|

GM strike heads into dog days

|

|

June 23, 1998: 6:57 p.m. ET

As the idled count mounts, GM and UAW show signs of hunkering down

|

NEW YORK (CNNfn) - The fiats have begun to fly from the executive suites of America's largest carmaker, hastily composed memos alerting mid-level managers and other pinstriped spendthrifts to belt-tightening ahead.

Outside General Motors Corp., the sense of hunkering-down after 18 days of continuous work stoppages is equally apparent as leaders of the United Auto Workers marshal their 9,200 striking members with rallying rhetoric about lasting "one day longer" than their bosses across the bargaining table.

Wherever one looks in this GM strike, the combatants' cries are rising in a symmetry of indignation that analysts say transcends the usual hue-and-cry of labor rest.

As of Tuesday, the strike had idled 136,700 workers at 24 of GM's 29 light-vehicle assembly plants in the United States, Canada and Mexico.

As both sides dig in, the strike threatens to become the worst labor unrest GM has seen since 1970. It has already started to eclipse anything GM experienced during a 1996 shutdown of two Dayton, Ohio, plants that lasted 17 days and resulted in a $900 million pre-tax loss for the company.

"It certainly has escalated," said Harley Shaiken, a professor specializing in labor issues at the University of California at Berkeley.

Echoing a widespread view, Shaiken said that while the strike could be settled tomorrow, "all signs indicate it could go a long while." For some, a resolution may come by mid-July - after GM's annual two-week summer shutdown, which begins the weekend of June 27 - or as late as mid-August. (Unless the strikers return to work by Friday, they will forfeit their first week of vacation pay.)

Halve discretionary spending

On the eve of the shutdown, however, neither side has shown any willingness to budge from its position. In a letter sent to top managers Monday, G. Richard Wagoner, the president of GM's North American Operations, said the firm's core automotive unit would cut its discretionary spending by half.

The letter urged managers to reduce expenditures that "don't impact our future growth."

At the same time, UAW leaders have held out the prospect of a rash of further walkouts unless their demands are met.

Richard Shoemaker, the vice president of the UAW's General Motors department, said Monday the Flint walkouts could be followed by strikes at a GM stamping plant in Indianapolis and at two brake plants in Dayton, Ohio, where disputes are brewing.

Meanwhile, talks have been sporadic and sluggish since June 5, when about 3,400 United Auto Workers from Local 659 walked off their jobs at a Flint metal-stamping plant in a dispute over work rules and productivity.

Six days later, on June 11, another 5,800 members of Local 651 struck the Delphi East plant across town, a diversified parts facility that makes spark plugs and instrument clusters.

Backing down on a pledge?

Union officials at Flint Metal contend GM has reneged on promises to invest $300 million in new equipment at the plant, while those at Delphi East say the automaker wants to contract out work that would mean the loss of 2,500 jobs at the plant.

GM officials have blamed the Metal Center walkout on UAW Local 659's refusal to change inefficient work rules that result in annual losses of $50 million at the plant.

GM has also dismissed taunts from UAW leaders that it is pursuing an "America Last" strategy. Instead, GM officials insist, the company is merely trying to revamp its lumbering operations along the same lines as its slimmed-down rivals, Ford Motor Corp. and Chrysler, in order to compete in the cutthroat global auto market of the future.

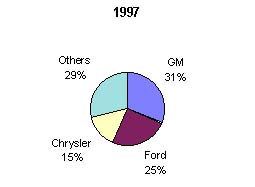

Since 1970, GM notes, it has seen its market share shrink from nearly 50 percent of the overall market, to about 31 percent, compared with 25 percent for Ford and 15 percent for Chrysler.

Share of the U.S. Vehicle Market

Source: Autodata Corp.

But unlike its rivals, which successfully streamlined in the 1980s, GM is yet to jettison many of its old operations, resulting in a glut of excess capacity.

Wall Street analysts estimate the strike is costing GM about $75 million a day. Al Adler, a company spokesman, said Tuesday that daily vehicle production was down to 2,000 units, from 22,000 cars and trucks before the strike. A protracted strike could cost the automaker $1 billion by the Fourth of July, analysts say.

Sending an unequivocal message

Shaiken said GM deliberately chose to "take the union on in this case" in order to send an unequivocal message that it has no choice but to put a premium on long-term efficiency - even at the cost of short-term labor strife.

Yet somewhere along the way, Shaiken suggests, the work stoppages took on a dynamic that seemed to catch the automaker off guard.

"The corporation knows the sensitivity of these kinds of issues, they have a lot of experience with what will provoke a local strike," Shaiken said, referring to dozens of walkouts over the past few decades, including six last year alone. "What I suspect they (the GM management) didn't anticipate is that it would reach this intensity."

Industry observers also suggested that the UAW rankled GM by timing the strike to fall just before the scheduled start of production on a new pick-up truck GM is counting on to boost sales. Should the strike last until mid-August, it could also delay mass production of other 1999 models.

"It's becoming a lot bigger than it could have been," said David Cole, the Director of the Office for the Study of Automotive Transportation at the University of Michigan at Ann Arbor. "I think the union's intention was to get this over."

With the battle lines drawn, there is a diminishing incentive on both sides of the negotiating table to back down. The strike has mushroomed from a local spat into a national battle of "economic wills," Shaiken said.

And while GM may need a strong domestic base to grow in the future, it is not willing to abandon its global ambitions in the present.

"GM didn't invent globalization," said a company official who wished to remain unidentified. "It's a reality and it's one we have to be a part of."

Shares of GM (GM) ended down 1/16 at 68 in composite trading on the New York Stock Exchange Friday.

--By staff writer Douglas Herbert

|

|

|

|

|

|

|