NEW YORK (CNN/Money) -

Drugstore chain CVS Corp. raised is guidance for the first quarter Tuesday and said that same-store sales increased 12.5 percent over the same period last year, due to an early Easter period.

Pharmacy same-store sales for the Woonsocket, R.I.-based company increased 12.8 percent for the quarter, while front-end same-store sales increased 11.9 percent.

The company revised its earnings expectations by 1 cent, estimating the chain will report earnings of 43 cents per share for the first quarter. Analysts on average expect 42 cents a share, according to tracking firm First Call.

"I am pleased with our year-to-date performance, said Tom Ryan, CVS chairman, president and CEO. "We had a very strong Easter selling season, reflecting our enhanced seasonal and general merchandise offerings."

Total sales for the quarter, ended March 30, rose 12.6 percent to $2.32 billion, compared to $2.06 billion in the prior year period.

First-quarter sales for the No. 2 U.S. drugstore behind Walgreens benefited from an early Easter, which fell on March 31 this year. Last year, the Easter holiday landed on April 15, in the second quarter.

Same-store sales for the year through March 30 increased 10.2 percent over the same period last year and total sales for the period increased 10.9 percent to $5.97 billion, compared with $5.39 billion in 2001.

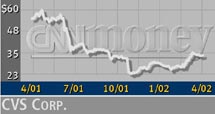

Shares of CVS (CVS: up $1.22 to $35.04, Research, Estimates) gained about 4 percent in early trading Tuesday.

|