NEW YORK (CNN/Money) -

Merrill Lynch & Co. is facing a court order requiring the brokerage firm to institute immediate reforms, due to findings that it has been "issuing misleading stock ratings," according to New York State Attorney General Eliot Spitzer. But according to Merrill, a judge has issued a 72-hour stay preventing the implementation of those changes.

Spitzer, who won the order from a lower state court in New York, issued a statement in which he charged an investigation by his office uncovered a "major breakdown" in the supposed separation between the banking and research arms. He charged analysts issued top ratings for companies they believed were bad investments in an effort to please the firm's investment banking clients.

"In fact, analysts at Merrill Lynch helped recruit new investment banking clients and were paid to do so," said Spitzer's statement. "The public, however, was led to believe that research analysts were independent and that the firm's rating system would assist them in making critical investment decisions."

Spitzer said the court order, which requires Merrill Lynch to make disclosures to investors about its business with investment banking clients and provide more context for the ratings, is a first step. But Merrill Lynch issued a statement attacking Spitzer's investigation and conclusion, as well as the court action.

"There is no basis for the allegations made today by the New York Attorney General," said the statement. "His conclusions are just plain wrong. We are outraged that we were not given the opportunity to contest these allegations in court. We are confident that a fair review of the facts will show that Merrill Lynch has conducted its research with independence and integrity."

Spitzer said his investigation of brokerage ratings is a wide-ranging one that includes other financial services firms, although he did not identify the other institutions. He said it has been ongoing for 10 months.

Analysts' stock recommendations came in for particularly harsh criticism and calls for reforms after many analysts did not lower their recommendation on technology stocks, even as the price of many of those stocks plunged.

Spitzer's statement charges that, "as part of a quid pro quo between the firm and its investment banking clients Merrill Lynch analysts skewed stock ratings, giving favorable ratings to preferred clients, even when those stocks were dubious investments."

| |

Related stories

Related stories

| |

| | |

| | |

|

Spitzer said copies of internal communications at Merrill showed that even the analysts did not believe the ratings they were issuing.

"These communications show analysts privately disparaging companies while publicly recommending their stocks," said Spitzer's statement.

Click here for a look at financial stocks

Spitzer's statement identified two companies that received such undeserved ratings as Excite@home, which he said an analyst called "such a piece of crap" on June 3, 2000, despite it having an "accumulate" rating, or the second strongest recommendation, and InfoSpace Inc. (INSP: down $0.05 to $1.52, Research, Estimates), which Spitzer said an analyst called a "piece of junk" on Oct. 20, 2000, despite a top "buy" rating. InfoSpace stock has fallen to $1.49 from its Oct. 20, 2000 closing price of $21. Excite@home has filed for bankruptcy court protection, essentially wiping out shareholders' stake in the company.

Spitzer also released e-mails from analysts that suggested they were uncomfortable with the pressure being applied by investment banking customers in reaction to potential negative comments from analysts.

"The more I read of these, the less willing I am to cut companies any slack, regardless of the predictable temper-tantrums, threats and/or relationship damage that are likely to follow," reads one e-mail from Henry Blodget, the firm's former Internet stock analyst who was widely criticized in the press for not taking his recommendations lower as the stocks he followed fell. "If there is no new e-mail forthcoming from (Merrill management) on how the instructions should be applied to sensitive banking clients/situations, we are going to just start calling the stocks ... like we see them, no matter what the ancillary business consequences are."

Merrill said the e-mails cited by Spitzer showed no evidence of wrongdoing.

"E-mails are only one piece of a continuous conversation, isolated at a single point in time -- not the end conclusion," said the firm's statement. "The e-mails in question show that there was normal give and take as well as vigorous debate among analysts as they assessed different companies. These kinds of interchanges are customary and appropriate."

Merrill's statement said that virtually all the Internet stocks that Merrill covered were given the highest risk factor, which it said made them the recommendation only for investors with the stomach for great price volatility.

It also said that the research department at Merrill does not report to investment banking or equity capital markets, and that its research analysts' compensation is based on broad factors and is not tied directly to the success of investment banking transactions. It also said Merrill Lynch was the first major firm to prohibit analysts from purchasing stocks that they cover.

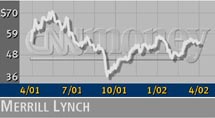

Shares of Merrill Lynch (MER: Research, Estimates) closed down 45 cents to $53.45, but that was slightly higher than the early afternoon price before Spitzer's announcement.

|