|

A portfolio of priorities

|

|

October 10, 2000: 5:58 a.m. ET

Properly allocating money is easier when you know what you want

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - No matter how much you make, committing more than 50 percent of your pay to savings is laudable by any standard, all the more so if you're making less than a ransom. The task is made much easier, though, if you have discipline, concrete goals and clear time horizons.

That's what Chris Terrazas has in spades. The single 34-year-old plans to buy a new car in nine months, purchase a home in three to four years and build up a solid retirement nest egg, which she doesn't expect to draw from before age 65.

And she is always assessing what she needs to do to reach those goals.

She makes $39,000 a year as a product associate for a Chicago-based firm specializing in online airline reservation distribution services. After taxes and a 6 percent pretax 401(k) contribution, she takes home about $2,223 a month. From that, she pays $815 in expenses, socks away $1,000 a month in a money market account and contributes $50 to the TIAA-CREF Growth and Income Fund.

To date, she has saved $17,500 in her 401(k) and $15,000 in a money market account and CD.

Debt proved an early teacher

It helps, of course, that Terrazas has no debt. That wasn't always the case. In fact, she came by her discipline and determination the hard way.

Portfolio Rx is a weekly CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

"Earlier in my life I didn't really save money. I was a spender," she said. So much so that in her mid-20s she met with a credit counselor to help her deal with her credit card debt.

"It was a real eye-opener," Terrazas said, explaining that the experience taught her that without good credit she would never get some of the things she needs.

Now at 34, she takes her financial goals and the need to look at the cost of things seriously. In addition to the house and car, she said, "I need to look at what my retirement is going to be. You know, you can't keep spending money the way you used to."

Off to a promising start

Financial planners say Terrazas is on track to achieve her goals but would be in an even better position if she makes a few adjustments to how her money is allocated.

Although they suggest slightly different tactics for her, certified financial planners Karen Altfest of L.J. Altfest & Co. in New York and Heather Locus of Balasa & Hoffman in Schaumburg, Ill., commend her on her savings discipline. Although they suggest slightly different tactics for her, certified financial planners Karen Altfest of L.J. Altfest & Co. in New York and Heather Locus of Balasa & Hoffman in Schaumburg, Ill., commend her on her savings discipline.

"This woman is amazing. I should take her to one of the classes I teach on debt," Altfest said.

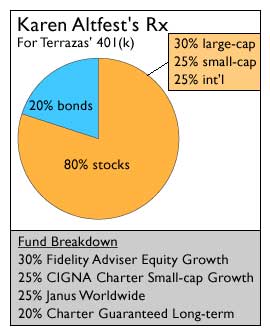

But given that Terrazas describes herself as someone with a moderate tolerance for risk, Altfest is concerned that her 401(k) portfolio, which currently has 91 percent of her assets in stocks and 9 percent in bonds, is too risky. "She has invested riskier than she wants," said Altfest, who recommends an 80-20 mix instead.

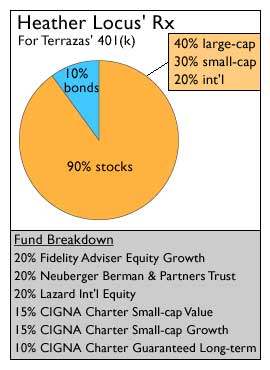

Locus disagreed. For someone as young as 34, a 90-10 balance is fine for the long term, she said.

Take aim without AIM

Terrazas currently invests in four funds in her 401(k): AIM Constellation, a large-cap growth fund with more than 50 percent of its investments in technology; Janus Worldwide, a large-cap world stock fund; and two funds that are not publicly traded -- one in small-cap growth stocks and one in bonds.

Altfest recommended getting rid of the AIM fund -- in part because she felt it was too risky for Terrazas -- and invest instead in Fidelity Advisor Equity Growth, a large-cap growth fund that has a strong track record and is also in the plan. She also suggested Terrazas reduce her allocations in the Janus and small-cap funds to 25 percent each, while increasing her bond exposure to 20 percent from 9 percent. Altfest recommended getting rid of the AIM fund -- in part because she felt it was too risky for Terrazas -- and invest instead in Fidelity Advisor Equity Growth, a large-cap growth fund that has a strong track record and is also in the plan. She also suggested Terrazas reduce her allocations in the Janus and small-cap funds to 25 percent each, while increasing her bond exposure to 20 percent from 9 percent.

Locus favored the AIM-Fidelity switch as well. But she also made more changes to the portfolio based on the 401(k) plan offerings, in part to add more value-oriented investments to a predominantly growth portfolio.

