|

Asia rebounds on techs

|

|

October 16, 2000: 5:44 a.m. ET

Telecom, technology shares take their cue from gains in U.S. markets

|

LONDON (CNNfn) - Most Asian markets rebounded Monday, led by technology and telecommunication shares following a surge in the value of their U.S. counterparts Friday.

Tokyo's benchmark Nikkei 225 average rose 1.2 percent to close at 15,512.32 as chip-related issues led advances in the high-tech sector.

In Hong Kong, the Hang Seng index ended up 2 percent at 14,973.40  , while Singapore's Straits Times index closed 1.2 percent higher at 1,883.37. , while Singapore's Straits Times index closed 1.2 percent higher at 1,883.37.

In the currency market, the U.S. dollar strengthened against the Japanese yen to ¥108.11 from ¥107.82 in late trading in New York before the weekend.

In the U.S. Friday, the Nasdaq composite index jumped 242.09 points, or 7.9 percent, to 3,316.77, posting its second-biggest one-day gain ever, as investors scooped up shares seen as cheap after seven straight declines. The Dow Jones industrial average gained 157.60 points, or 1.6 percent, to 10,192.18.

In Tokyo on Monday, Japan's biggest chipmaker NEC gained 2.9 percent and rival Fujitsu closed up 4.1 percent.

Internet investor Softbank rose 1.2 percent, profiting from the recovering value of its holdings. The company has investments in more than 400 Web-related firms such as Internet portal Yahoo! and online broker E-Trade Group.

Nippon Telegraph and Telephone climbed 3.8 percent while its mobile-phone unit NTT DoCoMo gained 2.6 percent.

Transportation shares moved higher, after losing ground on Friday on concerns that higher energy costs would hurt their earnings. Japan's largest ship operator Nippon Yusen KK was up 2.9 percent, recouping part of Friday's 3.8 percent loss, and Japan Airlines inched up 0.5 percent.

Information equipment dealer Fujitsu Business Systems slid 14 percent after the firm on Friday lowered its group net profit forecast for the business year to next March to ¥400 million ($3.7 million) from an earlier estimate of ¥2.0 billion.

Telecom, banks revive in Hong Kong

In Hong Kong, mainland Chinese telecom operator China Mobile rallied 2.5 percent after shedding 15.3 percent in last week's market rout.

HSBC Holdings gained 3.4 percent while its affiliate Hang Seng Bank rose 3.8 percent.

Mainland China's biggest computer maker Legend Holdings surged 5 percent, paring last week's decline of 15.6 percent.

Pacific Century CyberWorks ended down 5.9 percent after earlier soaring 7.2 percent as its shares resumed trading for the first time after Friday's announcement detailing its revised deal with Australian telecom firm Telstra. The Hong Kong Internet and telecom company said the new terms meant it would receive $3.56 billion in cash from Telstra, but would surrender control of its mobile-phone business.

Hong Kong airline Cathay Pacific Airways advanced 4.9 percent, rebounding from a 15.8 percent slide last week.

Newly listed Sun East Technology (Holdings), a maker of electronic and production line equipment, fell to 66 Hong Kong cents, well below its HK$1.18 issue price, after hitting a high of HK$1.29.

Profit jitters hit Taiwan

In Singapore, contract manufacturers bounced following Friday's Nasdaq rally. Venture Manufacturing and Chartered Semiconductor Manufacturing were each 6.3 percent higher, while NatSteel Electronics climbed 3.9 percent.

Shares in Singapore Telecommunications dived 20.9 percent, following an uncharacteristic 29 percent jump late Friday that remained unexplained by the company and exchange officials. Index heavyweight Singtel had been about to close at 2.72 Singapore dollars when a buy order for two million shares at 3.50 Singapore dollars was placed just before the end of trading Friday. The Singapore Exchange has launched an investigation.

In Taipei, the Taiwan Weighted index failed to hold on to early gains, ending down 4.2 percent at a 20-month low of 5,630.95. Chipmaker Taiwan Semiconductor Manufacturing fell 5.2 percent. Makers of dynamic random access memory (DRAM) slid after Nanya Technologies confirmed weekend reports that it had cut its pretax profit estimate for this year by 46.6 percent because of falling chip prices. Shares in Nanya and rivals Mosel Vitelic and Winbond all fell by the daily trading limit of 7 percent.

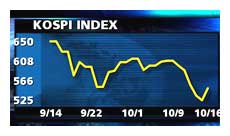

In Seoul, the Kospi index rose 4.9 percent to 550.10. Memory-chip maker Samsung Electronics climbed 4.3 percent. Mobile-phone operator SK Telecom surged 10 percent while state-run Korea Telecom gained 6.8 percent. In Seoul, the Kospi index rose 4.9 percent to 550.10. Memory-chip maker Samsung Electronics climbed 4.3 percent. Mobile-phone operator SK Telecom surged 10 percent while state-run Korea Telecom gained 6.8 percent.

Australia's benchmark S&P/ASX 200 index ended up 1.8 percent at 3,260.3.

Media firm News Corp.'s ordinary shares and preferred shares, which together make up about 12 percent of the index, jumped 7 percent.

Telstra was up 1.8 percent, lifted by Friday's news of its revised deal with PCCW.

Manila's PHS Composite index tumbled 2.2 percent to a two-year low of 1,295.02 following a slide in the Philippine peso and concerns about political uncertainty following allegations that President Joseph Estrada accepted payoffs from illegal gambling syndicates.

Kuala Lumpur's KLSE Composite index gained 2.2 percent and Jakarta's JSX index ended up 0.9 percent. Bankgok's SET index was up 1.6 percent in late trade.

--from staff and wire reports

|

|

|

|

|

|

|