|

Alcoa bids for Reynolds

|

|

August 11, 1999: 2:56 p.m. ET

Unsolicited offer attempts to revive merger proposal made in March

|

NEW YORK (CNNfn) - Alcoa Inc. made an unsolicited offer to purchase competitor Reynolds Metals Co. for $5.6 billion in cash and stock Wednesday, just hours after another deal shook up metal industry hierarchy.

The Alcoa offer, made in a letter sent Wednesday to Jeremiah J. Sheehan, Reynolds' chairman and chief executive officer, would instantly create the nation's top aluminum producing company by both production and market capitalization, with annual sales approaching $21 billion.

The combined entity would manufacture everything from aluminum siding and wheels to aluminum cans and cooking bags and employ nearly 122,000 people worldwide.

By deciding to make their offer public now, analysts said Pittsburgh, Pa.-based Alcoa is leaving little to chance, particularly given the proposal follows so closely after a deal struck earlier in the day among three international firms angling to unseat Alcoa as the world's top metal company.

"With what happened earlier this morning, I guess [Alcoa] decided to show their cards," said Leo Larkin, an analyst with S&P Equity Group in New York.

Reynolds officials weren't immediately available for comment.

50/50 cash, stock split

Alcoa proposes exchanging $65 in cash for half of Reynolds' outstanding shares and swapping 0.9784 share of Alcoa stock -- equal to $65 in value -- for the remaining half. Company officials declined to comment on whether debt assumption was included in their $5.6 billion deal valuation.

The $65 value represents a 16.33 percent premium over Reynolds' closing price of 56-1/8 Tuesday.

By early afternoon, however, Reynolds (RLM) stock had eclipsed that level, climbing 10-1/4 to 66-1/8, a sign investors believe the hostile offer could ignite a bidding war for the Richmond, Va.-based company.

Analysts questioned whether any other company boasted deep enough pockets to top Alcoa's bid, although one obvious alternative might be the massive aluminum concern proposed Wednesday before the markets opened.

In that deal Canada's Alcan Aluminium Ltd., France's Pechiney SA and Switzerland's Alusuisse would enter a three-way merger to form the world's largest aluminum producer by revenue, with annual sales of $21.6 billion. Although that entity technically wouldn't exist yet, analysts cautioned it still might make a play to keep Reynolds off Alcoa's payroll.

Offer floated once before

The letter sent Wednesday indicates Alcoa and Reynolds, the nation's two largest aluminum producers, first discussed a possible merger last March. No indication is given whether Reynolds rejected that deal or simply never responded to the proposed union, and Alcoa officials wouldn't comment.

Since then, the letter notes, both Reynolds and Alcoa have generated impressive first-half earnings, but Reynolds' stock price has lagged Alcoa's healthy gains.

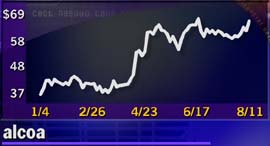

Alcoa's stock is up more than 75% year-to-date . . .

. . . while Reynolds' stock has inched closer to its January levels

Alcoa officials indicated they decided to make the letter public in order to ensure the information is taken directly to Reynolds' shareholders.

"This is not the first time we've done this at Alcoa," said Bonita Cersosimo, an Alcoa spokesman. "This simply lets everyone know this is it. There's nothing else being hidden here. "

The bid for Reynolds holds several strategic advantages for Alcoa, analysts said.

Not only would it reinforce the company's position as the world's top aluminum company -- a claim Alcoa still could maintain in terms of market capitalization and tons of aluminum produced, even without the Reynolds acquisition - but it also would facilitate the company's move away from the volatile raw aluminum business and into more finished aluminum products.

For Reynolds, the deal would allow the firm to align itself with a strong partner at a time when its stock price has suffered.

"Reynolds said in its last conference call that it would be open to mergers," Larkin said. "In light of what happened this morning, Reynolds may have left it self out to dry."

In its letter, Alcoa left the door open to peaceful negotiations, but made it clear the company intended to press the issue.

"Let me reiterate Alcoa's desire for a negotiated, mutually satisfactory business combination," wrote Alain J. Belda, Alcoa's president and chief operating officer. "I must tell you, however, that we feel strongly this is a transaction we must pursue. Accordingly, we have concluded that both our own stockholders and yours should be informed of this proposal and we have been advised that this is the best legal course of action."

Alcoa (AA) jumped 2-9/16 to 69 in mid-afternoon trading.

|

|

|

|

|

|

|