Instead of Janus Worldwide, she recommended investing in Lazard International Equity; she also suggested adding Neuberger Berman & Partners Trust, a large-cap value fund, and a Berger-run small-cap value fund in the plan.

Lastly, she thought Terrazas should lower her allocation in the small-cap growth fund to 15 percent from 39 percent, while adding an extra 1 percent to her bond fund assets.

Add more to 401(k) over time

Since Terrazas' company matches dollar-for-dollar the first 3 percent of an employee's 401(k) contributions, she is taking advantage of the full match available to her. But Locus would like to see her bump up her 6 percent contribution by 1 percentage point a year until she reaches the federal limit on 401(k) contributions.

"At retirement it'll be a big difference, but she won't notice it as she goes," Locus said, especially if she gets yearly raises.

But even if she doesn't bump up her contributions, she still may have enough, depending on her needs. Factoring in 3 percent for inflation, and assuming she gets a 3 percent raise every year and an average return of 8 percent on her investments, when Terrazas retires at 65 she should have, after taxes, the equivalent of $2,000 a month in today's terms, Locus said.

Maximize short-term money

Even though Terrazas' 401(k) portfolio is stock-heavy, her overall portfolio is not, given that she has $15,000 in liquid assets -- $10,000 in a money market account and $5,000 in a CD, both of which earn 6.3 percent interest. Given that her time horizon for buying a $27,000 car and a $140,000 house is less than five years, Locus is pleased the money is not invested in the stock market.

If Terrazas continues to contribute $1,000 a month to the pool for the next nine months, she'll have $24,000, enough to put down 75 percent -- or $20,000 -- on the car next June. She will also have $4,000 left over, which she should treat as an emergency fund, something both Locus and Altfest recommend she have.

Then, if she keeps contributing $1,000 a month for the next 28 months after that, she will have enough to put down 20 percent -- or $28,000 -- on a house, Locus said.

Investing outside the 401(k)

Altfest agrees Terrazas should start contributing new money toward her house down payment after she gets the car and creates an emergency fund.

But she questioned whether Terrazas might not get more growth from investing that new money in some mutual funds, although she agreed it is a riskier proposition if you have less than a five-year time horizon given that the stock market may be a difficult place for short-term money. And if she is set on buying the house in less than five years she might be better off holding onto her money.

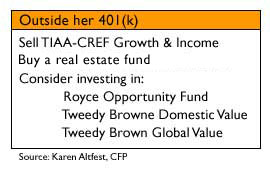

If she can wait the five years, however, or if she wants to make some contributions to her retirement nest egg outside of her 401(k), Altfest suggested a few funds for consideration. If she can wait the five years, however, or if she wants to make some contributions to her retirement nest egg outside of her 401(k), Altfest suggested a few funds for consideration.

They include Royce Opportunity, Tweedy Browne Domestic Value and Tweedy Brown Global Value. They are all good long-term bets and would offer Terrazas another way to balance out her current growth-dominated 401(k) portfolio, Altfest said.

They all require between $2,000 and $2,500 initial investments, something Terrazas wanted to avoid. But Altfest cautioned that it takes a very long time to build up any significant growth on amounts less than that. So if she chose that route, she should save for a couple of months before investing in one fund; then save for another few months before investing in a second, and so on. "In six months she'll have a different portfolio and a very good one," Altfest said.

Both planners thought Terrazas' choice of the TIAA-CREF Growth & Income fund was a good one, although Altfest thinks she might benefit more if she put her money in a good real estate fund instead, such as Fidelity Real Estate Investment. It would be more of a value play and, since a real estate fund offers what none of her other holdings do, it may resist market fluctuations, Altfest said. "I think that will perk up her portfolio."

Put money on your priorities

However Terrazas tweaks her positions, both planners think she is well on her way to achieving her goals.

Click here to read this week's Checks and Balances column.

Click here to read last week's Portfolio Rx.

What particularly impressed Locus was Terrazas' adherence to a principle that Locus tries to teach her clients. Once you have set goals and given yourself deadlines, she said, "put the most money toward your highest priority goal." But, she added, don't neglect your other goals that are farther off on the horizon.

With her 401(k) investments, her TIAA-CREF fund investment and her $1,000-a-month money market savings habit, "She's taking a nice, balanced approach," Locus said.

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name in an upcoming story. Please include a daytime phone number so that we may reach you.

* Disclaimer

|

|

|

|

|

|

|