|

GenXer hexed by tech

|

|

November 28, 2000: 6:03 a.m. ET

Spread your investment risk among sectors, experts say

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - Like many Generation Xers, Kurt Dunn is worried about Social Security and questions whether it will be around for him when he's ready to retire in 25 years. So the 29-year-old government worker is leaning to the side of caution.

But while he's trying to save all his pennies, his portfolio is lopsided, with too much weight in tech stocks and funds. He's on the right track but financial planners say he'll get burned with too much exposure to the technology sector.

"I think Social Security won't be there (for my retirement), so pretty much, I'm on my own," said Dunn, who lives in Alexandria, Va. "I'll have to fund my own retirement. I like to hear about people retiring early and having a set retirement. After a house, retirement is the next big thing to save for."

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

Like many young aggressive savers, he's made a killing on technology stocks that have skyrocketed in the past few years. But planners agree that an investor like Dunn must diversify his holdings and cushion his portfolio from future downturns in technology.

Social Insecurity?

Social Security has been a hot issue during the 2000 presidential election, and regardless of which man ends up running the White House, Dunn is a little concerned about factoring in the federal plan for his retirement.

As a Department of Defense employee who budgets accounts for military travel, Dunn is all too familiar with numbers.

CNNfn.com's Special Retirement report: The Road to Riches!

With that in mind, Dunn, who makes about $55,000 a year, opened a Roth IRA where he contributes the maximum allowable amount each year -- $2,000. He holds the Janus Mercury Fund and the T.Rowe Price Global Science & Technology Fund in his Roth IRA.

While saving about 10 percent of his salary, Dunn has $36,000 in his retirement plan at work. Also, he's socked away about $10,000 in each of the following funds: Janus Mercury, Janus Worldwide, and T.Rowe Price Blue Chip Growth Fund. In addition, Dunn has an online brokerage account currently worth $45,000 in some of the following tech stocks: RF Micro Devices, Ciena Corp, Jabil Circuit, and Dycom Industries.

Many investors Dunn's age haven't even begun to take advantage of their company's retirement plan or done other saving, so Dunn is definitely on the right track, financial planners say.

Check how your mutual funds are doing!

With his portfolio charging full steam ahead, Dunn seems like he's in the catbird seat. But how he's divvied up his investments may be slightly alarming since he's heavily weighted in technology stocks and funds.

Whether you've amassed a huge retirement account or you haven't even begun to save, you should make sure your portfolio is diversified and spread among different investment sectors, experts agree.

Learn how to manage your money!

Read CNNfn.com's Checks & Balances every Monday

"Some of my friends are invested," Dunn said. "I'm one of the first ones who got started."

Where to start?

| |

|

|

| |

|

|

| |

His portfolio is terribly out of whack.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Steven Kaye

CFP

Watchung, NJ |

|

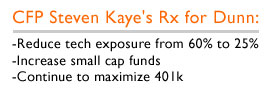

Steven Kaye, a certified financial planner (CFP) in Watchung, N.J., commends Dunn on his aggressive saving tactics over the years. Dunn maximizes his retirement plan at work by investing $10,000 a year and the government kicks about $2,750.

But as Kaye notes, Dunn's portfolio is "terribly out of whack."

With 61 percent of his holdings in technology names, Dunn has constructed a very risky portfolio, Kaye said. In addition, services alone such as telephone companies comprise about 25 percent of his holdings -- another red flag.

"He has huge bets on just those two sectors," said Kaye. "He's not just making a huge bet on those (sectors), but he's making a big bet against other sectors."

So to round out his portfolio and make it less risky, Kaye suggests Dunn slice his technology holdings to more like 25 percent. While doing that, he should increase his small cap exposure to 20 percent, up from his current 12 percent.

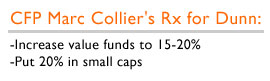

CFP Marc Collier, in Wellesley, Mass., agrees Dunn is on a great savings path by taking advantage of his retirement options – his work-sponsored plan and even the Roth IRA. But to stay in the game, Dunn must mix around his holdings or he'll get crushed by his overabundant tech holdings.

So Collier suggests investing in value funds at this time.

"I think given his age he should be mostly in growth and technology as he is, but with about 15 to 20 percent in value," Collier said.

Collier suggests the T. Rowe Price Equity Income Fund and the T. Rowe Price Mid Cap Value as two choices to pick up value exposure.

"He's putting money away every year so he's doing good," Collier said. "But I think he should be building up an emergency account too with any investments outside the IRA and pension."

So although retirement is still decades away for Dunn, he dreams about traveling and living close to the ocean.

"I spent a year in Europe for my job," he said. "I could envision living in a condo on the beach. The East Coast is pretty reasonable."

-- Staff Writer Jennifer Karchmer covers news about retirement for CNNfn.com.

* Disclaimer

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name and photo in an upcoming story. Please include a daytime phone number so we may reach you.

|

|

|

|

|

|

|