|

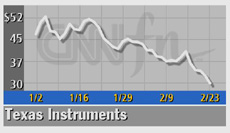

Texas Instruments warns

|

|

February 26, 2001: 12:02 p.m. ET

Chipmaker sees sales even weaker than its own previously reduced forecast

|

NEW YORK (CNNfn) - Texas Instruments Inc. warned Monday for the second time this year that sales would be weak in the first quarter, noting the slowing U.S. economy was hurting demand for its semiconductor products.

The biggest maker of computer chips for mobile phones said it expects sales to fall 20 percent from the $3 billion recorded in the fourth quarter. On Jan. 22, when it reported fourth-quarter results, Texas Instruments said sales in the first quarter would drop about 10 percent from the fourth quarter.

The Dallas-based company also said it expects a declining operating margin.

The company cited a softening industry-wide demand for technology products sparked by the slowing economy. The company cited a softening industry-wide demand for technology products sparked by the slowing economy.

TI's wider-than-expected drop in sales comes in spite of cost-cutting measures put in place early in the quarter, including the idling of several plants, imposing a hiring freeze and shortened workweeks.

On Monday, TI began offering employees an early retirement program.

However, the company said it still plans to forge ahead with research and development spending on new technology.

Check other technology stocks

The latest warning comes after Motorola Inc. warned Friday that it may post a loss in the first quarter.

Mobile phone manufacturers such as Motorola (MOT: Research, Estimates) and Qualcomm (QCOM: Research, Estimates) and Nokia (NOK: Research, Estimates) have been hurt by a slowing economy in which demand for cellular and wireless phones has softened.

Telecommunications companies have also taken a hit in the slowing economy as the traditional long-distance business loses ground and executives rejigger strategies for high speed and wireless communications products. That environment has prompted pared back orders for technology-related equipment such as chips, routers, and fiber-optic lines.

Texas Instruments (TXN: Research, Estimates) fell 20 cents to $29.95 in midday trading after dropping $2.55 Friday.

-- from staff and wire reports

|

|

|

|

|

|

|