NEW YORK (CNN/Money) -

General Electric Co.'s first-quarter profit increased from a year ago, the company said Thursday, matching Wall Street expectations, though disappointing revenue sent the conglomerate's shares tumbling.

The blue-chip maker of such diverse products as light bulbs and aircraft engines reported a first-quarter profit of $3.5 billion, or 35 cents a share, up from $3 billion, or 30 cents a share, a year earlier. Analysts on average anticipated a profit of 35 cents a share, according to earnings tracker First Call.

"GE delivered in the first quarter for the same reason we have delivered throughout the economic downturn -- the strength of our business model," CEO Jeff Immelt said in a statement. "[Our] mix of businesses and execution of our [productivity and business development] initiatives ... enable GE to deliver earnings and cash growth through economic cycles."

The company also reaffirmed 2002 earnings guidance of $1.65-to-$1.67 a share, within the range of analysts' estimates of $1.65 a share.

But first-quarter revenue was flat at about $30.5 billion, below analysts' forecasts of $32.6 billion, according to First Call. In a conference call discussing its results, Chief Financial Officer Keith Sherin said the quarter was "even tougher than we expected" and the economy was "as tough as we've seen in a long time."

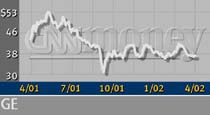

GE (GE: down $3.68 to $33.52, Research, Estimates) shares dropped nearly 9 percent following the conference call, as traders expressed their disappointment with GE's revenue growth.

"Without [revenue growth from its] power systems [unit], there would have been no growth, and the question is, as it peaks, how fast will the other businesses rebound and make up for the power systems decline?" Edward Jones analyst William Fiala told Reuters. "It's going to make double-digit earnings growth tougher to come by in the next couple of years."

First conference call

The conference call was the first in the company's 110-year history and likely was in response to last month's criticism of GE's credibility by influential bond fund manager Bill Gross and questions raised about corporate accounting methods following Enron Corp.'s collapse last fall.

In the call, the Fairfield, Conn.-based company gave much more detail about its business segments than usual, revealing dismal sales performance for nearly all its industrial businesses. The shining lights were its power systems business -- GE's biggest revenue source -- which rose 24 percent from a year ago, and NBC, which got a boost from the Olympics, lifting sales 48 percent from a year ago.

Otherwise, aircraft engine revenue fell 6 percent, lighting systems fell 11 percent and plastics fell 19 percent.

But Sherin also said there were signs of improvement in several of those businesses. NBC, for example, saw some improvement in a tough advertising market. And the volume of orders for its plastics business is up in all segments except business equipment. Despite a "brutal, tough pricing environment," the increase in orders is a good sign of recovery in the broader economy, Sherin said.

Revenue from GE Capital, GE's financial services unit, also fell, due in large part to low interest rates. But the unit got a lift from increased productivity and lower costs.

"If you take out the effects of sold businesses and the effect lower interest rates had on revenue, the actual number is more like a 6 percent increase," Goldman Sachs analyst Martin Sankey told CNNfn's Money Gang program.

GE Capital's income also was boosted by a number of acquisitions that added $142 million in the quarter. Some analysts, including Gross, recently have criticized GE for using acquisitions to boost its earnings.

| |

Related links

Related links

| |

| | |

| | |

|

GE's industrial side made acquisitions in the quarter totaling about $2.1 billion. About $700 million of that was in stock, but $1.4 billion was in cash, GE said.

The company also addressed criticism raised by Gross and others concerning GE Capital's reliance on the commercial paper market to raise cash to make acquisitions.

Sherin said commercial paper -- short-term debt with a very low interest rate -- amounted to 42 percent of GE Capital's debt in the quarter, but would continue to shrink in the future as the company moves to more stable, secured, longer-term debt.

"We feel great about where we are with our debt strategy," Sherin said, citing the company's March 21 announcement that it hopes to cut its commercial paper debt to between 25 and 35 percent of its total debt by the end of the year.

|