NEW YORK (CNN/Money) -

Biotechnology is on the brink of a large growth period, according to a number of analysts and fund managers. But in a sector where one word from regulators can destroy a portfolio or open the door for a huge profit, biotech investors can also end up having more than a financial interest in ulcer treatments and heart medication.

Two weeks ago, shares of biotech Corixa (CRXA: up $0.05 to $6.31, Research, Estimates) fell 37 percent in a day after the Food and Drug Administration rejected its application for a cancer drug. But a week later the stock jumped 12 percent when the company landed a development deal with Johnson & Johnson.

And earlier this year, shares of ImClone (IMCL: down $0.71 to $24.50, Research, Estimates) dropped from the mid-60s to under $14, and the company was forced to restructure its development deal with Bristol-Myers Squibb (BMY: up $0.17 to $39.67, Research, Estimates), after the FDA demanded more clinical data for cancer drug Erbitux.

But while many biotechs will always hold the risk of huge losses if regulators reject a drug, these days there are investment opportunities for people who would rather ride the merry-go-round than the roller coaster.

"The group has a high degree of inherent volatility in it," said Brian Clifford, manager of the SunAmerica Biotech Health Fund. "But one of the big things that has happened over the past few years is the maturation of the biotech sector."

Clifford said a number of top-tier biotech firms have put blockbuster products on the market, turning the companies "into revenue, cash-flow and earnings stories."

According to fund managers, the risk simply decreases with the size of the companies, with the larger biotech firms able to ride out the rejection of a drug.

Companies fitting that description include Amgen (AMGN: up $0.22 to $60.85, Research, Estimates), the 500-pound gorilla in the sector which recently agreed to buy Immunex for about $16 billion in cash and stock. Amgen has a market cap of nearly $65 billion and earned about $1.2 billion in 2001.

"If you pick any profitable companies, you're all right," said Sam Isaly, manager of the Eaton Vance Global Health Sciences Fund. "And they are growing at about 20 percent per year."

"Obviously the more products you have and the more earnings you have, the less risk you have," said Eric Schmidt, biotech analyst with SG Cowen Securities.

Along with Amgen, other biotechs that would fall into this category include Genentech (DNA: down $0.19 to $51.10, Research, Estimates), with a market cap of $28.4 billion and 2001 earnings of $150.3 million, and Biogen (BGEN: down $0.40 to $49.53, Research, Estimates), which has a market cap of $7.4 billion and a 2001 profit of $273 million.

Moving on to lower market capitalizations, the risk increases, Isaly said.

"You have about 40 between $1 billion and $5 billion," he said. "All of the ones between one and five, you have a reasonable risk of losing half your money if one program goes wrong."

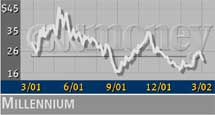

One company in that segment, which repeatedly came up as a promising stock, is Millennium Pharmaceuticals (MLNM: down $0.23 to $22.04, Research, Estimates).

Millennium is strong in cancer, inflammation and metabolic diseases, and recently bought COR Therapeutics and its top blood clot drug Integrilin for about $2 billion in stock. Millennium has a market cap of $6.8 billion, and lost $193 million in 2001.

Dan Gillespie, senior portfolio manager for the Rydex Biotech Fund, said Millennium has a fairly decent pipeline, a good business, and about $2 billion in cash on its balance sheet.

SunAmerica's Clifford said he liked IDEC Pharmaceuticals (IDPH: down $0.26 to $67.73, Research, Estimates), a $10.5 billion company which boasts antibody-based cancer treatment Rituxin, which is licensed by Genentech.

Last month the FDA approved IDEC's Zevalin to treat non-Hodgkins lymphoma.

"We're on the cusp of another two years of impressive growth (for IDEC)," Clifford said.

Rydex's Gillespie also noted Human Genome Sciences (HGSI: up $0.07 to $22.30, Research, Estimates) is a strong company. Human Genome has a market cap of about $3 billion and lost $117.2 million in 2001.

"They were one of the first genomic companies to decide they were going to produce and market their own drugs," he said.

At the end of 2001, Human Genome had cash and short-term investment totaling nearly $1.7 billion and the company has eight drugs currently in human clinical trials.

But Gillespie said considering the recent number of rejections by the FDA, the difficulty of biotech finding cash in a tough economy, and the volatility of the sector, investing in individual stocks is very risky.

| |

Related Stories

Related Stories

| |

| | |

| | |

|

"A lot of times there's too much money chasing too few stocks," he said. "The stocks overreact to good and bad news."

He said out of all the sectors, biotech is the one where investors need to spread their risk and invest in a diversified mutual fund.

"And I don't just say this because I run a fund," Gillespie added.

Disclaimer

|