NEW YORK (CNN/Money) -

DuPont Co. Tuesday posted first-quarter earnings that missed Wall Street expectations although the company said it expects to beat current second-quarter forecasts.

The nation's largest chemical company posted earnings of $552 million, or 55 cents a share, excluding special items. That was a penny less than the consensus earnings-per-share forecast of analysts surveyed by results tracker First Call. Their EPS estimates ranged from 53 to 60 cents.

The company earned $567 million, or 54 cents a share, excluding special items a year earlier. Profit per share rose on a 4 percent decline in the number of shares outstanding. Including special items the company posted net income of $479 million, or 48 cents a share, down from $495 million, or 46 cents a share, in the year-ago quarter.

The company raised its guidance for the quarter earlier this month, saying it expected to top the consensus EPS forecast that was then at 51 cents.

The company said it expects to earn 55 cents a share excluding special items in the second quarter, which is a penny better than First Call's EPS forecast for the period and up from the 41 cents a share it earned a year ago.

| |

Related stories

Related stories

| |

| | |

| | |

|

"The company expects sequential volume momentum and year-over- year lower raw materials costs to benefit results," said its statement. "These positives will likely be mitigated by a continued strong dollar and difficult price environment."

First-quarter revenue fell to $6.2 billion from $7 billion, as the company saw sales volume fall by 2 percent, a 2 percent negative impact on revenue from changes in currency exchange rates and a 4 percent decrease in local prices. DuPont cautioned a "significant" period of demand growth is needed to absorb capacity before pricing strengthens in the manufacturing sector.

Click here for a look at manufacturing stocks

"DuPont is being squeezed on every side, and if they had not cut costs things would be a lot worse," said David Kerans, an analyst at Argus Research. "The chemical industry is still suffering from excess capacity. And the strong U.S. dollar makes it even more painful for U.S. chemical companies."

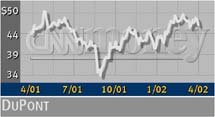

Shares of DuPont (DD: down $1.52 to $44.83, Research, Estimates), a component of the Dow Jones industrial average, were about 3 percent lower in late afternoon trading Tuesday.

-- Reuters contributed to this report

|