|

Bonds edge lower

|

|

December 23, 1999: 3:27 p.m. ET

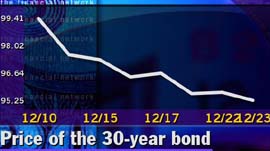

Treasury yields hit 27-month high, capping two weeks of losses

|

NEW YORK (CNNfn) - Treasury bonds fell Thursday, pushing yields to their highest levels in 27 months and capping two weeks of losses in the fixed-income market.

In a shortened pre-holiday session, the price of the benchmark 30-year bond fell 13/32 to 95-8/32. Its yield, which moves inversely to its price, climbed to 6.48 percent, the highest since September 1997.

Bonds, flat for most of the session, fell in the final hour of trading. But analysts cited no fundamental reason for the late slide. Rather, they blamed the fall on the kind of volatility that comes with light pre-holiday trading volume.

"Volume is extraordinarily thin,” said Kevin Flanagan, bond trader at Morgan Stanley Dean Witter. "People are trying to square the books” ahead of year’s end.

Still, the drop caps two weeks of losses that have come largely on fears the Federal Reserve next year will begin a series of interest rate hikes.

What data?

Bonds posted no reaction to the day’s economic indicators, which showed the economy continued to strengthen, but largely at a pace that met analysts’ forecasts.

The Commerce Department said Americans’ incomes rose 0.4 percent in November while spending climbed 0.5 percent. The numbers suggest the American consumer continues to spend, spurred in part by the trillions of dollars in paper wealth created by soaring stock markets. A little more of that wealth was created Thursday, when the Nasdaq climbed above 4,000 for the first time.

"We’re spending more than we’re making largely because the stock market is doing so well,” said John Lonski, senior economist at Moody’s Investors Service. "Never before in the history of the U.S. economy have U.S. consumers enjoyed such an increase in terms of wealth generated by an equity price rally.”

Orders placed with U.S. manufacturers for big-ticket items, meanwhile, jumped a greater-than-expected 1.3 percent in November, the Commerce Department said, suggesting a pickup in demand.

"I don’t think there’s a sign of weakness in any of these numbers,” Maureen Allyn, chief economist at Scudder Kemper Investments, told CNNfn.

Finally, the number of Americans filing for first-time unemployment benefits rose to 288,000 last week from a revised 267,000 the previous week. Though higher, the number is still consistent with the low unemployment and tight labor markets that have existed for years. Jobless claims rarely move the market. Thursday was no exception.

Explaining the lack of market response to the day’s indicators, David Ging, Treasury strategist at Donaldson Lufkin & Jenrette, cited a slowdown in trading ahead of Friday’s Christmas holiday.

In addition "there weren’t a lot of surprises in these numbers,” Ging said.

Rate hikes seen

Still, the reports may only strengthen the view among economists that the Federal Reserve will hike interest rates ahead. While the nation’s central bank held its main lending rate steady at 5.50 percent this week -- out of concern over disrupting the markets ahead of the century change -- it expressed concern that the nation’s hot economy eventually will trigger inflation.

"The only way the Federal Reserve might find reason not to hike rates at its Feb. 2 meeting would be if there were some unforeseen global economic crisis developing,” Moody’s Lonski said.

The Fed’s three rate hikes since June have had little apparent effect. Stocks continue to soar. Unemployment remains near a 30-year low, possibly pressuring employers to hike wages ahead to retain workers.

These fears of inflation have sent long-term yields higher for much of 1999, pushing the bond market toward one of its worse years on record.

Dollar mixed

The dollar fell against the euro but gained against the yen Thursday, reversing recent euro weakness and yen strength.

Just before 2:45 p.m. ET, the dollar rose to 102.09 yen from 101.60 Wednesday. The euro rose to $1.0133 from $1.0095 Wednesday.

Still, analysts cited no news behind the session’s currency market action, blaming it mostly on volatility from light trading volume. Japan’s markets were closed for a holiday, the emperor’s birthday.

|

|

|

|

|

|

|