|

Can they afford a baby?

|

|

December 4, 2000: 8:18 a.m. ET

The Kershaws have a two-year marriage, a new home and plans to start a family.

By Staff Writer Alex Frew McMillan

|

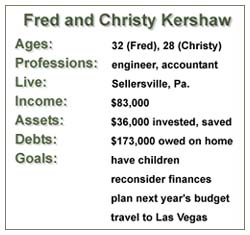

NEW YORK (CNNfn) - The Kershaws got married two years ago. This year they bought a house. Now they figure it's time to start a family.

But when they ran their rough budget for next year, they only had $2,000 left over. And Christy would likely stop her job as a junior accountant to have a kid. Without that income, Fred Kershaw's tally shows they'd be at least $12,000 in the hole.

"What brought all this on was, I always wanted to have a kid by 32," Fred Kershaw, now 32, says. "I didn't want to be real old by the time they're in their teen-age years."

At 28, Christy Kershaw is starting to feel like it's time, too, he continues. So when they sat down in mid-fall to discuss starting a family, she assumed he meant right away. But Fred Kershaw pointed out they might have to wait six months or longer. That annoyed her, he says.

Between them they make a good living. They know others have started families on less. So how come their finances don't seem to allow it? "What are we doing wrong?" he asks.

Checks & Balances runs weekly. People with questions about financial planning are invited to write in. Click here to go to the Checks & Balances page, with past columns and details on how to submit your information.

Both Fred Kershaw and his wife grew up in and around Philadelphia. They met through family members who worked together and thought they'd get along.

They did. "It was almost instant," Fred Kershaw recalls. "We only dated about six months and then we got married."

First they lived in Fred Kershaw's condo. Then, this July, they bought their dream house, a three-bedroom colonial with an acre of space in Sellarsville, Pa.

The Kershaws put down 10 percent, mortgaged 80 percent of the $192,000 purchase price and got a home-equity loan on the last 10 percent. With that "piggyback" loan, they avoided private mortgage insurance.

It's big enough for two kids, which is what they're planning on. "I bought this house with the intention of never moving again," Fred Kershaw says. He's been steadily moving into the suburbs, which is what he likes. Now he has the right amount of space, he believes.

He loves what he does

Fred Kershaw, who has a mechanical engineering bachelor's from Drexel University, has worked at John Evans' Sons for the decade since he graduated. He likes being at a family company, even though he figures he might make more elsewhere.

Because he's been there a while, Fred Kershaw is vested in his 401 (k). He puts in 11 percent of his salary. The company is adding an extra 18 percent of whatever he puts in, up to 15 percent. He says he doesn't know the first thing about investing.

Christy Kershaw is maxing her 401 (k), putting in 15 percent. She got a late start, hopping jobs a few times after landing an associate's degree at Montgomery County Community College. She's taking night classes there to learn more-advanced accounting, something her bank says would be good for her.

A Star Trek trek for next year

The couple has some plans for next year that cut into their budget. Fred Kershaw's sister is getting married, so they've set aside $1,000 to get to the wedding and to buy the right dress for Christy Kershaw.

The Kershaws are also big Star Trek fans. So they've allowed $1,800 for a trip to Las Vegas in 2001. They want to go see Star Trek: The Experience in the Las Vegas Hilton.

Fred Kershaw likes to pad his spending a little. For instance, he budgets $150 a month for electricity, even though that normally runs around $90. Other than their house, they don't have a lot of debt.

They own both their cars, a 1991 Mazda Navajo and a 1996 Chevrolet Lumina. Christy's Navajo will need replacing soon, though, they think.

Mainly, though, they want to start a family by the middle of next year.

"We look at our budget and don't see any way we can afford a baby," Fed Kershaw writes. Even if they cut out his 401 (k), and stopped paying $100 extra a month toward their mortgage like they do now, they'd still be in the hole, big-time, if Christy stopped working. That's not even figuring in baby-care costs.

"What are we doing wrong? Did we overextend ourselves with our house?" he asks.

What the planners say:

First, Brian Orol in Raleigh, N.C. would like to point out that he's a certified financial planner. "I'm not in the family planning business," he says. "Certain decisions need to be made outside of the cold, hard facts that financial planners deal with."

