|

Aluminum firms smelt deal

|

|

August 11, 1999: 3:40 p.m. ET

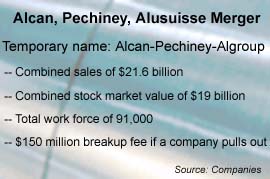

Alcan, Pechiney, Algroup forge $9.5B deal to rival Alcoa, which counters

|

LONDON (CNNfn) - Canada's Alcan Aluminium Ltd., France's Pechiney SA and Switzerland's Algroup announced their widely expected merger Wednesday, in a stock swap valued at about $9.5 billion that would create one of the world's largest aluminum producers.

Just hours after that announcement, U.S.-based Alcoa (AA), currently the world's top producer of aluminum, unveiled its response: an unsolicited bid for Reynolds Metals Co. (RLM), the No. 2 U.S. producer, for $5.6 billion in cash and stock.

Alcan-Pechiney-Algroup -- as it would be known at first -- would be formed out of an unusual three-way merger spanning two continents and creating a company with annual sales of roughly $21.6 billion and a market value of about $19 billion.

That would put the trans-Atlantic company -- which also would be a top maker of packaging products -- in a neck-and-neck race for the title of world leader in terms of revenues. But a merged Alcoa-Reynolds would leapfrog past of APA in both aluminum output and market capitalization.

Under the Euro-Canadian deal, Alcan will offer stock for Pechiney and the Alusuisse division of Switzerland's Algroup. APA would plan to cut about 4,500 jobs as it seeks savings from the merger.

Faced with speedy industry consolidation -- as underscored by Wednesday's pair of deals -- and pricing pressures, the APA merger would allow it to re-work the "competitive chessboard," Algroup CEO Sergio Marchionne said at a news conference.

Industry analysts said the APA merger makes sense for all three companies as they buck up for competition with Alcoa, and to insulate themselves from swings in the price of aluminum.

"This is a very good deal," said Credit Lyonnais Europe analyst Christian Georges. "It answers key questions in aluminum and packaging."

U.S. investors latched on to the APA deal Wednesday. Shares of Alcan Aluminium Ltd. (AL) rose 2-13/16 to 36-7/16, while American depositary receipts of Pechiney (PY) rose 2-3/16 to 30-7/16.

Producers dogged by volatility

Big swings in aluminum prices have dogged producers in recent years, but the agreement will allow APA to reduce its exposure to raw material prices by combining activities and relying more on finished aluminum and packaging products, analysts said. APA still will smelt aluminum but also will use it to create finished industrial products.

"They have used Alcoa's model and improved upon it," said Georges, noting that Alcoa has integrated its operations but still remains exposed to variations in aluminum prices.

The APA deal, which faces U.S. and European regulatory approvals, would be an effort to catch up with Alcoa -- which already has been snapping up businesses in the United States and Europe.

The Pittsburgh-based company stepped up pressure on its rivals last year with a $3.8 billion buyout of Alumax, the fourth-largest U.S. producer. In Europe, it struck deals in Spain and Italy, and on Tuesday unveiled a pact with a Turkish aluminum producer.

The APA deal won't come without costs: The company plans to cut its combined workforce of 91,000 by about 5 percent, officials said. Within two years of completing the deal, it expects savings of $600 million annually from the merger, most of that from aluminum activities, which will account for about 60 percent of its business.

Algroup's Lonza chemicals operations, which already was planned for a spinoff, is not included in the deal. Algroup shareholders still will have a right to those new shares when they are floated in Switzerland sometime after October.

While the merger is meant to bring the three aluminum businesses together, it also will create a giant packaging company that is likely to focus on becoming a supplier to major food producers, Georges said.

Investors drove Pechiney stock up 8 percent to 55.25 euros ($59.11) in Paris Wednesday after a lackluster response Tuesday amid reports the three companies were in merger talks. Algroup stock fell almost 1 percent in Zurich.

Bougie to be the boss

The new company will be headed by Alcan chief executive Jacques Bougie. While APA will be a Canadian corporation, Bougie will be based in New York City, with the company's stock listed in New York, Toronto, Paris, Zurich and London.

Jean-Pierre Rodier, currently chairman of Pechiney, will become chief operating officer of APA, and is scheduled to replace Bougie within two years.

More consolidation in the sector could lie ahead and APA may do more deals, Bougie told analysts. And further down the line, the packaging operations could be sold to provide cash for more deals in aluminum, analysts said.

On a pro forma basis, and excluding Algroup's chemicals business, the new company generated revenue of $21.6 billion in 1998 and earned $1.5 billion before tax and interest. Alcoa had sales of $15.3 billion last year -- but with Reynolds its sales would also be $21.6 billion.

APA will have a combined yearly aluminum output of 2.77 million metric tons, just ahead of Alcoa's 2.7 million tons -- but less than the 3.8 million tons that Alcoa could produce with Reynolds on its side.

And Alcoa's market value is about $23 billion, compared to roughly $19 billion for APA. Shares of Reynolds, which Alcoa valued at about $5.6 billion, were worth about $4.2 billion Wednesday after the announcement as its stock rose 9-7/8 to 65-3/8.

Alcan, Pechiney and Algroup hope to complete their deal within six months, and preliminary talks with European Union regulators already have taken place.

Shareholders also will vote on the proposal, and if the deal falls apart there is a $150 million break-up fee, payable by the company opting out of the deal.

Alcan and Pechiney will merge first, in advance of the disposal of Algroup's non-aluminum activities. The companies said they would go ahead with their merger even if Algroup fails to join them.

Algroup has been re-evaluating its business strategy since its planned merger with German utility conglomerate Viag collapsed earlier this year.

-- from staff and wire reports

|

|

|

|

|

|

Alcan

Pechiney

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|