NEW YORK (CNN/Money) -

The Securities and Exchange Commission is investigating Adelphia Communications Corp.'s off-balance-sheet debt, the embattled cable provider said Wednesday.

Adelphia, the No. 6 U.S. cable provider with about 6 million subscribers, said it was cooperating fully with the SEC's "informal" inquiry, including requests for "clarification and related documentation" of some $2.3 billion in off-balance-sheet debt.

The news comes on the same day the Wall Street Journal reported that Adelphia may have actually understated its exposure to off-balance-sheet debt by about $400 million. The report said last week's revelation of $2.3 billion in debt referred only to debts incurred last year.

Citing analysts, rating agencies and others, the report said the company took on more debt this year, possibly as much as $500 million. The loans were made to members of the Rigas family that founded and holds a controlling interest in Adelphia, who then purchased more shares of Adelphia.

Adelphia did not return a call seeking comment on the Journal report.

The SEC confirmed a separate report that said the agency had opened 49 new investigations into corporate accounting practices in just the first two months of 2002, though it would not identify specific companies it was investigating. Corporate bookkeeping has become a hot-button issue in the wake of the collapse of Enron Corp. and its associated accounting scandals.

Coudersport, Pa.-based Adelphia last week admitted that Highland Holdings, a partnership owned by the Rigas family, borrowed money against credit facilities co-guaranteed by Adelphia. Some of the money was used by Highland to buy more shares of Adelphia.

| |

Related links

Related links

| |

| | |

| | |

|

Adelphia also said last week it could be liable for $500 million in loans to Adelphia Business Solutions Inc. (ABIZ), a local-telephone provider it spun off in January. ABIZ filed for Chapter 11 bankruptcy protection last week. Adelphia also said that the involvement of the Rigas family in ABIZ could represent conflicts of interest.

On Monday, Adelphia said it would delay filing its 10-K annual report for 2001 financial activity with the SEC, saying it needed additional time to try to explain the debt. The Journal reported Monday that the company was considering selling some of its assets to pay off some of its $14 billion in total debt.

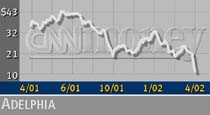

Shares of Adelphia (ADLAC: down $2.03 to $9.80, Research, Estimates) fell more than 14 percent in early Wednesday trading. The stock plunged about 30 percent last week after the company revealed its exposure to the off-balance-sheet debt.

|