|

Europe mixed, techs rally

|

|

October 16, 2000: 12:20 p.m. ET

Telecom, media, electronics track Nasdaq; Frankfurt dips, euro falls

|

LONDON (CNNfn) - Europe's major bourses were mixed at the close Monday as electronic hardware and phone operators' shares extended the previous session's gains, though declines in the retail and banking sectors dragged Frankfurt down.

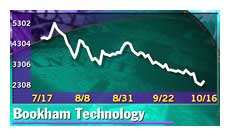

London's FTSE 100 rose 76.1 points, or 1.2 percent, to 6,285.7, with optical fiber component maker Bookham Technology (BHM) and the world's biggest mobile-phone operator, Vodafone Group (VOD), posting the leading gains.

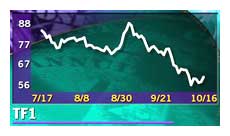

In Paris, the CAC 40 blue chip index edged up 0.4 percent to 6,088.04, led by TV broadcaster TF1 (PTFI) and chipmaker STMicroelectronics (PSTM) In Paris, the CAC 40 blue chip index edged up 0.4 percent to 6,088.04, led by TV broadcaster TF1 (PTFI) and chipmaker STMicroelectronics (PSTM)

Frankfurt's Xetra Dax couldn't hold on to its early rise, falling 0.5 percent to 6,627.25, with retailer Metro (FMEO) and Commerzbank (FCBK) among the weakest stocks on the index.

In Amsterdam, the AEX index climbed 0.3 percent while the SMI in Zurich slipped 0.6 percent and Milan's MIB30 index was little changed at 44,406.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, was up 0.6 percent, with the information technology sub-index rising almost 3 percent.

In the currency market, the euro slipped to its lowest level against the U.S. dollar since Sept. 21 to 84.83 U.S. cents, down from 85.50 cents in late New York trading before the weekend. The head of the European Central Bank signaled the bank and the G7 won't buy the currency in the exchange market if the Mideast crisis sparks a sharp fall in the single currency.

"Our sights remain on a plunge to 80 cents," Steve Barrow, a currency economist at Bear Stearns, said in a note to investors. "If Duisenberg's most recent comments are correct, it looks as if intervention is stumbling already."

"Worse still, there are ominous signals from the U.S. that the ECB might not have a willing ally in the Republican Party, if the GOP gets its feet under the desk at the Oval office on Nov. 7," Barrow said. "Bush's chief economic advisor Lawrence Lindsey suggested that the U.S. was wrong to intervene on behalf of the euro."

In the U.S. Monday at midday, the Nasdaq composite index fell more than 1 percent to 3,281.90 while the Dow Jones industrial average gained 0.3 percent to 10,221.78.

In London, fiber-optic component maker Bookham Technology (BHM) surged 10.1 percent and chip designer ARM Holdings (ARM) jumped 6.3 percent. Network equipment maker Marconi (MNI) rose 3.6 percent, and in Paris, rival Alcatel (PCGE) climbed 2.3 percent. In London, fiber-optic component maker Bookham Technology (BHM) surged 10.1 percent and chip designer ARM Holdings (ARM) jumped 6.3 percent. Network equipment maker Marconi (MNI) rose 3.6 percent, and in Paris, rival Alcatel (PCGE) climbed 2.3 percent.

Vodafone, the most heavily weighted stock on London's FTSE index, jumped almost 2 percent, COLT Telecom (CLT) gained 5.5 percent, and network operator Energis gained 5.3 percent.

France Telecom (PFTE) climbed 13 percent in Paris while telecom and construction firm Bouygues (PEN) gained 1.4 percent. Germany's Deutsche Telekom (FDTE) jumped 2.7 percent.

Gains in Paris media stocks

French TV broadcaster TF1 was the biggest gainer in Paris, surging 7 percent.

Among other media firms, France's Lagardère (PMMB) gained almost 4 percent and publisher EMAP (EMA) rose 2.7 percent. Music publisher EMI (EMI), which earlier this month called off a planned joint venture with Time Warner's (TWX: Research, Estimates) Warner Music division, climbed 4 percent in London.

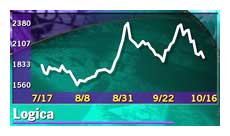

Software and information technology stocks tumbled in London on concerns about how software companies account for sales. Logica (LOG) dropped 2.8 percent, Sema Group (SEM) dipped almost 4 percent, and Sage Group (SGE) slipped 2.2 percent. Under current rules, a software company books its income for a sale when the agreement is signed, although the actual revenue may come later, or not at all, the Sunday Times said. Software and information technology stocks tumbled in London on concerns about how software companies account for sales. Logica (LOG) dropped 2.8 percent, Sema Group (SEM) dipped almost 4 percent, and Sage Group (SGE) slipped 2.2 percent. Under current rules, a software company books its income for a sale when the agreement is signed, although the actual revenue may come later, or not at all, the Sunday Times said.

In Frankfurt, only three stocks out of 30 that make up the Dax benchmark index rose. Chip maker Infineon Technologies (FIFX) was the biggest decliner, falling 4.3 percent, closely followed by retailer Karstadt Quelle, down 4.2 percent.

Dresdner Bank (FDRB) fell 3.4 percent and Commerzbank (FCBK) lost 2.1 percent.

Engineering and electronics company Siemens (FSIE) fell 3.5 percent. The company declined to comment on a Sunday Telegraph report that it is preparing a bid for U.S.-based Honeywell's (HON: Research, Estimates) industrial control and automation business for $1.5 billion.

--from staff and wire reports

|

|

|

|

|

|

|