NEW YORK (CNN/Money) -

U.S. Treasurys, oil and the dollar posted strong gains Friday, lifted in part by Iraq's rejection of U.S. demands to allow weapons inspectors into the Arab oil-exporting country, but gold prices fell.

President Bush told the United Nations Thursday that U.S. action against Iraq would be unavoidable unless the U.N. acted swiftly to force Baghdad to disarm.

But, Iraq's Deputy Prime Minister Tareq Aziz rejected Friday the unconditional return of U.N. arms inspectors, saying the move would not avert U.S. military designs on Baghdad.

Some investors headed to Treasurys, seeking a safe haven from the volatile equity markets.

Two-year Treasury notes gained 2/32 to 100-4/32, yielding to 2.04 percent, while the five-year note rose 7/32 to 101-8/32, pushing yields down to 2.97 percent from 3.03 percent at Thursday's close.

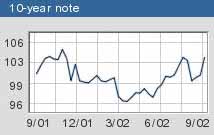

The benchmark 10-year note jumped 13/32 to 103-24/32, yielding 3.91 percent, down from 3.97 percent at yesterday's close. This marks the lowest weekly close on the 10-year note since 1963. The 30-year bond climbed 26/32 of a point to 109-12/32, yielding 4.76 percent against 4.82 percent Thursday.

"You have the war drumbeat and it looks like they're going to take action sooner rather than later and that's having an impact on bonds," said Gib Clark, head governments trader at Zions First National Bank Capital Markets. "Meanwhile, the stock market is acting miserably and everybody is talking about retesting the lows."

Weaker-than-expected consumer sentiment in the first part of September also boosted Treasurys. The University of Michigan's preliminary reading on consumer sentiment in September was 86.2, down from 87.6 in August, sources said.

The Commerce Department said retail sales rose 0.8 percent after gaining 1.2 percent in July. Excluding volatile automobile sales, retail sales rose 0.4 percent after rising 0.2 percent in July.

Also, the Labor Department said its producer price index, a measure of wholesale inflation, was unchanged after falling 0.2 percent in July.

Oil prices rise

Baghdad's rebuttal raised the likelihood of a U.S. military attack on Iraq, which traders fear could spill over to other countries in the Gulf region, which pumps about a quarter of the world's oil supply.

Prices drew further support from comments from the Organization of the Petroleum Exporting Countries (OPEC), suggesting the cartel is unlikely to decide to increase output when it meets next week in Osaka, Japan.

Light crude for November delivery gained 97 cents to $30.00 a barrel on the New York Mercantile Exchange, while Brent Sea crude for November delivery added 86 cents to $28.67 a barrel.

Dollar higher against yen, euro

In the currency market, the dollar rose nearly ¥2, the highest one-day gain since July 26, and also made gains against the euro.

The dollar bought ¥121.65 in afternoon trading in New York, up from ¥120.07 Thursday. The dollar also rose against the euro, which bought 97.25 U.S. cents, down from 98.15 cents late Thursday.

"The U.S. has been leading the world's economy but it's stumbling along. People are not sure where to put money, so the market is at the crossroads almost," said Bilal Hafeez, currency strategist at Deutsche Bank.

Gold prices slip

Analysts said gold, which hit a six-week high last week at $324, would continue to take its direction from Washington's policy of "regime change" in Iraq.

Gold for December delivery fell $2.30 to $318.10 per troy ounce.

|