|

Tax veto override fails

|

|

September 7, 2000: 5:46 p.m. ET

Republicans fail to get votes needed to override Clinton's veto of estate tax bill

|

NEW YORK (CNNfn) - An attempt to override President Clinton's veto of the Republican-backed estate tax repeal failed in the House of Representatives on Thursday. In a 274-157 vote, Republicans failed to get the two-thirds majority they needed to keep the bill alive.

Small-business groups have closely monitored the movement of the estate-tax bill, hoping there might finally be some tax relief for small-business owners and family farmers this year.

"We're extremely disappointed, obviously," said National Federation of Independent Business spokeswoman Angela Jones. NFIB led a coalition of dozens of business groups who lobbied Congress to repeal the estate tax.

There has been substantial disagreement between the two parties as to who would benefit if the hefty estate taxes, which range up to 55 percent on estates valued at more than $675,000, were eliminated. In vetoing the legislation, Clinton said he could not in good conscience support a measure that would benefit only the wealthiest Americans.

The debate goes on

Small-business groups, however, have been consistently annoyed by the  Democratic characterizations of the legislation. Small-business owners and farmers are among the hardest hit by estate taxes. Democratic characterizations of the legislation. Small-business owners and farmers are among the hardest hit by estate taxes.

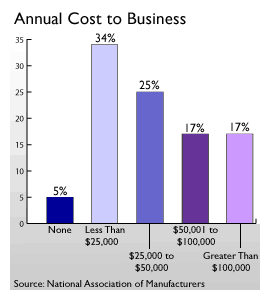

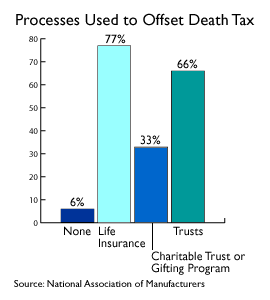

In the worst cases, the heirs of small-business owners have been forced to sell the family firms they inherit in order to pay off their estate tax bills. Many small-business owners buy life insurance and set up trusts to ease the pain of estate taxes, but they believe that money would be put to better use if invested in the business.

The first time the House voted on the estate tax, 65 Democrats and one independent joined all Republicans in the House to pass the repeal in June by a 279-136 vote, slightly more than the two-thirds margin needed to overturn a Presidential veto.

Democrats argued on Thursday for a smaller, more targeted relief plan that would raise exemptions from the current level of $675,000 per individual to  roughly $1 million by 2001. It would also gradually increase the family-owned-business exemption from the current $2.6 million per couple to $8 million per couple by 2010. roughly $1 million by 2001. It would also gradually increase the family-owned-business exemption from the current $2.6 million per couple to $8 million per couple by 2010.

Don't think, however, the issue is dead. Expect Republican presidential candidate George W. Bush to mention it in an effort to cast Democrats as the party that doesn't support small businesses and family farmers. Bush has said he supports eliminating estate taxes. Vice President Al Gore, for his part, has said that he would support increasing the exemption for small-business owners, but does not support an overall repeal of the estate tax.

|

|

|

|

|

|

|