|

Greenspan defends Fed

|

|

March 2, 2001: 1:01 p.m. ET

Central bank chief says Fed's monetary policy helped prevent further slowdown

|

NEW YORK (CNNfn) - Federal Reserve Chairman Alan Greenspan on Friday defended the central bank's monetary policy, rejecting suggestions that the Fed helped trigger the economic slowdown because it waited too long to reduce interest rates.

Greenspan, in testimony to the House Budget Committee, said he did not accept the view of critics that the central bank responded too slowly to growing signs of weakness in the economy.

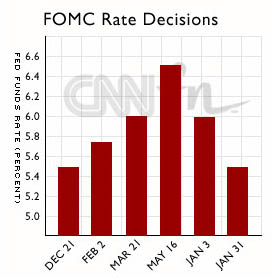

He said the Fed's series of rate increases that ended last May probably prevented an even more severe slowdown, and added that if the Fed had moved too soon to cut rates, the central bank could have forced bigger economic problems. The Fed lowered interest rates in January by a full percentage point in an effort to stimulate economic growth.

"In retrospect, I see nothing that we did that was inappropriate in terms of policy," Greenspan said in response to lawmakers' questions.

| |

|

|

| |

|

|

| |

In retrospect, I see nothing that we did that was inappropriate in terms of policy.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Fed Chairman Alan Greenspan |

|

Had the Fed cut interest rates too soon, "we would have altered the path of adjustment and conceivably created a higher level of economic activity than we are currently seeing, inducing far greater imbalances and a far greater correction of adjustment than we are seeing at the moment," Greenspan said.

Greenspan did not comment on the future of interest rate policy. But he said he hoped he had been "sufficiently ambiguous" in remarks to a Senate committee earlier this week about the possibility of another interest rate shift. Wall Street has been looking to the Fed chairman in hopes of a surprise rate reduction before its next meeting March 20.

"I hope I was sufficiently ambiguous not to have indicated timing of when or if we would move. I hope I was adept at what we term 'Fedspeak' on that issue ... a couple days ago," Greenspan said. The Fed chief also told the committee that he thinks inflation is well-contained in the U.S. economy.

The Dow Jones industrial average jumped in afternoon trading, reversing course after an early sell-off. The Nasdaq composite traded lower.

Greenspan, reiterating remarks made in a Jan. 25 appearance before the Senate Budget Committee, said he sees tax cuts as the best way to use ballooning surpluses. A surplus of that size would allow the government to significantly reduce the federal debt, plus provide tax relief, he said. Greenspan, reiterating remarks made in a Jan. 25 appearance before the Senate Budget Committee, said he sees tax cuts as the best way to use ballooning surpluses. A surplus of that size would allow the government to significantly reduce the federal debt, plus provide tax relief, he said.

"The changes in the budget outlook over the past several years are truly remarkable," the Fed chief told the House Budget Committee. With debt reduction in check, tax cuts appear possible because "the sequence of upward revisions to the budget surplus projections for several years now has reshaped the choices and opportunities before us."

However, as he did before the Senate, Greenspan cautioned, "We need to resist those policies that could readily resurrect the deficits of the past and the fiscal imbalances that followed in their wake."

Greenspan said tax cuts are desirable because, with growing surpluses, the government could start accumulating private assets, something he has warned would be harmful.

Greenspan's endorsement of tax cuts has helped bolster President Bush's argument for his $1.6 trillion tax relief proposal, although he has not commented specifically on Bush's plan. However, many Congressional Democrats are angry that Greenspan appeared to be modifying his stance on tax cuts to accommodate the new GOP administration.

-- from staff and wire reports

|

|

|

|

|

|

|