Many families don't have enough income to make ends meet. Somehow, "things have a way of working themselves out," he goes on. But Orol applauds them for running numbers and doing their homework.

They ask whether their house is too much for them. The Kershaws need to bear in mind that the real-estate agents and mortgage company representatives they've dealt with are salespeople. Nothing wrong with that, Orol says, but they may have their own interests at heart.

Still, the Kershaws have their house now. It would only be worth considering a sale if it jumped in value. And refinancing isn't an option, since mortgages have risen slightly since they bought.

Click this link to read the latest Checks & Balances column.

Click the following link to read last week's Portfolio Rx, a column that runs every Tuesday in CNNfn's Retirement section. Each article reviews an investor's long-term portfolio, using financial experts to offer advice.

Paul Hrisko, a certified financial planner in Cleveland Heights, Ohio, likes that the Kershaws have no debt beyond their house. "They are the rare exception of folks who do charge and pay them off each month. Bravo!" he says.

Hrisko notes that the Kershaws have $13,000 in savings and money market accounts. That's a little high, he says. To plan for their child, they might consider dollar-cost averaging some of the money -- $150 a month, say – into two to three mutual funds.

Stick with a fund family, Hrisko recommends. For instance, with the American funds family, they might put $50 a month into the large-cap Growth Fund of America (AGTHX), the international EuroPacific Growth fund (AEPGX) and the growth-and-income Investment Company of America fund (AIVSX).

Don't stop the 401 (k)

As far as their retirement plans go, "I would hate to see this couple reduce their contributions," Hrisko says. "There are still too few people contributing to 401 (k)s nationally."

Hrisko likes that Fred Kershaw is investing 90 percent of his retirement money in equities. He also has a good balance, with international and domestic funds. And he gets a generous employee match.

Fred Kershaw has a 15 percent allocation in the Vanguard European Stock Index fund (VEURX). Hrisko encourages Christy Kershaw to redeploy 15 percent to 20 percent of her 401 (k) in an international fund, too.

Hrisko advises them not to borrow against their 401 (k)s, either, another popular move. "They are on the right track, and it would be unfortunate for them to reduce contributions and matches and lose potential market gains."

Click here to review your mutual-fund portfolio with CNNfn.com's Morningstar tools.

Click here to go to CNNfn.com's 401 (k) and pension-plan page.

Hrisko points out that Christy Kershaw's Navajo will be 10 years old next year. At that point, it may be worth dropping collision and comprehensive insurance. Or they could raise their deductibles. Either course would free up income, the planner notes.

Orol has some other ideas for them to prepare for a kid. "Save, save, save!" he exhorts. While they're planning for a baby, they have to lead as modest a lifestyle as they can.

They should set every penny they can aside into a credit union, money market or savings account, he says. They should also stop making the extra $100 mortgage payment immediately, the planner believes.

Christy Kershaw could continue working

The Kershaws should also consider job options, according to Orol. Many employers offer chances to telecommute, and they may be able to find a part-time job or a job sharing position. Christy Kershaw should be able to find plenty of temporary work as an accountant, he says, and it may be work she could do while staying home with a baby.

Orol also encourages them to search for a family member who might be able to take on at least some day-care duties. Then perhaps Christy Kershaw could work a few days a week.

Hrisko has a few family-oriented issues for them to pursue. They need to get disability insurance for Fred Kershaw, if he doesn't have it at work. That coverage should cover at least 60 percent of his earnings and be good for six months to three years. Otherwise a disabling injury or illness would be catastrophic, Hrisko notes.

Insurance issues when they can afford them

They're living fairly frugally, the planner says. So their company insurance will have to do for now. But they need to beef up their life insurance coverage as soon as they can, he thinks. A variable life plan might be the right idea, Hrisko says.

The Kershaws should also draft wills, if they haven't already. And they need to check the maternity benefits of their health insurance before they start a family.

They may have overextended themselves on their house, Hrisko says. "But most of what they are doing now is right," he says. Life is a series of choices, and sometimes you have to make a choice and make it work.

Orol says that their discipline in budgeting "shows a strong commitment to fiscal responsibility." Given that, he is confident the Kershaws could keep their money train on track, even with a new addition to the family.

* Disclaimer

Got questions about financial planning? Need some advice? Click here for more on CNNfn.com's weekly feature Checks & Balances.

|

|

|

|

|

|

|