NEW YORK (CNN/Money) -

Harlan Waksal, CEO of embattled drugmaker ImClone Systems Inc., told shareholders Tuesday that the company's credibility took a serious blow last year and that its application to federal regulators for approval of its would-be blockbuster drug Erbitux "should have been stronger."

Waksal, in prepared remarks delivered at the company's annual shareholder meeting, did not comment on questions raised by congressional investigators and the Securities and Exchange Commission about stock sales by senior executives and one prominent friend of the former CEO, Martha Stewart, that came just after the company was tipped off that the Food and Drug Administration would not approve its anti-cancer drug Erbitux.

But shareholders didn't question Waksal about the alleged insider trading during a meeting, held in Somerville, N.J., that was surprisingly congenial, according to reports from Reuters and the Associated Press.

"Harlan was very articulate. He opened up the floor to anyone who wanted to ask questions and he answered all of them," Charles Berner, a shareholder from Yardley, Pennsylvania, told Reuters. "I was very impressed with the way the meeting was conducted."

Waksal said the company still believes Erbitux will benefit many kinds of cancer patients, but he said at the end of his remarks, "I realize that the events of 2001 have seriously damaged our credibility with many of our constituents, including cancer patients, oncologists, and you, our investors."

He would not comment on the timing of a new application for approval of Erbitux -- which some analysts believe is ImClone's only hope for a marketable drug -- but he did say the company was dedicated to getting the drug to market.

Allegations of insider trading

Waksal is scheduled to appear Thursday before a congressional committee seeking to find out whether ImClone misled shareholders and if its top executives profited from illegal trading in ImClone shares. His brother, former CEO Sam Waksal, has been subpoenaed to appear, but is expected to invoke his Fifth Amendment right against self-incrimination.

Sources have told CNNfn that ImClone executives were warned that the FDA was unlikely to approve Erbitux, and several of them made large stock sales in the days prior to the FDA's formal refusal to review the drug -- even though the company did not warn other shareholders, who were expecting quick approval.

Stewart's representatives have repeatedly said she had no knowledge of the FDA action before selling her shares, and other executives have said the FDA action was a surprise to them. ImClone could not be reached for comment.

Entering the meeting, one shareholder, Anthony Midis, was asked if he believed senior executives profited to the detriment of shareholders. Midis said, "[It] smells like it." Asked about the sale by Martha Stewart, Midis said, "That smells, too." Midis said he owns several thousand ImClone shares.

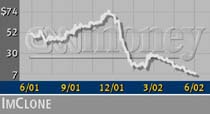

ImClone (IMCL: up $0.17 to $7.85, Research, Estimates) shares rose Tuesday as the meeting progressed, but they have fallen precipitously from their 52-week high of 75.45.

Also closely monitoring ImClone's struggles is drugmaker Bristol-Myers Squibb (BMY: down $0.87 to $26.03, Research, Estimates), which has a $1 billion equity stake in the company, is helping ImClone get approval for Erbitux and has agreed to make another $1 billion in milestone payments to ImClone at certain stages of Erbitux's approval.

In March, the companies renegotiated the terms of their relationship, with Bristol-Myers backing down from demands for complete control of the approval process, the elimination of milestone payments, fewer restrictions on selling shares of ImClone, and the removal of ImClone CEO Sam Waksal and then-COO Harlan Waksal until the drug was approved.

ImClone was hit with a barrage of class action suits alleging Waksal made misleading statements about Erbitux's approval process, and the company is also the target of informal federal investigations.

Company founder Sam Waksal, a lightning rod for the criticism of shareholders who saw his frequent hobnobbing with celebrity acquaintances such as Mick Jagger as distracting him from the company's business, resigned in late May and was succeeded by his brother.

Following the FDA's refusal to approve Erbitux in late December, Sam Waksal said in a Dec. 31 conference call that the problem was one of documentation. But he told investors and analysts at a Jan. 9 conference that it was "not an insignificant problem," that certain data did not exist and that the company "screwed up."

A January report in the Cancer Letter said the company's application was rejected not only because of certain record-keeping failures but also concerns about the drug's effectiveness, including questions about the number of patients who died after treatment with Erbitux.

Harlan Waksal said Tuesday that ImClone was primarily hopeful that Erbitux would be approved to treat colorectal cancer, but that it would also study the drug's effectiveness in treating head-and-neck, lung and pancreatic cancers.

|