|

A nuclear portfolio

|

|

October 3, 2000: 8:02 a.m. ET

Connecticut power plant worker prepares to retire New Orleans-style

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - Listening to the sweet sounds of Louisiana jazz, eating seafood gumbo, and fishing on the banks of the river on a lazy summer day. That image is a far cry from the Connecticut nuclear plant where Steve Ellis tracks equipment orders and dreams about retirement next year.

But the 61-year-old plans to quit his job and head back to his native New Orleans to get a whiff of Creole cooking and play with his grandkids. He just needs to power up his portfolio and make sure he's not too tech heavy.

"Well, I don't know that I won't be bored," Ellis said about his anticipated retirement next year. "It's something that I'm going to try. I'll miss working -- not necessarily at a nuclear power plant."

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

Ellis knows that during retirement he may have to work part-time to keep the cash flow coming, since he began saving in a 401(k) plan only recently.

Still he's optimistic about moving south where he grew up and raised four children. And despite working in a risky occupation, Ellis's job isn't as hazardous as it sounds.

"Most people say, 'How much radiation exposure do you get at work?,'" said Ellis, a mechanical planner who works in an office. "You get very little. The radiation is shielded at nuclear power plants with minimal exposure to employees and the surrounding community."

Never too late

Ellis regrets not taking advantage of his company-sponsored retirement plans early in his career. So today, with an annual salary close to six digits, he's maxing out his current contributions, putting away $10,500 a year -- the maximum amount the IRS allows.

Unfortunately, he lost years of compounding by not contributing to a 401(k) plan. Still, in the last 10 years, he's amassed a portfolio of about $171,000 spread across his 401(k), rollover IRA, and separate mutual fund account.

He holds a variety of mutual funds from Firsthand and invests in the Vanguard Mid-Cap Index fund, the Alger Mid-Cap fund, and the Putnam New Opportunities fund. In addition, Ellis holds the following stocks in his 401(k) account: America Online, AT&T, Biomira, Intel, Microsoft, Pfizer, and Qualcomm.

Ellis has about $5,000 in debt and expects a $4,400 annual pension from a previous employer when he retires. He has a home in Louisiana worth about $80,000 where he and his wife plan to retire.

Did you miss CNNfn.com's retirement special? Click here to get it all

Ellis would like to retire at 62-1/2, at which time he expects to receive reduced Social Security benefits of $1,280. If he waits until age 65, he could receive full benefits which is about $1,600 a month. His wife, Diane, 52, is unemployed now and, because of her age, they don't expect to rely on her Social Security benefits for quite awhile.

Max out the plan

Financial planners laud Ellis for maxing out his 401(k) plan because that's the first place to begin saving, since those contributions come out of your paycheck before taxes. In addition, many companies offer matching dollars, helping your money grow faster.

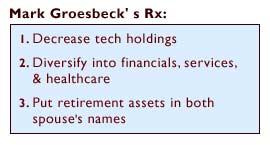

The next step is to assess how Ellis has his money allocated, which is cause for concern since 70 percent of his portfolio is in technology names, notes certified financial planner (CFP) Mark Groesbeck in Houston.

"When you look at his current allocation, it looks like someone who wants to be aggressive and wants to retire," Groesbeck said. "Even for an aggressive investor, that's too much," in technology.

Groesbeck suggests Ellis branch out into other sectors that he considers promising such as financials, health care, and energy, but will cushion his portfolio if the technology sector takes a hit. Also, he needs some international exposure.

"I would typically say you could add 15 percent international, put 30 percent in small cap companies and 55 percent in large domestic growth names," Groesbeck said.

Click here to read last week's Portfolio Rx on CNNfn.com!

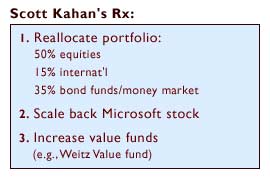

CFP Scott Kahan in New York said Ellis's Microsoft stock is a red flag because he holds 500 shares, which represents a large portion of his portfolio. So Kahan suggests scaling back that name and then diversifying his overall portfolio with the following funds:

In addition, Ellis's portfolio is going to be tight if he plans on fully retiring in just over a year. He may want to consider working part time or putting off retirement for another few years.

"He's going to have to be very careful, because he could run out of money much earlier especially since his wife is younger than he is," Kahan said.

"It means you need to plan for many more years."

Learn how to manage your money!

Read CNNfn.com's Checks & Balances every Monday

Lastly, for estate planning purposes, Groesbeck suggests Ellis and his wife balance their assets in both of their names. Currently, Steve holds all of the 401(k) and IRA plans in his name.

"Having assets balanced between husband and wife means you can take advantage of credit shelter trusts," which will save them taxes in the long run, Groesbeck said.

Good cooking and smooth jazz

So Ellis plans on enjoying his wife's Southern cooking even more when they relocate to Louisiana for retirement.

Admittedly, he'll miss the change of seasons, the Northeast boats, and the cool, breezy weather in the autumn.

"I like the weather up here," he said. "It's very hot and humid in summer in New Orleans, with not a lot of changes in weather patterns. It's basically tropical."

But he added, "It's a fantastic city. You just fall in love with it. The food is so great. The jazz festival the last week of April (is), too."

-- Staff Writer Jennifer Karchmer covers news about retirement for CNNfn.com. Click here to send her e-mail.

* Disclaimer

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name and photo in an upcoming story. Please include a daytime phone number so we may reach you.

|

|

|

|

|

|

|