|

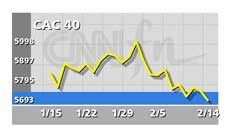

Paris hits 12-month low

|

|

February 14, 2001: 12:23 p.m. ET

Orange float depresses telecom stocks for a second day; techs slide

|

LONDON (CNN) - European markets fell sharply Wednesday, with telecom stocks continuing to slide after another miserable day for Orange.

Bourses also were cowed by words from U.S. Federal Reserve Chairman Alan Greenspan Tuesday that lowered hopes for hefty rate cuts. Chip stocks crumbled at the latest earnings warning to rile the sector.

The CAC 40 index in Paris dropped 1.6 percent to a 12-month low of 5,644.23 as France Telecom (PFTE) shed 8.5 percent a day after shares in its mobile phone unit Orange went public in a lackluster debut. The CAC 40 index in Paris dropped 1.6 percent to a 12-month low of 5,644.23 as France Telecom (PFTE) shed 8.5 percent a day after shares in its mobile phone unit Orange went public in a lackluster debut.

Orange sank 6.3 percent Wednesday to  8.81, below its offering price to retail investors of 8.81, below its offering price to retail investors of  9.50. 9.50.

London's benchmark FTSE 100 index shed 0.8 percent to 6,176.2, led lower by chip designer ARM Holdings (ARM), off 7.7 percent. Index heavyweight and cell phone group Vodafone (VOD) fell 2.8 percent.

Frankfurt's electronically traded Xetra Dax fell 68.52 points, or 1 percent, to 6,489.41, with telecom and tech stocks accounting for four of the top five decliners. Tech companies are sensitive to interest rates because they often need to borrow money to fund growth.

Among other leading European markets, the AEX index in Amsterdam shed 0.9 percent and the MIB 30 in Milan lost 1.5 percent, while the SMI in Zurich fell 1.1 percent.

The broader FTSE Eurotop 300 index, composed of a basket of Europe's largest companies, shed 1.2 percent. The computer services component shed 2.7 percent and the telecom index dropped 4.2 percent

The technology manufacturing sub-index retreated 6.8 percent, led by its biggest components. Nokia, the world's biggest mobile phone handset maker, fell 7.6 percent in Helsinki. Ericsson, the biggest maker of mobile phone networks, plunged 6.7 percent.

U.S. markets were mixed Wednesday midday. The Nasdaq composite rose 0.25 percent, while the blue-chip Dow Jones industrial average dropped 87.09 points, or 0.8 percent, to 10,816.23.

In the currency market, the euro traded lower against the dollar at 91.81 U.S. cents compared with 92.10 in late New York trading Tuesday.

Telecom and tech stocks slumped after Applied Materials (AMAT: Research, Estimates), the big U.S. chip equipment maker, warned late Tuesday that more difficult business conditions lie ahead.

ASM Lithography, a Dutch chip equipment maker, sank 3.5 percent in Amsterdam, German chip company Infineon Technologies (FIFX) fell 3.5 percent, and Franco-Italian rival STMicroelectronics (PSTM) shed 5.1 percent.

Among telecom stocks, Deutsche Telekom (FDTE) tumbled 5.9 percent to a new two-year low, while French telecom and construction group Bouygues (PEN) plunged 8.8 percent.

British Telecom (BT-A) fell 7.1 percent and U.K. business network operator COLT Telecom (CLM) fell 8.8 percent. Spain's Telefonica shed almost 6 percent in Madrid.

Bookham Technology (BHM) fell 12.4 percent. The optical component maker issued another profit warning. Bookham Technology (BHM) fell 12.4 percent. The optical component maker issued another profit warning.

British mortgage bank Abbey National (ANL) the subject of a bid tussle, edged up 0.4 percent after reporting an 11 percent rise in profit for last year. Abbey said pretax profit rose to £1.98 billion ($2.9 billion) from £1.78 billion in 1999 and above analysts' forecasts for £1.94 billion.

The world's third-largest soft drink firm, Cadbury (SBRY), rose 2.7 percent to top the FTSE 100 in London after it said it expects to ink more deals in the confectionery and beverage industries. The company said despite the slowdown in U.S. economic growth, it expects 2001 to be another good year.

Autos stocks rose. Renault (PRNO) revved up 6.3 percent as investors seized on a strong outlook for Japanese partner Nissan Motor and shrugged off a gloomier downtrend in the firm's core European business.

Renault said 2000 operating profit fell 8.3 percent in 2000 and forecasts of another sharp drop in margins this year.

French rival Peugeot (FPUG) rose 2.6 percent. DaimlerChrysler (FDCX), the world's fifth-largest automaker, added 1.7 percent, luxury carmaker BMW (FBMW) gained 1.6 percent, and Volkswagen (FVOW), Europe's biggest automaker, climbed 1.5 percent.

-- from staff and wire reports

|

|

|

|

|

|

|