|

Economy at full throttle

|

|

September 22, 1999: 3:57 p.m. ET

Federal Reserve's 'beige book' notes strong growth but little inflation

|

NEW YORK (CNNfn) - The U.S. economy continues to run full throttle and the labor market won't quit, though some evidence of rising inflation is beginning to show up, according to a Federal Reserve economic survey released Wednesday.

The Fed's so-called "beige book," a survey of the economy conducted eight times a year, noted that robust manufacturing activity and surging retail sales are evidence that the U.S. economy isn't slowing all that much. The report, which comes two weeks before the next Fed policy meeting, is used as a reference for officials in their deliberations about monetary policy and interest rates.

"All district economies continue to exhibit overall

strength, with most experiencing moderate-to-brisk rates of growth,'' the report said. At the same time, "the majority of district reports indicate that price pressures at the retail level are not readily apparent. Where they are apparent, they are categorized as temperate."

Divided we stand

Stocks and bonds were little changed after the report's release. A separate report from the Treasury Department showing that the government posted a $2.5 billion budget deficit in August -- less than analysts' forecasts -- also did little to move markets. The number suggests the government is on track to post a second budget surplus for its fiscal year, which concludes Sept. 30.

For the most part, analysts and economists have been divided on whether the Fed will move to raise rates a third time this year to slow the pace of the economy, now in its ninth year of uninterrupted expansion. While many indicators suggest robust growth, only a smattering of evidence exists that inflation -- the nemesis of the financial markets and the Fed -- is showing signs of accelerating.

"While price pressures at the consumer level remain mostly calm, numerous districts report significant increases in some materials prices," the report said. Higher prices for materials include commodities such as oil and natural gas, whose prices have risen dramatically this year.

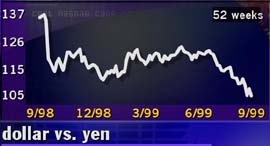

The U.S. dollar's rapid decline against the yen may factor into the Fed's upcoming decision on lending rates

That could convince Fed officials to hold off raising rates at their Oct. 5 policy meeting. The Federal Open Market Committee has voted to raise rates twice this year, a quarter point each on June 30 and Aug. 24, to cool the economy and keep inflation under wraps. The Fed's trend-setting fed funds rate currently is 5.25 percent.

At the same time, the surge in value of the Japanese yen against the U.S. dollar along with other evidence showing surging retail sales and robust manufacturing output could sway officials anyway, economists said.

As for the robust U.S. labor market, the survey noted that not much had changed since the last report released in mid-August: "For the most part, the theme of this report is unchanged from recent reports: The demand for labor continues to outstrip the readily available supply of labor in most areas."

Signs of a slowdown?

The nation's unemployment rate currently rests at a generation low of 4.2 percent. The next employment tallying September's job growth will be released on Oct. 8, three days after the FOMC meeting.

One optimistic note in the report was that higher interest rates, particularly rising mortgage rates, may be starting to impact economic growth -- something the Fed wants to see happen.

Even though home sales remain strong, the report noted that some slowing recently had become apparent in both sales and construction. "Just about all districts cite higher mortgage rates as a primary reason for the recent slowing," the report said. At the same time, many regions of the country experienced strong lending activity, particularly among consumers, it said.

The report, compiled this time by the Fed Bank of St. Louis, is a compilation of views and statistics from all of the Fed's 12 district banks. Each of the district banks takes a turn at compiling the report throughout the year, though the author of each report is not made public until the report itself.

|

|

|

|

|

|

Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|