|

The high price of money

|

|

May 12, 1998: 4:16 p.m. ET

GAO survey says ATM fees keep rising despite fewer transactions

|

NEW YORK (CNNfn) - The convenience of doing your banking with automated teller machines has come at a higher price over the last year.

According to a survey released Tuesday by the U.S. General Accounting Office, the number of ATMs extracting surcharges from users rose more than 50 percent between February 1997 and February 1998.

At the same time, the average surcharge fee assessed by banks increased from 69 cents last year to $1. That figure averages in the ATMs which have no surcharges.

When the non-surcharge ATMs are taken out of the equation, the average fee jumps from $1.17 to $1.27 this year. The most typical fee was $1.50, compared to $1 the previous year.

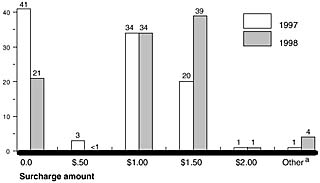

The high cost of ATM banking

(Percentages of ATMs with various surcharges)

(source: GAO)

The GAO, the investigative arm of Congress, based its results on a survey of 500 banks of various sizes in the United States. The survey did not include credit unions or other non-bank ATM operators such as grocery store chains.

The GAO discovered that even though the number of banks in the United States in 1998 was approximately the same as the year before, the number of ATMs increased 13 percent to an estimated 132,000 machines.

Most of that growth occurred off of bank premises as banks attempted to extend the geographic reach of their services.

However, the increasing ATM fees may be leading consumers to less trips to the machines. The survey found a 15 percent decline in ATM transactions by bank customers, who are usually not levied fees. Transactions by non-customers, who typically have to pay fees, dropped an even steeper 24 percent.

Until April 1996, the two primary national ATM networks, run by Visa and Mastercard, banned the practice of surcharging non-customers for use of their network's ATMs. However, statutes in 15 states prevented the ATM networks from enforcing that ban.

The two networks relented on the ban, and if you weren't a member of a bank, it became possible for that financial institution to charge you a fee to use their ATMs.

That change opened up the way for even more ATM fees. Now, ATM networks can charge you a switching fee, used to pay for processing of the transaction along with an interchange fee, another type of handling fee.

The increasing ATM fees have raised the ire of some legislators, including Senate Banking Committee Chairman Alfonse D'Amato. He is seeking passage of legislation he introduced last June to ban the added fees.

|

|

|

|

|

|

|