|

Stock picks by the pros

|

|

September 25, 2000: 4:08 p.m. ET

Analysts pick Intel, Baxter, Medtronic, Ciena, Sycamore, Lucent and more

|

NEW YORK (CNNfn) - Market strategists and sector analysts reviewed the health care, semiconductor, biotech and optical networking sectors Monday, recommending such stocks as Intel, Titan Pharmaceuticals, Medtronic, Ciena and Sycamore Networks.

While the markets inched up in midday trading, recent guests on CNNfn commented on the stocks they are buying and why.

"  Long term we like Intel (INTC: Research, Estimates). We like it fundamentally very much. Our analyst is quite high on the stock long term. I believe he has a target of about $82 in the long term," Peter Green, market analyst for Gerard Klauer Mattison & Co. Long term we like Intel (INTC: Research, Estimates). We like it fundamentally very much. Our analyst is quite high on the stock long term. I believe he has a target of about $82 in the long term," Peter Green, market analyst for Gerard Klauer Mattison & Co.

"We like Titan Pharmaceuticals (TTP: Research, Estimates). Today they just got some good news in their phase III trial regarding their schizophrenic drug that they have been working with Novartis. The stock looks very bullish technically and we love it fundamentally. If the stock were to touch 53 today or this week, we have a long-term target of $71 on the stock," Green said.

"Corvas International (CVAS: Research, Estimates) trades on the Nasdaq. The stock on a relative strength basis has been a barnburner. We like the stock because we see a diversification of drugs in the pipeline for cancer and infectious diseases and cardiovascular drugs. We have a long term of $29. It's roughly around 20 now," he said.

"We see these companies and companies like Corvas and Titan, they will now earn money over the next five years. And the time to be buying them if you are a long-term investor is now," Green said.

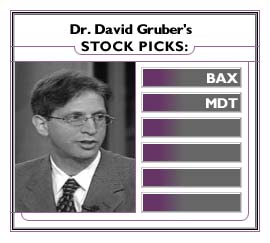

"  We initiated coverage for Baxter (BAX: Research, Estimates) back in October with a buy rating at $59 a share. We made it our No. 1 pick. It's a stock that suffered from a lack of credibility historically," said David Gruber, medical technology analyst for Lehman Brothers. We initiated coverage for Baxter (BAX: Research, Estimates) back in October with a buy rating at $59 a share. We made it our No. 1 pick. It's a stock that suffered from a lack of credibility historically," said David Gruber, medical technology analyst for Lehman Brothers.

"Medtronic (MDT: Research, Estimates) is, you know, money in the bank. It's a stock that's grown 38 percent compounded for the last 10 years. Medtronic is the best medical technology company in the world. They're investing for the long haul and they have initiatives in many different areas. They're the dominant leader in cardiac with management which is the most exciting part of medical technology today," Gruber said.

"I think people are aging and people get sicker respective of whether there's recession or not. But investors in the medical technology sector have an investment horizon of 12 to 18 months. I think in five years on the Street I've had two accountants ask me what the companies look like three to five years from now. It's where the money flows, but again, for those interested in terms of the longer-term perspective, Medtronic takes the long-term view. They're investing lots of money in R&D and there are very exciting developments. I think the key driver is product innovation going ahead," he said.

Gregory Geiling, telecom equipment analyst for J.P. Morgan, said Monday he thinks Ciena's new contract with Korea Telecom gives it a "strong foothold" in Asia, a lucrative market.

"A lot of the big telecom equipment companies are aggressively going after the Asian market, and a lot will be successful; but for Ciena (CIEN: Research, Estimates) it's a great [foothold]."

"It's a very large market. Billions of dollars. The Asian opportunity, or the Korean opportunity, is several billions of dollars in business because a lot of these markets are now upgrading to these new optical products that Ciena provides." "It's a very large market. Billions of dollars. The Asian opportunity, or the Korean opportunity, is several billions of dollars in business because a lot of these markets are now upgrading to these new optical products that Ciena provides."

"This whole [optical networking] group has been beaten up over the past couple of weeks because of capital-spending concerns. The optical stocks are still very attractive from a growth perspective. And even though their valuations are still pretty lofty [compared with] other industries, Ciena is one of the more attractive names from a valuation perspective. We're still very positive on the stock."

"There are four or five major players in the space today. A lot of these guys will win contracts over the next 12 to 18 months. Other than Ciena we're fans of Nortel Networks (NT: Research, Estimates). Nortel's the largest, most established optical company out there, a very strong performer."

"The other two names are new, up-and-coming names in this space -- Sycamore Networks (SCMR: Research, Estimates) and Corvis (CORV: Research, Estimates). Both of these guys are coming to market with the best next-generation technology. They've only been around for a short period of time, but their revenue ramps will be astronomical."

"I think [Sycamore's] stock has been volatile because it's been one of these highflying names in the marketplace. But I think Sycamore [has] great long-term fundamentals. It's a stock that posted the strongest revenue ramp of any company in history over the past 12 months since it's been public. Great management team. Very good traction."

"Over the past 9 to 12 months, Lucent (LU: Research, Estimates) has disappointed a couple of times, and the stock really has fallen back to a very deep value level. It's still a very interesting time for Lucent. They're going through a lot of management turnover, but at end of the day it's a stock that's very cheap. It's trading at 15 times forward earnings, which for this sector is a very attractive value. This is a company with great customer relationships and great internal technology. I think investors really have to start giving Lucent a second look."

--compiled by staff writers Lucy Banduci and Mark Gongloff

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|