|

Spending gains continue

|

|

August 28, 2000: 11:37 a.m. ET

Savings rate in July falls to lowest on record; spending gains top income

|

NEW YORK (CNNfn) - Americans' spending pace outstripped their rate of income gains in July, pushing the amount they put away in savings to its lowest level on record, the government reported Monday.

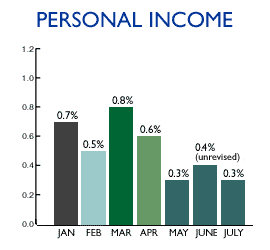

Personal income rose 0.3 percent last month, the Commerce Department said, slightly less than the 0.4 percent gain expected by economists polled by Briefing.com and the unrevised 0.4 percent increase registered in June.

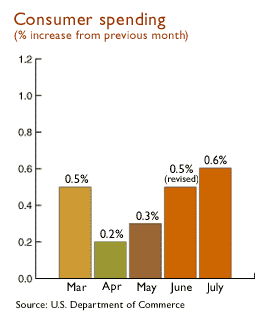

Spending, meantime, gained 0.6 percent last month, above expectations and the revised 0.5 percent pace recorded a month before. June's increase in spending was revised upward from the originally reported 0.4 percent gain. It was the largest monthly rise since a 1.2 percent surge in February, Commerce figures showed. Spending, meantime, gained 0.6 percent last month, above expectations and the revised 0.5 percent pace recorded a month before. June's increase in spending was revised upward from the originally reported 0.4 percent gain. It was the largest monthly rise since a 1.2 percent surge in February, Commerce figures showed.

All that pushed the country's savings rate to a negative 0.2 percent in July -- the lowest since Commerce began calculating the monthly number in 1959. June's savings rate was unrevised at a 0.1-percent increase.

The numbers paint a picture of U.S. households earning a bit less and spending a bit more, a situation the Federal Reserve has been trying to temper for the past year or so by periodically raising short-term interest rates. Fed officials opted to hold the line last week on raising rates, though some analysts expect they may notch up rates yet again if more evidence of slowing growth doesn't appear on the horizon. Fed officials next meet Oct. 3.

Good news? Incomes are moderating

All the same, the numbers did hold some good news from an economic point of view -- that Americans' income gains are moderating. In the last three months, incomes have risen an annual pace of 3.9 percent, much less than the 6.3 percent pace recorded over the last 12 months.

That should lead to slower consumer spending down the road, ensuring that consumer prices remain in check, according to Steve Wood, an economist with Banc of America Securities in San Francisco. That should lead to slower consumer spending down the road, ensuring that consumer prices remain in check, according to Steve Wood, an economist with Banc of America Securities in San Francisco.

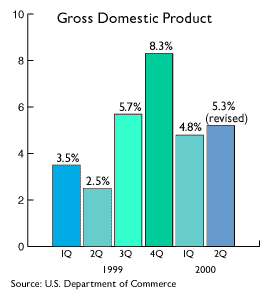

The data "add to the evidence that the economy is settling into a slower growth trajectory," he said. He predicts the U.S. economy will grow by about 3 percent in the third quarter, down from 5.3 percent in the second.

Financial markets registered little reaction to the numbers, mostly because they come in the face of near-record U.S. employment, which naturally encourages people to spend more and save less, according to economists.

Consumer spending accounts for more than two-thirds of the nation's output of goods and services. In the second quarter, spending grew at a 2.9 percent annual pace, the slowest in three years. That followed a spending rate of 7.6 percent in the first quarter, the fastest pace in 17 years, according to a Commerce Department report released last week.

Spending more, saving less

Even so, the negative savings rate could be a concern for Fed policy makers, who have raised rates six times since June 1999 in an effort to make borrowing more expensive and saving more worthwhile. Fed officials held off raising rates at their most recent meeting held about a week ago. The fed funds rate currently is at a nine-year high of 6.5 percent.

A negative rate suggests that consumers still are financing their spending through borrowing, or by using previously accumulated savings or investments to fund their purchases. A negative rate suggests that consumers still are financing their spending through borrowing, or by using previously accumulated savings or investments to fund their purchases.

"Even though the Fed is raising rates and stocks are volatile, we haven't seen much impact on either income growth or consumer confidence, which will provide support for spending in the second half of the year," according to Tim Rogers, chief economist with Briefing.com in Boston.

Still, with rates a point and a half higher than they were a year ago and with prices for at least some goods and services now elevated, not all analysts agree that U.S. consumer spending is about to resume its record streak.

"Consumer spending has rebounded from its spring lull, but isn't snapping back rapidly enough to present a problem for the Fed," said Sherry Cooper, chief economist with brokerage BMO Nesbitt Burns Inc. "Indeed, early anecdotal reports for August are less than overwhelming; income and inflation trends remain moderate."

|

|

|

|

|

|

|