NEW YORK (CNN/Money) -

U.S. stocks ended flat, giving back earlier gains, after the Federal Reserve signaled that the lowest interest rates in 40 years have yet to spark a strong economic recovery.

Hinting that borrowing costs won't go higher anytime soon, the Fed for the third straight meeting left interest rates unchanged in its ongoing effort to maintain consumer spending and coax businesses to buy new equipment.

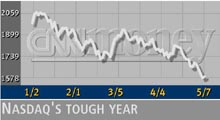

Up by as much as 111 points before the afternoon decision, the Dow Jones industrials ended at 9,836.55, a 28.51-point gain. The Nasdaq composite index, up as much as 16 points, slipped 4.66 to 1,573.82. The Standard & Poor's 500 index dipped 3.18 to 1,049.49, widening its year-to-date loss to 8.6 percent.

Fed policy makers said that businesses replenishing depleted inventories caused a pickup in economic activity this year. But central bankers also voiced concern that the sustainability of any expansion "is still uncertain."

"Any economic data we've had suggests that the economy's going to recover at a moderate pace," said Mike Murphy, head trader at Wachovia Securities. "We are not going to see this V-shaped recovery that everyone wants to see."

Looking ahead, Ian Shepherdson, chief U.S. economist at High Frequency Economics, said the Fed won't hike rates without evidence that businesses are spending money again. And that may take a while.

"There is still a good chance for an August hike, but we are leaning increasingly to September or even November," Shepherdson said.

The Fed's unanimous decision came hours after a report showed that businesses boosted productivity while cutting labor costs during the first three months of the year. But it also follows more recent figures showing that the unemployment rate rose to its highest levels in nearly eight years in April as employers added jobs for the first time in nine months.

More stocks fell than rose. On the New York Stock Exchange, declining issues topped advancing ones 9-to-7 as 1.3 billion shares traded. Nasdaq losers topped winners 10-to-7 as 2 billion shares changed hands.

In other markets, the dollar gained against the euro and yen. Treasury securities edged higher.

Will they move in August?

Economists trying to forecast the Fed's next move are looking to August for the first possible increase in borrowing costs.

"If the Fed is not going to do the heavy lifting, the bond market is going to do it for them," Mike Ryan, senior fixed-income strategist at UBS PaineWebber, told CNNfn's The Money Gang.

Bond yields, which tumbled last year, have been rising as investors anticipate that a recovering economy may eventually generate inflation.

One of the Dow's biggest gainers, United Technologies (UTX: up $0.81 to $68.15, Research, Estimates), the aerospace company, reaffirmed its 2002 outlook for earnings per share of $4.32.

Lifting the Dow along with United Technologies and rival Honeywell International (HON: up $1.80 to $37.80, Research, Estimates), IBM (IBM: up $0.50 to $76.50, Research, Estimates) recouped a fraction of its 7 percent slide from Monday. Financial stock J.P. Morgan Chase (JPM: up $0.23 to $34.63, Research, Estimates) rebounded from prior session losses.

Retailers Wal-Mart Stores (WMT: up $1.02 to $55.01, Research, Estimates) and Home Depot (HD: up $1.01 to $45.71, Research, Estimates) also advanced. So did Hewlett-Packard (HPQ: up $0.19 to $18.41, Research, Estimates) after Morgan Stanley upgraded the computer maker to "overweight" from "equal-weight."

Cisco Systems (CSCO: up $0.19 to $13.08, Research, Estimates) after the close of trading logged a fiscal third-quarter profit that improved over the same period last year as the maker of networking gear such as routers and switches topped forecasts.

The Fed cut interest rates 11 times last year, with four of those cuts coming after the Sept. 11 terrorist attacks, taking the overnight interbank lending rate to 1.75 percent.

But stocks haven't benefited. The Nasdaq hit a new seven-month low Tuesday. Below 10,000, the Dow industrials are at levels first crossed more than three years ago.

David Briggs, head trader at Federated Investors, said technology companies in particular face problems of expensive stock valuations combined with poor short-term business conditions.

"There is light at the end of the tunnel, but how long is the tunnel?" Briggs asked.

U.S. productivity posted its biggest gain in nearly 19 years in the first quarter, the government said Tuesday, while unit labor costs plunged 5.4 percent, the biggest drop since the second quarter of 1983.

Stocks initially rallied on the news, which bodes well for improved corporate earnings and limited inflation.

"This brings the possibility of steeper-than-anticipated gains in profits," said John Lonski, senior economist at Moody's Investors Service, who added the falling labor costs may help keep the Fed from hiking rates until August at the earliest.

"That may give the economy a chance to shift into higher gear," Lonski said.

|