NEW YORK (CNNfn) - You've got your money in an index fund. You think you've outsmarted investment risk. But there will probably come a time when you'll be less convinced.

Index funds have become a hot commodity among investors who are looking to keep pace with the overall market and minimize risk.

The most popular index funds are based on the S&P 500 index. While many believe the S&P 500 is comprised of the 500 largest U.S. companies, it is actually an ever-changing entity which tries to capture the returns of many different sectors of the U.S. economy.

Funds based on the S&P 500 have gained momentum over the past few years because they've beat out most actively managed funds. In 1997, these index funds bested 85 percent of actively managed funds.

However, that hasn't always been the case. There have been stretches of time when the actively managed funds proved superior to the indexed ones. In the period between 1991 and 1993, actively managed funds were top dogs, as well as from 1977 to 1979.

Percentage of funds outperforming the S&P 500

| YEAR |

|

YEAR |

|

| 1977 |

85% |

1988 |

41%

|

| 1978 |

69% |

1989 |

18%

|

| 1979 |

80% |

1990 |

36%

|

| 1980 |

47% |

1991 |

55%

|

| 1981 |

63% |

1992 |

54%

|

| 1982 |

62% |

1993 |

60%

|

| 1983 |

40% |

1994 |

22%

|

| 1984 |

22% |

1995 |

15%

|

| 1985 |

26% |

1996 |

25%

|

| 1986 |

24% |

1997 |

15%

|

S&P 500 index funds essentially have their hands tied. An index fund manager's job is not to use his research and intuition to find the best stocks. Instead, these managers merely attempt to mirror where the money is going in the overall market.

Typically, bull markets are spurred on by specific sectors, but the index fund manager is powerless to take advantage of this.

For example, if financial stocks are outpacing the overall market, the index fund manager can do little about it. He can only apportion his portfolio to the same percentage that the overall market holds financial stocks.

This has other built in disadvantages. As these financial stocks become pricier (due to increased market demand) the fund must chase after them despite their increased prices.

No security in size

Additionally, S&P 500 index funds are at the mercy of large-cap stocks. The index is weighted by market capitalization. Therefore, larger companies like Microsoft (MSFT) and Coca-Cola (KO) exert a larger influence on these index funds. When the big companies tank, so do the funds.

"There's a false sense of security that large caps don't go down," said Doug Fabian, president of Fabian Investment Resources. "I've got news for you -- they do."

Fabian said the recent mania for large-cap stocks has become a self-fulfilling prophecy. As index funds become more popular, their managers pour more money into large-cap stocks and the cycle begins again.

Not all index funds are based on the S&P 500 foundation.

Others cast their stocks over the broader market. Such funds may use as their benchmark the Russell 2000 index, which consists of the 2,000 smallest companies among the 3,000 largest U.S. companies.

The broadest index can be found on the Wilshire 5000 Equity index, consisting of all regularly traded U.S. stocks. In addition, various mutual funds try to mimic the stocks of other markets in Europe and Asia.

However, broader index funds don't necessarily equate to better funds, said Kevin McDevitt, a mutual fund analyst at Morningstar Inc.

"The S&P 500 is the most efficient branch of the market. It has the most analyst coverage and the closest values," he said. "I would make a huge distinction between a S&P 500 index fund and the others."

Bears, bulls and lemmings

Sitting in the middle of a bull market, today's index funds look pretty good. But how would they look when things turn bearish?

Some investors think that in a bear market it becomes all the more important to have the flexibility to pursue those sectors that show promise instead of following a dropping market in a lemming-like manner.

However, Bryan Metter, spokesman of the Vanguard Group, which offers a variety of index funds, said it's a "fallacy" that an actively managed fund will do better in a down market.

"The bad news is the index fund is going down as much as the market. The good news is it's going down as much as the market," he said.

Metter said the belief that an actively managed fund can handle the waves of a choppy market is based on the assumption that an investor can find a fund manager capable of steering toward the best stocks. This, he said, is more difficult than it sounds.

Actively managed funds do have one protection from bear markets that index funds lack. By definition, an S&P 500 index fund is fully invested.

However, other fund managers usually keep some of the money under their control in cash, safe from any market downturns. Index fund managers must continue to put their money in the stock market whether they want to or not.

The looming threat of capital gains also exists for index funds. In the midst of a major market sell-off, the index fund must dump its own shares to mimic the market. When that happens, capital gains taxes result, and the burden falls on the investors.

Vanguard's Metter said that index fund's capital gains liabilities have been overplayed, however. In the event of broad market selling, lower stock prices would result, raising the likelihood that instead of making money, the fund would be selling stocks at less than they paid for them, bringing capital losses.

Despite the downsides of index funds, public fervor for these funds looks likely to continue. Their perceived reduced risk, recent strong performance, combined with the fact that they usually charge lower fees than actively managed funds, will probably keep the money pouring into these funds.

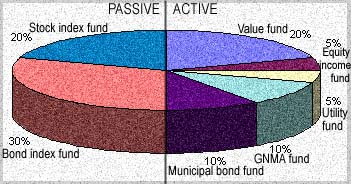

Indeed, it's not even necessary for the two types of funds to be mutually exclusive. Vanguard suggests having 50 percent of your investments in index funds (30 percent in stock index funds, 20 percent in bond index funds) with the remaining 50 percent in active funds.

Fabian takes it a step further. He said you can utilize various types of stock index funds, for instance, keeping some of your investments in an S&P 500 index fund, some in a Russell 2000 index fund.

"I see them as part of a diversified approach for the investor that wants to keep pace with market returns," said Fabian.

All sides agree that no one should look to get rich quickly. "It's not a short-term investment," said Vanguard's Metter. "Indexing strength accrues over time."

-- by staff writer Randall J. Schultz

|