|

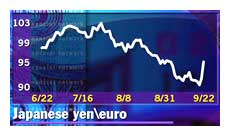

ECB underpins ailing euro

|

|

September 22, 2000: 2:08 p.m. ET

Euro jumps over 4% after central banks intervene to prop the flagging currency

|

LONDON (CNNfn) - The European Central Bank spearheaded a long-awaited defense of the ailing European single currency Friday, joining forces with other central banks to curb the currency's slide.

The euro jumped over 4 percent against the dollar to 90.30 cents after the European Central Bank (ECB), the U.S. Federal Reserve, the Bank of Japan, the Bank of England and the Bank of Canada bought euros, marking the first coordinated intervention on behalf of a major currency since 1995.

The euro has lost about a third of its value against the U.S. dollar since its inception in January 1999, hitting a record low of 84.37 cents on Wednesday.

The central banks started buying euros for dollars and yen in the global  currency markets Friday. As is common, they declined to say how much money they spent, but analysts speculate they bought at least $5 billion euros. currency markets Friday. As is common, they declined to say how much money they spent, but analysts speculate they bought at least $5 billion euros.

The ECB said in a statement that the action was prompted by "shared concern about the potential implications of recent movements in the euro exchange rate for the world economy."

Several economists in London pointed to the inflationary pressures that have cropped up in Europe as a result of the weaker euro, coming at the same time as oil prices hit 10-year highs. For countries outside the zone, the weak euro makes goods manufactured in Europe relatively less expensive, to the detriment of domestic industries.

"U.S. competitiveness was being damaged by the weakness of the euro," said Bill O'Neill, an investment strategist at HSBC, told CNNfn.com. "These coordinated moves in the currency market tend to be very significant -- at the least it should provide a base for the euro."

Only this week, several U.S. companies said the weak euro would hurt earnings. Among them were razor maker Gillette Co. (G: Research, Estimates) and McDonald's (MCD: Research, Estimates), the world's largest restaurant chain.

Leaders of the International Monetary Fund this week called for action in defense of the euro, echoing the wishes of several prominent European politicians.

The surprise intervention occurred one day before finance ministers and  central bank chiefs from the Group of Seven (G-7) leading industrial nations meet in Prague as part of the annual meetings of the World Bank and International Monetary Fund. central bank chiefs from the Group of Seven (G-7) leading industrial nations meet in Prague as part of the annual meetings of the World Bank and International Monetary Fund.

"Given they have a G-7 meeting this weekend, the intervention took the market by surprise," said Andrew Busch, director of fixed income at Bank of Montreal in Chicago.

And some economists said next Thursday's Danish referendum on whether to join the euro zone could also have been a factor in the thinking of the central bankers.

"The foreign exchange market has been a little disorderly of late, but I'm a bit surprised by the timing." O'Neill said. Many economists had predicted a move to defend would be politically inconvenient before the U.S. presidential election next month. "I wouldn't be surprised if it was because of the Danish referendum," said O'Neill.

Recent polls show the "No" campaign has a narrow lead. A victory for the "No" faction in Denmark could further weaken the euro, economists said.

Summers says dollar policy unchanged

Treasury Secretary Lawrence Summers insisted on Friday that U.S. policy favoring a strong dollar was unchanged, despite participation by the United States in the coordinated global intervention to boost the euro.

"Our policy on the dollar is unchanged," Summers said at a news conference hours after the intervention. "As I have said many times, a strong dollar is in the national interest of the United States," he said.

Summers declined to comment further on the intervention, or to detail how much money the Fed had spent at the Treasury's instruction on the intervention.

"The statement speaks for itself," he said, referring to a one-paragraph Treasury statement earlier in the day, which confirmed the global intervention and cited concern over the euro's effect on the world economy.

No guarantee of success

Economists at Bear Stearns wrote in a note to investors Friday that the move was "well-timed". But added, "It may be game and first set to the central banks, but it is by no means 'match' on the euro's recovery yet."

Reuters reported that top government officials in several euro-zone countries, such as France, Germany, the Netherlands and Italy, spoke in favor of the euro defense Friday, following the central banks' actions.

There's no guarantee the intervention will have the desired effect, however. Japanese authorities have persistently attempted to peg back the value of the yen in recent years, without appreciable success. The British government lost billions of pounds in 1993, when it tried to keep the sterling within a tied range to Germany's mark. Speculators eventually broke the government's resolve, and legendary investor George Soros reputedly made £1 billion ($1.5 billion) in a single day's trading.

In Prague, Hans Tietmeyer, former president of Germany's Bundesbank refused to comment directly on Friday's ECB move, but told a packed audience of bankers, economists and IMF/World Bank officials: "In my view the markets are undervaluing Europe right now, and that's why I think it's favorable to send a signal ... favorable in special cases where the exchange rate is clearly out of line."

The ECB said this was the first time it had intervened at its own behest, although it said last week it would spend some of its interest income on buying euros, an announcement it categorically refused to call intervention. Last June, the Bank of Japan asked the ECB to intervene to cap the strength of the yen.

-- compiled from staff and wire reports

|

|

|

|

|

|

|