NEW YORK (CNN/Money) -

Tyco International executives tried to reassure investors Friday about ongoing concerns regarding its finances after two credit-rating agencies cut its debt rating and amid reports of a widening probe into transactions between the company and its former chief executive.

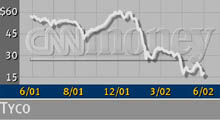

Tyco (TYC: Research, Estimates) stock fell a further 31 percent Friday, hitting a six-year low. It has lost about 83 percent of its value since December.

In a hastily scheduled conference call, Tyco's interim CEO, John Fort, said former chief executive Dennis Kozlowski's departure and his indictment on tax evasion charges related to purchases of fine art will have "no material impact on Tyco's financials."

Toward the end of the call, Fort emphasized, "Dennis is gone...Dennis is gone."

When asked about news reports of a widening criminal probe into whether the company bought homes and artwork for several executives without disclosing it, Fort said he would not comment, but he did say the company is conducting an internal investigation, led by the law firm of David Boies.

Boies represented Al Gore in the Florida presidential recount, the Department of Justice in the Microsoft case and currently represents Andrew Fastow, Enron's former CFO who is widely credited with forming the off-balance-sheet transactions which led to the company's collapse.

"My feeling is that Kozlowski's apparent game-playing with taxes on art that he purchased has opened up a Pandora's box that has made the doubting Thomases further believe that Tyco is not a company to be held," said Alan Ackerman, market strategist at Fahnestock & Co. "In a market where so many investors are fearful of portfolio peril, I'm not sure it's an issue many people want to gamble with at this point."

Meanwhile, Moody's and Standard & Poor's, two of the nation's leading rating agencies, cut Tyco's debt to just above "junk" status. S&P said it may cut the rating again if there are further developments in the criminal probe, an offering of its CIT financial services unit is not launched within the next two weeks, or if business conditions worsen.

Fort said the company is still pursuing an IPO or sale of CIT by June 30, but it might be delayed until early July.

Tyco's chief financial officer, Mark Swartz, said the downgrades affect $655 million in debt that may be called in the coming months, but the company has enough cash on hand to operate within its covenants.

"We expect a meaningful debt paydown within the next 12 months," Swartz said. He added that Tyco has a 52 percent debt-to-capital ratio, which it is required to remain within other debt covenants. Swartz said Tyco expects to operate at that ratio, and its total debt which is subject to downgrades or recalls amounts to $6.6 billion.

Kozlowski was indicted Tuesday on charges he evaded paying more than $1 million in taxes on valuable old paintings. He pleaded not guilty and was released on $3 million bail.

The indictment came a day after Kozlowski resigned from Bermuda-based Tyco, a manufacturing conglomerate he helped build into one of the world's largest companies over the last decade through a series of aggressive acquisitions.

Manhattan District Attorney Robert Morgenthau said Tuesday that Kozlowski bought six paintings worth $13.2 million, including valuable pieces by Renoir, Monet and other artists, using funds borrowed from Tyco.

Officials from the district attorney's office and the Securities and Exchange Commission declined to comment on the investigation Friday.

If prosecutors in the district attorney's office determine that Tyco used company money to buy personal items for Kozlowski and other executives, the company could be indicted on several charges, including income tax evasion and keeping false books and records, the Wall Street Journal reported Friday.

A source close to Tyco's board told the Journal that corporate funds were used to buy Kozlowski's $18 million New York apartment two years ago. He said the apartment, though listed in Kozlowski's name, actually is owned by Tyco. The arrangement apparently was made to skirt rules barring anyone except the person living in a cooperative apartment from owning it, the paper reported.

Kozlowski paid no rent on the apartment and its value to him was not disclosed in Tyco's proxy filings, a possible violation of federal securities rules requiring such perks be reported and included in any pay calculations, according to the report.

Investigators' suspicions were first raised about Tyco three years ago when New York prosecutors questioned a board member's sale of a Boca Raton, Fla., home to an in-house attorney for more than $2 million using funds from the company.

Tyco spokesman Brad McGee acknowledged Thursday that Kozlowski was granted a $23 million loan under an employee program in 2001, but it was fully repaid by the end of the year. The loan was disclosed in the company's annual proxy statement on file with the SEC, McGee said.

Last month Tyco backed off a plan to separate into four companies and said it would cut 7,100 jobs instead. Kozlowski called the plan a "mistake," considering the sluggish economy, spending cutbacks, and jitters on Wall Street over corporate accounting.

-- from staff and wire reports

|