|

Who cares if rates go up?

|

|

May 31, 1999: 12:40 p.m. ET

It's no big deal if the Fed hikes rates to slow growth, more analysts say

|

NEW YORK (CNNfn) - So what?

That's what a growing number of Wall Street economists and analysts are saying about the prospect of an increase in short-term interest rates by the Federal Reserve.

The U.S. economy has been on a blue-streak run of almost unprecedented growth for nine years now, offering Americans nearly uninterrupted economic prosperity. Since November alone, the Dow Jones industrial average has risen more than 1,800 points, or more than 21 percent, in a period of unprecedented growth and surprisingly benign inflation.

The new economy

The unbelievable resilience of the stock market and the economy at large has had even some of the most dire pessimists talking about the so-called New Economy, where productivity gains have allowed companies to stay competitive without raising prices.

And then the you-know-what hit the fan. On May 14, the U.S. Labor Department reported the biggest one-month jump in consumer prices in almost nine years. Five days later, Fed officials opted to ready themselves and the market for a possible rate increase -- adopt a 'tightening bias,' in econ-speak -- indicating the brakes may have to be tapped with an upward nudge in short-term interest rates.

Bonds suffered their worst losses in more than three years and the Dow tanked from the dizzying 11,000-and-change mark to close Friday at 10,559.74. In the blink of an eye, it looked like the party was over.

Or did the wimps just check out early?

'Much ado about nothing'

"Were in the camp that says this is very much ado about nothing," said Stephen Slifer, senior economist with Lehman Brothers in New York. "I really do think the markets have overreacted to the prospect of higher rates."

Some economists now are predicting the Fed could raise short-term rates at a moment's notice to boost the cost of borrowing and force the economy to rest on its laurels. At minimum, some argue, the Fed will vote to raise rates at its next meeting June 29-30.

But even if they do, how much of an impact will a 25- or even 50-basis-point rate rise have on the U.S. economy, and how much will financial markets really suffer as a result?

"It would be minimal," said Edward McKelvey, a senior economist with Goldman Sachs in New York. "In a broad perspective, we shouldn't really be looking for a tremendous slowdown," even if rates rise, he said. A basis point equals 1/100 of a percentage point.

An increase in short-term rates of that nature would bring the U.S. economy right back to where it was before the Asian flu hit, Long-Term Capital Management buckled, the Brazilian currency collapsed and the Russian debt crisis became an international concern, McKelvey and a growing number of other economists contend.

Because Asia and other world economies are recovering at such a quick clip, an increase in U.S. lending rates would more than likely allow growth, currently at 4.1 percent, to continue along the same merry path it's grown accustomed to.

Asia taking off

"The recovery in the global financial backdrop is a key part of the outlook for tightening," said Doug Porter, a senior economist with brokerage Nesbitt Burns Inc. in Toronto. "The Fed doesn't want to unwind the recovery completely, so any tightening is going to be cautious.

"The market is already well aware that there's recovery in Asia and that there's a price to pay for that," he added. Porter and his colleagues at Nesbitt are forecasting at least one 25-basis-point rate hike by the end of the year.

Similarly, Goldman's McKelvey forecasts a 25-point rise in interest rates before year's end, along with two more 25-point increases in the year 2000.

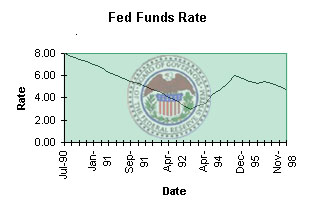

If McKelvey is right, that would bring the so-called fed funds rate -- the target that U.S. banks follow for lending money to each other overnight -- up to 5.50 percent within the next 18 months.

There are other, more technical reasons the market shouldn't get in a huff over rising interest rates. So-called real interest rates, which take into account the rate of inflation, remain at historically low levels and are in little danger of taking off soon.

Here's how Slifer figures it. When you subtract the rate of inflation -- currently an annual 1.9 percent -- from the official fed funds target -- now 4.75 percent -- you're left with a pretty low number -- 2.85 percent, to be exact.

What that number means, reasons Slifer, is that companies are paying a base rate of interest that's less than 3 percent a year. And on the flip side, bond investors are earning around the same amount. If that number were to increase by another 1/4 or 1/2 a percentage point, it won't ruin the party, Slifer said.

Hello, bond market?

Someone should tell that to the bond market. Since touching a generation low of 4.71 percent last October, the yield on the 30-year benchmark Treasury bond has risen more than 112 basis points to 5.83 percent Monday. Two-year Treasury notes, which are among the most sensitive to pending changes in monetary policy, have risen 157 basis points to 5.43 percent Monday from 3.86 percent last October. Bond yields tend to rise as prices fall and investors demand a higher premium to buy them.

Stocks, too, haven't quite convinced themselves that a rate increase, if it happens at all, won't be so bad. While higher rates make borrowing more expensive and tend to damp corporate profits, rising demand internationally for U.S. goods would work to offset that, "causing a form of inertia," McKelvey said.

Working against a Fed rate rise in the months ahead is the reaction that stocks and bonds already have had to the threat of one. Higher bond yields and declining stock values have essentially done part of the Fed's work for them, said Slifer.

"If you have growth that really does start to slow, that will relieve the intensity that the Fed somehow has to scrunch the economy right away," Slifer said.

What the tea leaves tell

And the economic slowdown many analysts have been calling for could still come, Slifer said, reducing market nervousness about a rate hike even more.

Indeed, market participants will be focused on upcoming reports to determine whether April's inflation report was the exception, rather than the norm. The National Association of Purchasing Management will release its monthly index of business activity for May on Tuesday. Other reports including leading economic indicators, chain store sales and manufacturing shipments, inventories and orders will catch the market's attention.

Most significant this week will be Friday's employment report. Analysts surveyed by Reuters anticipate that job growth slowed a little in May, with the number of new jobs declining to 225,000 from April's 234,000. The unemployment rate is seen holding steady at 4.3 percent.

"The unemployment report will be a big one," Porter said. "An indication that job growth is still going gangbusters is going to make the market even more weary of a rate hike."

But even if the tea leaves spell faster growth, the market shouldn't get too excited. As several Fed officials have aptly put it, one or two numbers don't necessarily make a case.

In an interview immediately following the CPI report, Susan Phillips, dean of George Washington University's School of Business and Public Management and a former Fed governor, indicated the Fed board would probably look for additional evidence before yanking the emergency cord on the economy.

"If this is the beginning of an upward trend rather than just a blip, then the [Fed] board will be looking very closely," she said. "I think there will be a variety of things they'll be looking for to build a case, but at this point all you have is one month's CPI."

-- by staff writer M. Corey Goldman

|

|

|

|

|

|

|