said.

Lastly, it should be noted that just because you're forced to begin taking distributions, doesn't mean you have to blow it.

"A lot of people say, 'They made me take the money out,' but the government isn't forcing you to spend it," Tacchino said, noting you can always reinvest that money into low-risk stocks or bonds.

(Click here for a sample retirement analysis and budget done for "Mr. And Mrs. Good Planner.")

Where you begin taking those distributions from is also important.

Most retirees have a diverse nest egg, comprised of IRAs, 401(k)s, savings accounts and Social Security.

Planners say it's best to spend first the money you receive from Social Security each month. Then, move on to investment income and finally tap your savings, if you must.

"Obviously, leaving tax-deferred savings in your IRAs as long as you can under the minimum distribution rules is smart," Tacchino said.

Fahlund noted, however, the Roth IRA is a unique case. Those IRAs, which are taxed up-front at the time of contribution, are best left to last.

"It turns out Roths are the ideal estate planning vehicle to leave to your kids, or better yet, your grandchildren," she said.

That's because required distributions on the Roth IRA don't begin until you die - there are no minimum requirements as there are for the traditional IRA. Therefore, you can pass that IRA on to your grandchild who may be 15 and he or she, upon your death, would calculate their minimum distributions over their life expectancy. That may be nearly 60 years of additional tax shelter for those dollars.

"We've just turned the whole IRA concept on its head," Fahlund said. "With a traditional IRA, we're talking about maybe 30 years of tax deferral for your account before you begin distributions at 70-1/2. But here, minimum distributions can be stretched out nearly twice that long."

Preserving your principal

Many financial pros prescribe a strict diet of principal preservation, which restricts retirees to spending only the income they earn from rental property, bond yields and stock dividends - while leaving their nest egg base untouched.

That, coupled with Social Security checks, the theory holds, should be enough to live on without draining the coffers dry.

But some planners suggest there may be other ways.

"I think that strategy is generally incorrect," said Phil Cook, a certified financial planner and head of Cook & Associates in Torrance, Calif. "In some cases, depending on your age and what you're earning on your assets, it's OK to spend some principal."

He explains: Say you've got an investment (rental property perhaps) producing 5 percent returns each year. You may be able to safely take 7 percent a year from that investment without reducing your principal.

That's because your assets are (hopefully) earning more than the 5 percent yield you enjoy today from dividends, interest payments and cash flow. The value of those assets, he said, also should appreciate each year giving you a total return, equal to return plus appreciation, of 10 percent or more.

Siphoning off 7 percent each year, therefore, would not be excessive, and, in fact, would still allow that investment to grow 3 percent a year.

Determining how rapidly your investments appreciate, of course, can be tricky. But Cook said you can get a good ballpark figure by simply studying the data.

"Look at the historical returns on that asset class, not just on that particular asset but over the whole asset class," he said. "You can then determine how much to reasonably expect."

|

|

|

|

|

|

|